Indemnification in securities lending remains popular with most beneficial owners, but the Basel III endgame in Europe creates an impetus for change that may ultimately help clients more broadly than expected.

The popular view of securities lending indemnification is that it puts the agent lender and beneficial owner on the same side of the transaction: both want to protect against potential defaults by borrowers. This was an easy addition to a service contract to deliver before Basel III rules went into effect.

Today however, indemnification carries a heavier financial cost to agent lenders as an unfunded liability on the Basel III Leverage Ratio. Lower revenues and thinner margins have introduced a new complexity to the business of agency lending: new costs are assessed by agent lenders while client fee splits have stayed constant or compressed since Basel III rules went into effect.

In Europe, Basel III rules and now the Basel III endgame are again shifting the landscape by requiring regulated agent lenders and borrowers to assess unrated counterparties using a higher Risk Weighted Assets (RWA) calculation than before. It remains to be seen whether these changes wind up excluding some participants from the market or result in a more robust securities lending business for everyone.

Cost impacts of the Basel III endgame

The way capital is assessed in Basel III for Securities Finance Transactions (SFTs) can be broken down into costs for agent lenders and costs for borrowers. Costs for agent lenders are focused largely on the knock-on effects to indemnification from the Leverage Ratio; this is where the credit exposure lies. Costs for borrowers include minimum haircuts and the calculation of the Leverage Ratio, Liquidity Coverage Ratio and Net Stable Funding Ratio. Both agent lender and borrower costs are significant and may impact beneficial owners.

New proposals in the European Basel III endgame, also called Basel IV, may make the cost of indemnification untenable in some cases but not others. The key decision factor will be the RWA assessment of the counterparty’s risk. The most recent proposed revisions to Basel III from the European Parliament and Council say that: “Exposures to institutions for which a credit assessment by a nominated [External Credit Assessment Institution – ECAI] is not available shall be assigned a risk weight in accordance with the credit quality step to which exposures to the central government of the jurisdiction in which the institution is incorporated.” If the central bank has a risk weight of 100%, then the unrated counterparty would have the same weight. The revisions also state: “Exposures for which no calculation is provided in Section 2 shall be assigned a risk-weight of 100%”. These two points have led some observers to estimate that tens of thousands of counterparties with low-risk weights may soon be rated at 100% RWA.

The reality appears to be more nuanced. Some unrated counterparties will indeed move to 100% while others may be treated more beneficially if they meet certain conditions. According to the UK Financial Conduct Authority, an institution with a central bank at a Credit Quality Step of 1, which is equivalent to a Moody’s Aaa to Aa3 or an S&P AAA to AA-, would have a 20% RWA. Lenders from countries like Germany and the Netherlands, with an AAA rating from S&P, may be able to claim a 20% risk weight. On the other hand, unrated Italian or Bulgarian lenders would be at 100%.

For agent lenders, this diversity of exposures could mean that some clients will be more expensive to indemnify, and that some lenders could be more expensive to borrow from unless there is a netting agreement in place or the transaction is conducted on a central counterparty (CCP) where different rules apply.

What European beneficial owners say about indemnification

The European client base for securities lending is segmented by UCITS funds, insurance plans, government affiliates such as sovereign wealth funds, and a mix of other client types including foundations and private funds. In our experience, and supported by Finadium surveys of beneficial owners, the majority of larger government-affiliated funds think that they may have no need for indemnification for most of their securities loans. These groups are big enough to have their own credit risk analytics teams and do business directly on a bilateral basis with the same counterparties they lend to via an agent lender. It makes sense that they do not require protection in securities lending when they are willing to engage with borrowers under ISDA or other agreements without indemnification. From an agent lender perspective, lending without indemnification for these institutions eliminates the RWA charge, making for greater lending opportunities and potentially a better client/agent lender relationship.

Indemnification becomes more important to beneficial owners in relation to the size of their entity. Firms without their own credit risk teams say they rely on indemnification to protect their interests more than large institutions. They may also be less inclined to have a market professional on staff who understands the nuances of securities lending and why overcollateralization offers a high degree of protection. These clients require the most explanations about lending and how it benefits the underlying beneficial owner’s clients. They are also the least likely to generate the highest revenues as they tend to hold fewer high value securities. But they are highly valued custody clients, and it is important for the overall relationship to include them in securities lending.

The European experience is similar to what external research has found in the United States. A November 2022 Finadium survey showed broad support for indemnification at US ’40 Act funds, driven by both operational managers and fund Boards. While no one wants to pay more for indemnification, which has been a historically free or bundled offering, one conclusion is that lending without it could be unacceptable to many fund Boards today.

Not all GC trades are equal

Soon after a Basel III endgame implementation, it may no longer be possible for European agent lenders to indemnify all securities loans without meaningful losses, and it is likely that part of that business will cease if General Collateral (GC) levels do not increase. Instead, agent lenders could propose indemnifying some trades but not others. Part of that will depend on whether the loan is for GC or hard-to-borrow (special) securities.

