William Dudley, the President of the New York Fed, just gave a speech at the New York Bankers Association 2013 Annual Meeting. His focus was on wholesale funding and these days, that means tri-party repo and money market funds. This post takes a look at what he had to say on tri-party repo. It was an important speech.

We won’t bore you with the details of the financial crisis vis-à-vis tri-party part of the speech. You know all that already although Dudley’s comments were as clear and concise a version of “who did what when” as we have seen. It was one of the rare narratives that includes the ABCP collapse (and not sub-prime, which isn’t even mentioned by name in the speech) as the first domino on the funding side.

So, what is to be done? How to provide long-term stability to the system? Dudley says, “…Capital and liquidity requirements for large complex financial institutions have been raised sharply, the largest broker-dealers have become part of bank holding companies subject to additional regulation, and risk-weights on assets have been adjusted to better capture risks and to reduce the scope for regulatory capital arbitrage by banks…” But that clearly isn’t enough for the Fed (especially with so many rules and regs getting delayed).

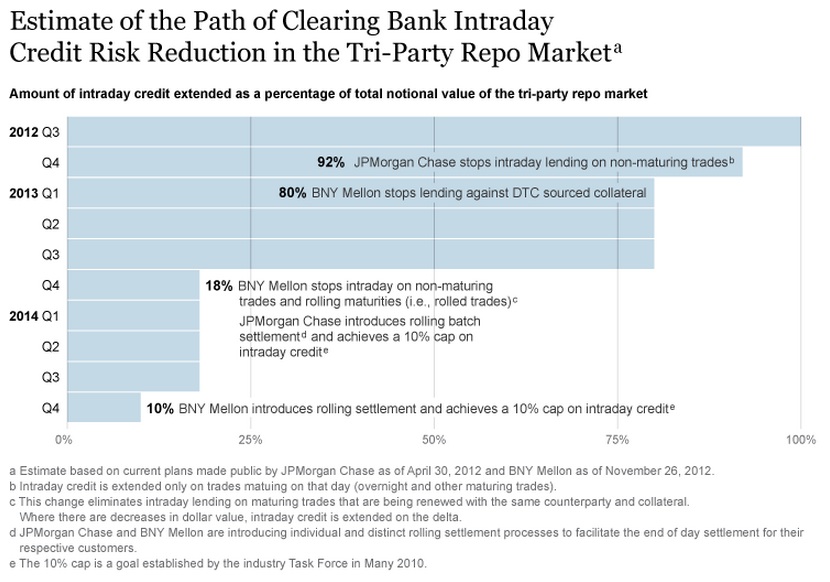

Specifically addressing tri-party, President Dudley had a nice chart on the timetable for the clearing banks reforms. He said “…Reducing the market’s dependency on intraday credit will make the market more resilient to future stress events, by forcing all participants to consider the credit and liquidity risks they are exposed to…”

Dudley said something that many people know but dare not say. Referring to tri-party repo and money market funds “…In fact, in each of these areas, one could argue that the risks have increased compared to prior to the crisis. That is because the Dodd-Frank Act raised the hurdle for the Federal Reserve to exercise its Section 13.3 emergency lending authority and because Congress has explicitly precluded the U.S. Treasury from guaranteeing money market mutual fund assets in the future. With extraordinary interventions ruled out or made much more difficult, this may cause investors to be even more skittish in the future. This is why it is essential to make the system more stable…”

President Dudley floated a suggestion that will send a shiver down many a repo desk and hedge fund. “…First, tri-party repo transactions could be restricted to open market operations (OMO) eligible collateral. Such collateral would likely remain quite liquid during a time of crisis…” So much for corporates or equities. Dudley did recognize that “…less liquid collateral could just migrate to be financed elsewhere, with associated run and fire sale risks…” (what we think of as the “Whac-A-Mole” problem) or that the reform at Freddie and Fannie could result in paper not OMO eligible and hence not tri-party eligible. And finally, simply blocking less liquid paper from tri-party doesn’t mean that liquidation, should it come to that, goes away (and, for less liquid paper, the threat of fire sales). It would, however, help contain the systemic risk embedded in the tri-party clearing banks. BNY Mellon in 2013:Q1, according to the Fed chart, will (or has?) stopped lending against DTC eligible collateral. We though those trades simply had to be pre-funded at maturity — which is not exactly the same thing as not lending versus those assets at all — but maybe this is the next step. Some banks have used repo conduits to fund this paper instead.

Another idea was to create a mechanism for orderly liquidation of collateral held in tri-party by a defaulted counterparty. “…One could imagine a mechanism that was funded by tri-party repo market participants and potentially backstopped by the central bank. This would have the advantage of dealing with the entire tri-party repo market and not artificially favoring one type of collateral over another. It would also push against the underpricing of liquidity and credit risk during good times by forcing market participants to pay for the costs of a liquidation facility up front…” Clearly there are no large-scale private sources of backstop liquidity, so it would have to be unwritten by the Fed. We are curious to see how this would be priced. It could be the shape of things to come.

The Fed realizes that market participants have zero incentive to push the backstop idea. It will cost them money. Instead they expect, in a crisis, that the alphabet soup of Fed programs — TAF, PDCF, AMLF, CPFF, and TALF — to be rolled out again. Dudley just put the financing world on notice that this was a fantasy not likely to make a repeat appearance. Politicians are not likely to forget very quickly.

Looking at the bigger picture, Dudley wants to make sure whatever solutions emerge, they squarely address the fire sale and bank run problems. He ran two broad ideas up the flagpole:

1.) “…take steps to curtail the extent of short-term wholesale finance in the system. In principle, regulators across a broader set of institutions and markets could take steps to directly limit the use of short-term wholesale funding to finance longer-term assets, and take actions that reduced the amount of maturity transformation associated with securitization markets…’’

and

2.) “…expand the range of financial intermediation activity that is directly backstopped by the central bank’s lender of last resort function. This expanded range could be defined either in terms of access by the types of firms that are systemically important in market-based finance, or by types of activity or assets…”

The former idea plays into the Basel III’s LCR and NSFR although takes it further by imposing a shift to matched funding. No more playing the yield curve guys. The second idea sounds a bit kinder and gentler (and we wonder if it may have been juxtaposed with the harsher first idea to insure it being the better of two evils). Of course in exchange for making the lender of last resort tent bigger, prudential regulation would also have to be part of the bargain. This levels a direct hit on shadow banking.

When the Fed disbanded the tri-party committee, they did so out of impatience on the implementation side of things. So far, other than a handful of speeches detailing the evils of tri-party and half-veiled threats for the clearers to get their act together faster, there really weren’t many new ideas. President Dudley’s speech changes that and foreshadows that 2013 will be year they get something done.

A link to the speech is here.