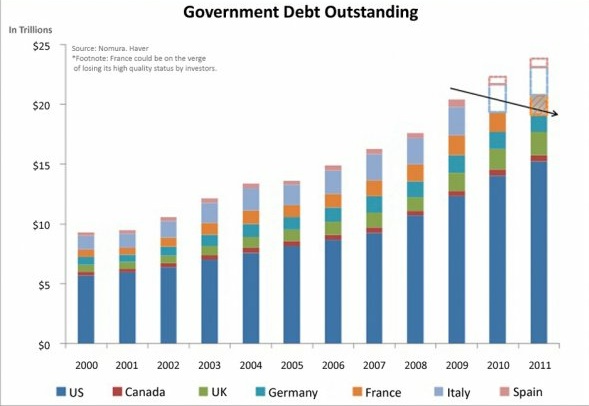

From Nomura, by way of businessinsider.com comes a nice graphic showing the growth and falloff in “safe assets”. We have written before about the double squeeze in the market for safe collateral. The growth of CCPs, Basel III liquidity rules, and the overall desire to collateralize every exposure possible generates demand for trillions in high quality paper. But the issuers which are considered safe have been falling away (read: Greece, Spain, Ireland, etc.) and the club is still shrinking. We can spend so much time focusing on the micro side of collateral management, that we forget there is a macro issue out there staring us in the face.

A link to the businessinsider.com post is here. Some of our earlier related posts can be found here and here and here.