The June 2015 Federal Reserve Senior Credit Officer Opinion Survey on Dealer Financing Terms (SCOOS) survey has been released. We take a look in a two-part post.

According to the report, participation on the repo side was broad.

“…The 21 institutions that participated in the June survey account for almost all dealer financing of dollar-denominated securities to nondealers and are the most active intermediaries in OTC derivatives markets…”

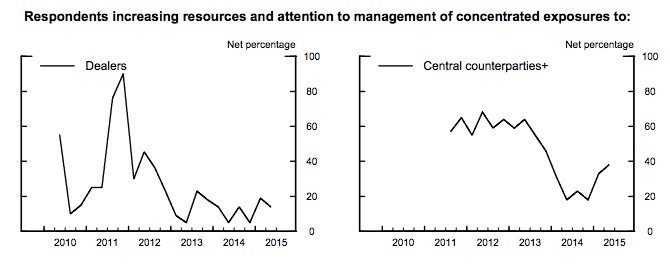

CCPs are influencing the market. The underbelly of central clearing is the focused risk and single point of failure conundrum. More repo dealers are thinking about it. It is no surprise given the public debate and tension between CCPs who want more dedicated member resources and the clearing members who think the CCPs need to raise more capital.

It also looks like some dealers might be referencing haircuts and margin on cleared trades as a template for uncleared trade terms. If cleared trades are less risky to the repo dealer, we’d expect margin and haircut rule to be harsher for bilateral deals. That certainly is the way it works for uncleared derivatives these days.

“…Nearly two-fifths of respondents reported an increase in the amount of resources and attention devoted to the management of concentrated exposures to central counterparties and other financial utilities over the past three months. Nearly one-third of dealers noted that the practices of central counterparties (including margin requirements and haircuts) influenced to some extent the credit terms applied to clients on bilateral uncleared transactions…”

But in all fairness, while the focus on centrally cleared trades has gone up to 40%, back in 2011 it was closer to 2/3rds of the respondents who reported increased focus on exposure to central counterparties.

Source: http://www.federalreserve.gov/econresdata/releases/SCOOS_201506.pdf

Most repo dealers haven’t changed their view on their competitors.

“…Over four fifths of respondents to the June survey reported that the amount of resources and attention devoted to the management of concentrated credit exposure to dealers and other financial intermediaries remained basically unchanged over the past three months, while the remainder pointed to an increase…”

The same goes for hedge fund clients…but 20% of the participants said they had tightened terms in response to balance sheet and capital availability. We wonder if that number is under-reported or lagging?

There continues to be some room to grow higher margin trades.

“…One-fifth of dealers reported in the June survey an increase in demand for funding of equities over the past three months, and almost one-third reported an increase in demand for funding of non-agency RMBS. Over one-third of respondents noted an increase in demand for term funding—that is, funding with a maturity greater than 30 days—of non-agency RMBS…”

While the most common response in the SCOOS surveys is “unchanged”, there are some hints of changes in the market. Will these turn into full-blown trends? Time will tell.

Tomorrow we will look at the special questions in the survey. They are about liquidity in fixed income markets.