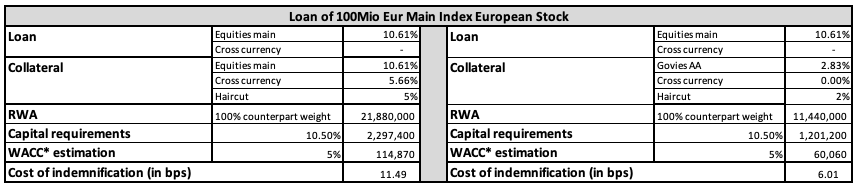

If agent lenders are required to apply standard RWA calculation methodologies, then the hurdle cost or minimum viable level for GC loans should also be calculated to ensure that return on equity is maximized. Current procedures are to assess the transaction’s principal when defining a lending fee and minimize the impact of collateral, haircut, risk weighting of the borrower (especially counterparts impacted by Brexit) and cross-currency add-ons. As a simplified illustration, the cost to indemnify an equity-based GC loan can vary between 6bps if government bonds are received as collateral and 11.5bps for standard equities (see Exhibit 1). Based on an 80:20 revenue split, the minimum viable rate for the bonds example would be 30bps, and over 55bps for standard equities.

Exhibit 1:

Indemnification costs for equities and bonds

Source: CACEIS

Note: Chart assumes 5% haircut on all types of collateral and an 80:20 revenue split

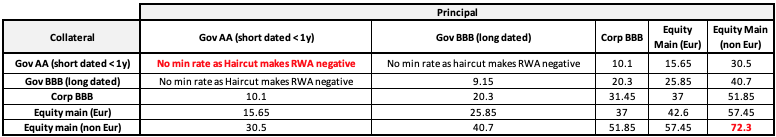

Minimum viable rate for a GC trade can vary from 0bps to 72.3bps (see Exhibit 2). These simplified calculations use a 5% rate, however the weighted average cost of capital (WACC) will vary considerably between banking institutions. If GC trades lose their profitability for Agent Lenders providing indemnification for clients, then the activity will cease. However, there are factors that can be adjusted, including haircuts, collateral type, cross-currency trades, and revenues splits, which can maintain indemnified trades’ profitability. This second example considers that GC rates would benefit from being calculated using greater granularity.

Exhibit 2:

Minimum viable rates for GC transactions

Source: CACEIS

It is essential to establish whether borrowers will be prepared to pay the 40/50bps for GC equities vs equities as collateral. Such rates may well become commonplace in a market where the RWA of the underlying lender clients makes it possible. And when Basel III endgame reforms are implemented, certain clients will gain the advantage of a reduced weighting and a corresponding increase in their return-to-lendable/return-to-on-loan balance. Other clients may not be so fortunate.

GC trades that fail to meet the indemnification hurdle rate become money losers for agent lenders. While some must be performed, recurring GC books of business become drains on profitability and ultimately cause concern among senior managers. Specials can comfortably surpass the initial indemnification hurdle cost and earn revenues for both beneficial owners and agent lenders, but the on-loan value of deep specials in the European market is estimated at around 2% of the EUR 235 billion of on-loan balances. This suggests that most European securities loans could not be profitably indemnified.

Reconsidering the CCP option

CCPs offer another model for securities lending that creates more appealing RWA exposures for agent lender and borrowers. Eurex’s Lending CCP was an option until 2021 when it closed due to a need for replatforming, but market participants have since asked Eurex to consider restarting their program. Existing European CCP models that accept the buy-side for repo and OTC derivatives have proven successful and could be for securities lending if the Basel III endgame introduces prohibitive costs for bilateral business.

The current risk weight exposure to a Qualifying CCP is 2%, according to Basel III rules. The EU revision presents a formula for calculating contributions to the default fund of a CCP, but this is certain to result in a much lower RWA than 100% or 20%; in the end, regulators want to see OTC business move to CCPs for standardization of risk management and a level of insurance in support of financial stability. CCPs have already branded part of their buy-side programs as “indemnified”, and extending that concept to securities lending would be a straight-forward step.

The ideas of offering indemnification for hard to borrow securities and moving transactions entirely to a CCP would be disruptive to the bilateral industry. However, even without the endgame, the status quo under Basel III has created complexities for agent lenders. The final rules may well force change to this logical conclusion.

About the Author

Olivier Zemb joined CACEIS in 2019 as Head of Equity Finance & Collateral Management in Luxembourg. He started his career in Paris at Fortis Investment Management as a Securities Finance Trader. He has over 16 years of experience in the Securities Finance industry with almost 10 years at BNP Paribas Securities Services in London where he was Head of Global Trading Strategies for the Agency Lending department. Olivier holds a Master 2 Research (DEA) in Markets and Financial Intermediaries from the Toulouse School of Economics.

Olivier Zemb joined CACEIS in 2019 as Head of Equity Finance & Collateral Management in Luxembourg. He started his career in Paris at Fortis Investment Management as a Securities Finance Trader. He has over 16 years of experience in the Securities Finance industry with almost 10 years at BNP Paribas Securities Services in London where he was Head of Global Trading Strategies for the Agency Lending department. Olivier holds a Master 2 Research (DEA) in Markets and Financial Intermediaries from the Toulouse School of Economics.