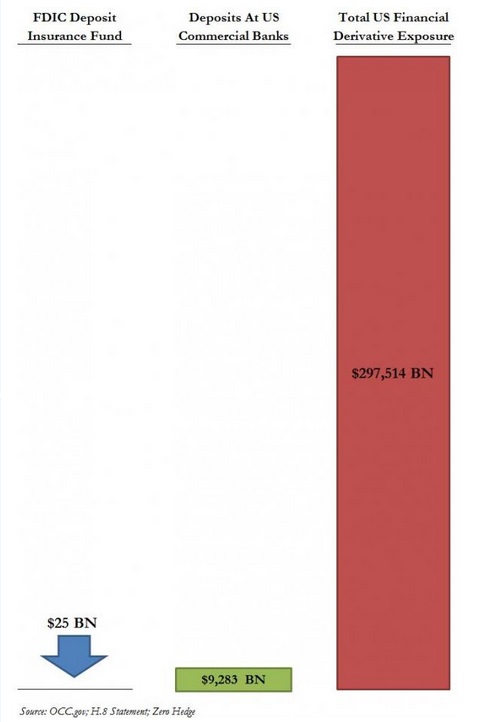

A post on zerohedge “US Deposits In Perspective: $25 Billion In Insurance, $9,283 Billion In Deposits; $297,514 Billion In Derivatives” caught our attention when it connected the dots between FDIC insurance, bank deposits, and the notional of derivatives held by U.S. banks (as published by the OCC). That was a bridge too far.

Here is a chart from the blog post

Why is this a problem? The column labeled “Total U.S. Financial Derivative Exposure” is misleading. Notional is not a very good way to measure derivatives risk. When derivatives are created, the PV of the trade is zero (or very close to it) implying that the trade could be unwound without gains or losses. Yet it still counts as notional. Looking at the same OCC report quoted by zerohedge, it said “…The notional amount of a derivative contract is a reference amount from which contractual payments will be derived, but it is generally not an amount at risk…”

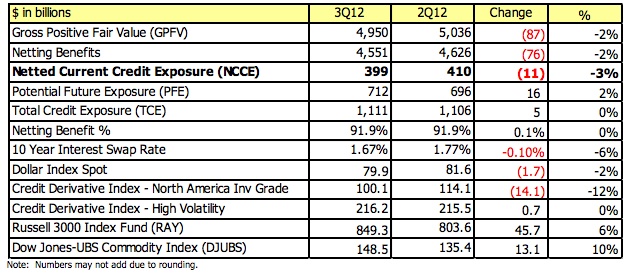

The OCC quoted some less news-bite worthy, yet very important, statistics:

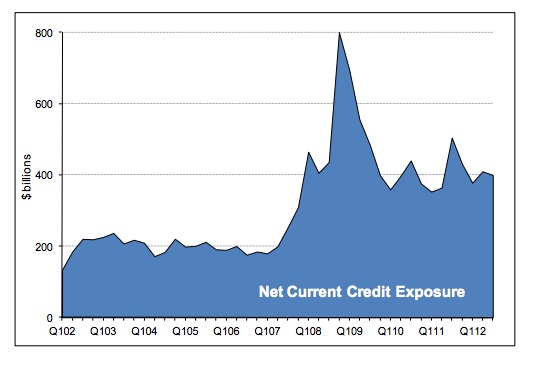

- Credit exposure from derivatives decreased in the third quarter. Net current credit exposure fell 3%, or $11 billion, to $399 billion.

- Trading risk exposure, as measured by Value-at-Risk (VaR), totaled $423 million at the 5 largest trading companies, 24% lower than in the second quarter.

The metric the OCC looks at to gauge derivatives exposure is the Net Current Credit Exposure (NCCE) in the banking system. This reflects the cumulative gross positive exposure to single counterparties, net of offsets available on legally enforceable netting agreements. That number is just below $400 billion, 71% of which is collateralized (and nearly 90% of the collateral is either cash, UST, or Agencies). The OCC then adds “Potential Future Exposure” (PFE) defined as “how much the value of a given derivative contract might change in the bank’s favor over the remaining life of the contract” to establish Total Credit Exposure (TCE). In 2012:Q3 PFE was $712 billion and TCE was $1.111 trillion. TCE is the number to pay attention to. Quoting $297.512 trillion in derivatives makes for great eye candy, but that is about it.

The OCC also compares charge offs against derivatives contracts to those made against commercial and industrial loans (C&I). In 2012:Q3 that number for derivatives was $26 million. For C&I loans, it was $1.9 billion.

We know that exposure can rise out of nowhere — including idiosyncratic and systemic risks — and correlation goes to 1 in a crisis. Bilateral risk can get very messy, legally enforceable netting or not. Mandated central clearing of derivatives is just coming online and doesn’t include everything (nor will it). But if someone is going to quote the OCC, they might read the entire report.

A link to the OCC 2012:Q3 report is here.

A link to the zerohedge post is here.

2 Comments. Leave new

Agree. BIS figures show global market value (before netting and collateral) of OTC is about $ 25 trillion. About time we started using these figures instead of notional.

See link for BIS figures:

http://www2.isda.org/attachment/NTE4Mg==/Market%20Analysis%2012-21-2012.pdf