One of our favorite thinkers on Shadow Banking, Zoltan Pozsar, has released a new paper on the role of Shadow Banking in financial markets. His previous work focused on the microstructure and mapping of Shadow Banking – who does what and how they do it. This latest piece makes the case that Shadow Banking plays an important part in leveraged bond portfolios, which in turn could create new policy arguments for increasing market liquidity without increasing balance sheet utilization. We review his draft paper published on January 31, 2015.

Pozsar’s paper, “A Macro View of Shadow Banking: Levered Betas and Wholesale Funding in the Context of Secular Stagnation,” is a big piece of work with big ideas; it takes a couple of reads to let it soak in. Our main takeaways are:

1) Pozsar makes the connection between leveraged bond portfolios and matched-book repo desks, with asset managers seeking repo because there aren’t enough Treasuries to purchase. These leveraged portfolios are not just confined to hedge funds but extend far and wide as options for financial market investors, including long-only funds. (Finadium subscribers can read more at “Unconstrained bond funds vs. securities lending? (Premium Content).“). As Pozsar notes:

Cash pools are cash rich but “safety poor” since they are too large to be eligible for insured money and face a structural shortage of Treasury bills. This drives them toward shadow money claims such as repos collateralized by bonds. On the other hand, levered bond portfolios are securities rich but “return poor” in the sense that they have a mandate to beat their benchmarks.

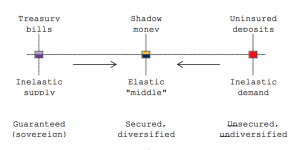

Basically, fund managers are working to meet pension investor demands for safe returns by extending into the safest leverage they can – typically Shadow Banking transactions based on pretty secure investments as collateral. Shadow Banking serves as a elastic middle ground for providing liquidity (see graphic).

2) The definition of repo as a tool for banks to fund their bonds is poorly suited to the matched-book business. This is important stuff – defining repo as a means for banks to leverage themselves and their clients up is a very different view than considering matched-book business as a way for asset managers to meet pension plan requirements. This gets back to a theme we’ve discussed often, which is the relationship between securities finance and the real economy. Pozsar says that the matched-book business is meeting an important need for real investors. This has been missed by regulators looking solely at repo as a shadowy leverage play. The difference plays into policy making:

From a macro-financial perspective, it is crucial to get a firm handle on who broker-dealers are funding through their financing operations, and by extension, the aggregate volume of levered bids they finance for fixed income securities throughout the asset management complex.

3) Pozsar argues for a Shadow Banking-oriented hypothesis on why Treasury term premiums and mortgage spreads compressed prior to 2008 and how this differs from hypotheses proposed by Ben Bernanke (Federal Reserve) and Hyun Song Kim (Princeton University).

4) There are three policy options arising from Pozsar’s analysis: first, the regulation of large banks could be adjusted to allow them more room as matched-book providers of liquidity to asset managers. Second, give asset managers alternative sources of liquidity to allow them to turn away from large banks as Shadow Banking liquidity providers. Third, and most likely unrealistic, is reforming the ecosystem to change investor demands and the way that cash investment pools are run entirely.

5) The tangible expressions of trying to find a balance to these problems are creating a Dealer of Last Resort (as the Bank of England is doing) and crowding out private money with public money (as the Fed is doing). Both solutions can work; the difference is whether the private sector or the public sector should be benefiting from the financial gains.

This paper is a good and important piece of work for separating out the conversation of Shadow Banking for bank leverage purposes and Shadow Banking as a means of meeting investor demands for safe returns. We recommend reading it with a couple of hours and a cup of coffee. It’s worth the time.

More of Zoltan Pozsar’s work has been reviewed on Securities Finance Monitor here:

Zoltan Pozsar: “Shadow banking and the global financial ecosystem”. A thoughtful new take on shadow banking., November 20, 2013

The IMF looks at policies for regulating shadow banking, January 3, 2013