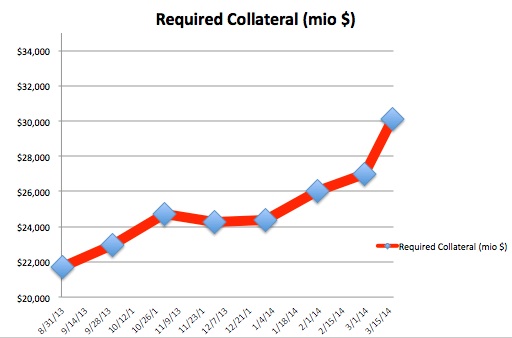

Is the talk of enormous collateral needs — and an impeding collateral shortage — based on reality? We are starting to wonder…and have some interesting numbers to look at.

The National Futures Association (NFA) collects and publishes how much margin FCMs hold on behalf of their clients against cleared swaps. Called the “FCM Cleared Swaps Customer Collateral Report”, the data differentiates between required collateral and excess collateral. Lets look at how much the top FCMs are holding as of March 17, 2014 (millions $):

These numbers have been growing.

But if the required collateral held for customers is $30 billion, how does this compare to what we read in the press? A recent headline about a study calling for $2 trillion of margin calls on cleared derivatives for the buy side seems a bit extreme when current numbers – granted this is just in the U.S. – are currently 1.5% of that number. We are sure readers will recall numbers from ISDA that were even higher (although they included a broader sweep of the market). Is the sky falling here?

So where is the disconnect? Hasn’t Securities Finance Monitor been writing about the need to get up to speed on collateral management? Well, the process is going to be a lot slower than some of the headlines would imply. Directional investors like insurance companies and pension funds are generally in the money on their legacy bilateral fixed income investments. We have heard that they are not terribly enthusiastic about novating trades to CCPs (which would raise required margin), especially if it means giving up CSA margin flexibility. Dealers will achieve capital relief with novations, but have generally kept it on the back burner for now.

Over time as client derivatives trading books turn over and high IOSCO-mandated margins on non-cleared trades kick in, required collateral will go up in earnest. Rising interest rates will also accelerate the process by encouraging portfolio turnover. But $2 trillion just for the buy side?

So is this the time for the buy side to start thinking about collateral management? For those with collateral management “systems” consisting of a bunch of spreadsheets held together with sticky tape, it is the right time to look seriously at upgrading. Collateral management (and its fancier cousin collateral optimization) will make a difference. Will big systems be the only answer out there for players with technology years past their “sell by dates”? It will be for larger investors. But what about the medium and smaller investors? Their path of least resistance may be their custodians or new vendors. We wrote about this dilemma in a post earlier in March “Collateral Management: Outsource, Insource or Cloud. Which way to go?”. There are some disruptive players out there too like Cloud Margin that could find a niche. It will interesting to see how it all shakes out.

Over the coming months, we will be watching the NFA numbers, not only for growth but for individual FCM market share.

1 Comment. Leave new

We will never see a figure anything close to 2T simply because assets of that volume do not exist. The figure of 2T is to be seen in the right perspective. If we continue with business as usual, thats the figure we’ll need. Key phrase being ‘as usual’. That means we can’t continue BAU and that front end activities will need to adjust. The bottleneck is amount of collateral available.

So, though we’ll not the kind of numbers floating around in press or in ISDA reports, the consequences are very real and recommendations still very valid.