Tradeweb reported average daily volume (ADV) of $763.4 billion in April across its electronic marketplaces for rates, credit, equities and money markets. This is an increase of 14.6% year over year (YoY).

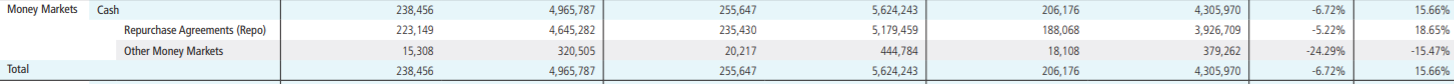

In the money markets segment, repurchase agreement ADV was up 18.7% YoY to $223.1 billion, and bilateral repo activity continued to grow as Tradeweb added new dealers and participants for electronic execution.

Source: Tradeweb

Lee Olesky, Tradeweb CEO, said in a statement: “Following historic volatility and volumes in March, activity was more normalized but was still higher than any prior April on record. Our clients are adjusting their workflows for the longer term, and we are seeing accelerated adoption of electronic protocols and processing.”

On the final day of April, Tradeweb set one-day records in US Treasury, European government bond and US credit trading, with more than $2.4 billion in credit portfolio trading.