It is easy to read all sorts of things into the $58 billion in “Fixed-Rate, Full-Allotment Overnight Reverse Repos” executed by the Fed over quarter-end. The Fed’s repos were done at 1bp while the UST GC market was 8~9 bp higher.

Quarter-end window dressing has long been practiced in the financial markets. Trades are rolled off and replaced with ones that have better optics. And what could be better than reporting to your investors that your cash is sitting with the Federal Reserve?

On the other side of the coin, repo desks act as a balance sheet shock absorber for banks. Often dealers reduce the amount of balance sheet dedicated to repo, telling clients to take their business elsewhere. (Aside: One wonders how often dealers can do that without permanent damage to their franchise, but this has been happening for a long time and life seems to go on.)

So around statement dates there are a lot of technicals that can skew repo rates. Typically levels are a bit higher and more volatile over quarter-ends. It is hard to read much into these periodic blips in the market. But with the introduction of the Fed’s overnight repo program, over time there will be a pattern developing that will bear analysis. We expect the Fed’s repo facility to establish a base for repo rates. The interesting part will be how the broker/dealer market is tiered above that. How much spread above what the Fed pays is too much? Will the availability of the Fed as counterparty simply dominates the credit equation? Is an incremental 8 or 9 bp worth the extra credit risk? If not, will this force banks to scramble for repo cash to fund themselves? What will happen if the Fed allows an “all you can eat” approach instead of the current $1 bio per counterparty limits (upped from $500 mm)? How will these spreads behave at higher nominal interest rates?

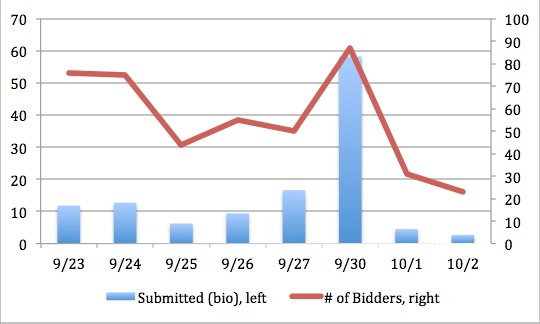

Federal Reserve Fixed-Rate, Full-Allotment Overnight Reverse Repos

Source: Federal Reserve

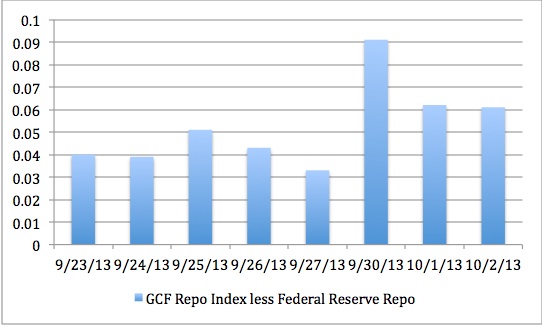

Looking at the spread between GCF Treasury Repo and the Fed rates will, over time, give us an idea of how the market is structuring itself. So far the spread has ranged from just above 3bp to 9bp. But this is not enough data. We will be watching.

GCF Repo Index less Federal Reserve Repo

Source: DTCC and Federal Reserve