A recent report by the Bank of England’s Market Practitioner Panel focuses on post-trade processing, an area where Panel members see significant scope for improvements in efficiency and resilience. It sets out the Panel’s analysis of the underlying issues, highlights some specific action areas, and sets out plans for further work aimed at catalyzing reform in post-trade.

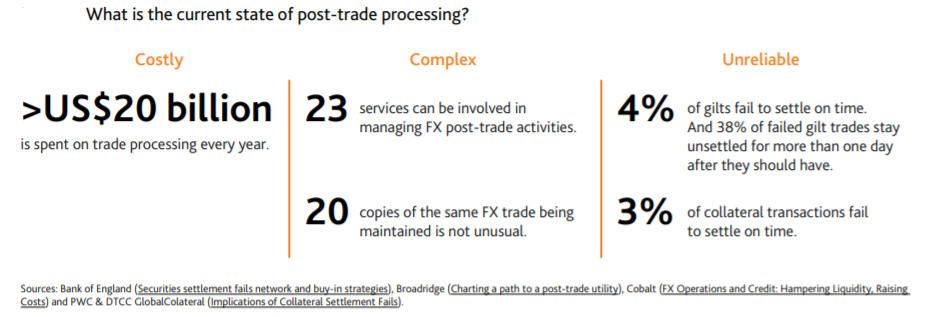

The post‑trade processes that support FICC markets are complex, costly and inefficient, and both within and across firms, have evolved organically over time, with layers of legacy technology systems, infrastructures, and workflows. The resulting patchwork, while functional, is complex, costly and inefficient, which impacts operational resilience. As just one example, data are not always standardized and are held in multiple systems that may require constant reconciliation, raising costs and the chance of errors. Taken together across the trade life cycle, across all asset classes, and across all firms, the inefficiencies in post-trade processes present both a significant opportunity for change, and a source of systemic risk.

While it focused on improving post-trade processes, the Panel also recognized that what happens before a trade is executed can have material knock-on implications for the efficiency and resilience of the processes that happen afterwards. For example a number of post-trade activities could be eliminated entirely if data were standardized, complete, accurate and consistently exchanged by all counterparties at or before the point of trade execution.

While it focused on improving post-trade processes, the Panel also recognized that what happens before a trade is executed can have material knock-on implications for the efficiency and resilience of the processes that happen afterwards. For example a number of post-trade activities could be eliminated entirely if data were standardized, complete, accurate and consistently exchanged by all counterparties at or before the point of trade execution.

The Panel identified a number of areas that pose particular problems during post-trade processing:

- Know your customer (KYC) and anti‑money laundering (AML) checks — data collection as part of the client on-boarding process is not standardized: inconsistencies arise in both the data themselves and the way data are collected. This leads to extensive duplication and significant manual processes for the industry.

- Uncleared margin and collateral related processes — margin calculations, communications and dispute resolution processes differ across firms. Non-standard processes hold back automated processing, leading to operational risks and to disputes, which are often dealt with via protracted bilateral communications (often over email).

- Trade enrichment — information beyond material economic trade data are not exchanged early enough in the trade life cycle and may be inaccurate, incomplete or not standardized, leading to the need to ‘enrich’ trade data through subsequent interventions.

- Internal and external data reconciliation — multiple copies of the same trade data are maintained (inconsistently) across firms, and automated interfaces for data exchange are underdeveloped. This holds back automation, resulting in duplicated processes, and increases operational and cyber-risks.

- Handling trade errors, exceptions, and breaks — lack of consistent protocols and procedures makes diagnosing and resolving errors time consuming and resource intensive.

- Processing corporate actions (eg share splits, mergers) and derivative life‑cycle events (eg novation, fee payments) — requires manual overrides and checks, and can be vulnerable to errors.

- Protecting against fraud and cyber‑risk — lack of standardized mechanisms for the collective sharing of data on suspicious activity in real-time increases the vulnerability of individual firms

Two broad themes emerged that underlie these issues, and give rise to complexity, cost and inefficiency: varying data standards, quality and accuracy; and different approaches to processes across firms. The BoE also prepared case studies for actions that could alleviate some of these pinch points.