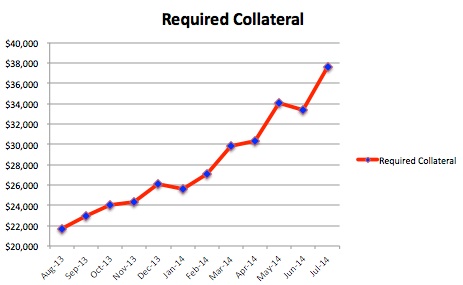

Required Collateral for Cleared Derivatives reached just under $38 billion at the end of July, 2014 for the top 15 FCMs. Although the figures are up 73% since August, 2013, the overall numbers seem pretty low.

We looked that the figures in a post on May 5th “A look at recent Required Reserves for Cleared Derivatives Trades numbers — they still look small” and our conclusions haven’t changed much since then.

The growth of required collateral held at FCMs looks like this:

In Billions, Source: http://www.nfa.futures.org/

In terms of notable changes in market share, Credit Suisse went from 17% in August, 2013 to 20% at the end of July, 2014. Wells Fargo doubled from 2% to 4% over the same period. The top five players (Credit Suisse, Barclays, Citi, Morgan Stanley, and JPMorgan) account for 74% of the market. The figure was 73% last August, so not a lot of change there.

- Credit Suisse Securities USA LLC 20%

- Barclays Capital Inc. 16%

- Citigroup Global Markets Inc. 15%

- Morgan Stanley & Co LLC 12%

- JPM Securities LLC 11%

- Goldman Sachs & Co 6%

- Merrill Lynch Pierce Fenner & Smith 5%

- Deutsche Bank Securities Inc. 5%

- Wells Fargo Securities LLC 4%

- UBS Securities LLC 2%

- NewEdge USA LLC 1%

- HSBC Securities USA Inc 1%

- RBS Securities Inc <1%

- BNP Paribas Securities Corp 1%

- Nomura Securities International Inc. <1%

Source: http://www.nfa.futures.org/, Finadium

One can’t help but notice a handful of players are scraping the bottom in terms of market share: UBS (2%), NewEdge (1%), HSBC (1%), BNP Paribas (1%), and RBS (<1%) and Nomura (<1%). RBS and BNY Mellon have withdrawn from the FCM market (BNY Mellon in December, RBS in May). Would it be surprising to see other others with tiny market share – but all the fixed costs – do the same? Those with large non-US clearing businesses (or aspirations for such) will probably stick it out. The investors using one of the clearers on the bottom of the market share scale should insure they have relations with some of the larger clearers too. Redistributing the 5% market share (should those institutions exit) isn’t going to change much in terms of market concentration.

As we said last May, the amount of collateral held by the FCMs against cleared derivatives seems pretty small. Not much of a collateral squeeze going on in this segment of the market, despite protests to the contrary. We agree with those who say the numbers will go up over time – but no one should hold their breath on this one. Will it ever be big enough to create shortages in the collateral market? Compare this to those saying required collateral would be in the trillions and we start to wonder.