Financial services firms with advanced technology models continue to outgrow peers, according to FIS research. Key findings show that: FS firms with more advanced technology are growing over twice as fast as peers; and use of cloud, AI and other emerging technologies gains momentum with top operational leaders.

While the financial services industry is growing more confident overall in its underlying technology, the firms with the most advanced technology operating models continue to outperform their peers in terms of revenue growth, driven by accelerated adoption of cloud, artificial intelligence (AI) and other emerging technologies.

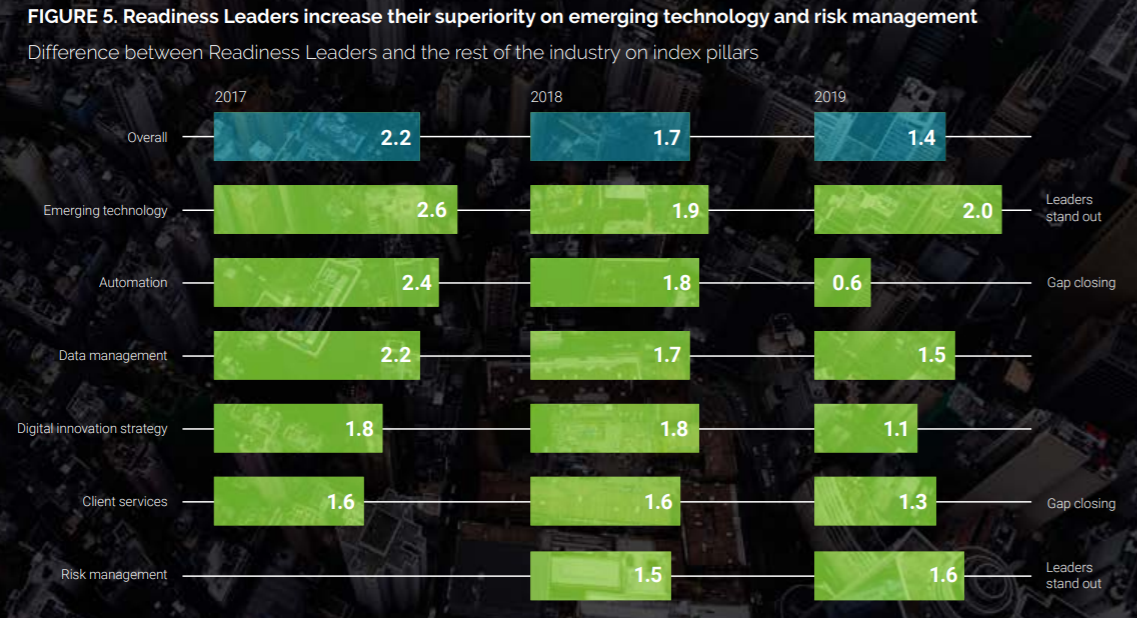

The third-annual FIS Readiness Report surveyed more than 2,000 senior executives from retail banks and buy-side, sell-side and insurance firms. Respondents were asked to assess their organization’s capabilities across six operational pillars: automation, data management, emerging technology, digital innovation strategy, client value, and risk management. Organizations that ranked in the top 20% across these pillars – the operational leaders – were studied as to how their investment priorities differ from their peers.

49% of the executives surveyed – nearly double the number from the 2017 report – said they were confident they have the right technology in place to support their growth ambitions, a number that climbs to 71% for operational leaders. Even more, operational leaders continue to outpace the rest of the industry in their adoption of the cloud, artificial intelligence and other emerging technologies. Importantly, the leaders also grew their revenue more than twice as fast as their peers (3.3% revenue growth versus 1.5% for the rest of the industry).

“Our 2019 research indicates that the industry’s growing confidence in its underlying technology to drive growth may be misplaced as operational leaders continue to sharpen their competitive edge over the rest of the pack,” said Martin Boyd, head of Capital Markets at FIS. “Particularly striking is the way these operational leaders are pivoting their innovation strategies away from operating efficiencies and moving towards emerging technologies to enhance service and grow their customer bases. For the rest of the industry, there’s a lot of catching up to do.”

The FIS research found that operational leaders are:

- Embracing the cloud: Nearly half of operational leaders have migrated to or are planning to put applications in the cloud – nearly double the rate of the industry as a whole.

- Investing in artificial intelligence: Among the operational leaders, 26% are using AI – up from 15% last year – to improve the customer experience and strengthen cybersecurity and fraud prevention. Only 4% of their peers reported investments in AI.

- Harnessing the power of open application programming interfaces (APIs): Forty percent of operational leaders have implemented open APIs to accelerate digital innovation, versus only 26% of the rest of the industry.

- Focused on client acquisition: Most operational leaders said they are focused on using technology to drive client acquisition, with 65% ranking it as a top growth objective in comparison to 50% of their peers.