US financial markets have a problem that Europe has known for years: interest rates for high quality liquid asset cash investments are hovering near zero or have turned negative. This has resulted in the skyrocketing use of the Federal Reserve’s Reverse Repo Facility (RRP) and an increasing interest in alternative repo products. These options have their own limitations however. Could the next choices for US cash be even further afield? A guest post from Natixis.

A host of interventionist monetary policy and regulatory dynamics have led to reduced options for US cash investors. The market was able to contend with Dodd-Frank and managed through low interest rates from 2008 to 2015, but the exceptional circumstances of COVID-19 is adding to stress. This is no surprise: as temporary relief measures like the exclusion of US Treasuries from the Supplementary Leverage Ratio (SLR) expired in March 2021, more short-term disruptions were to be expected.

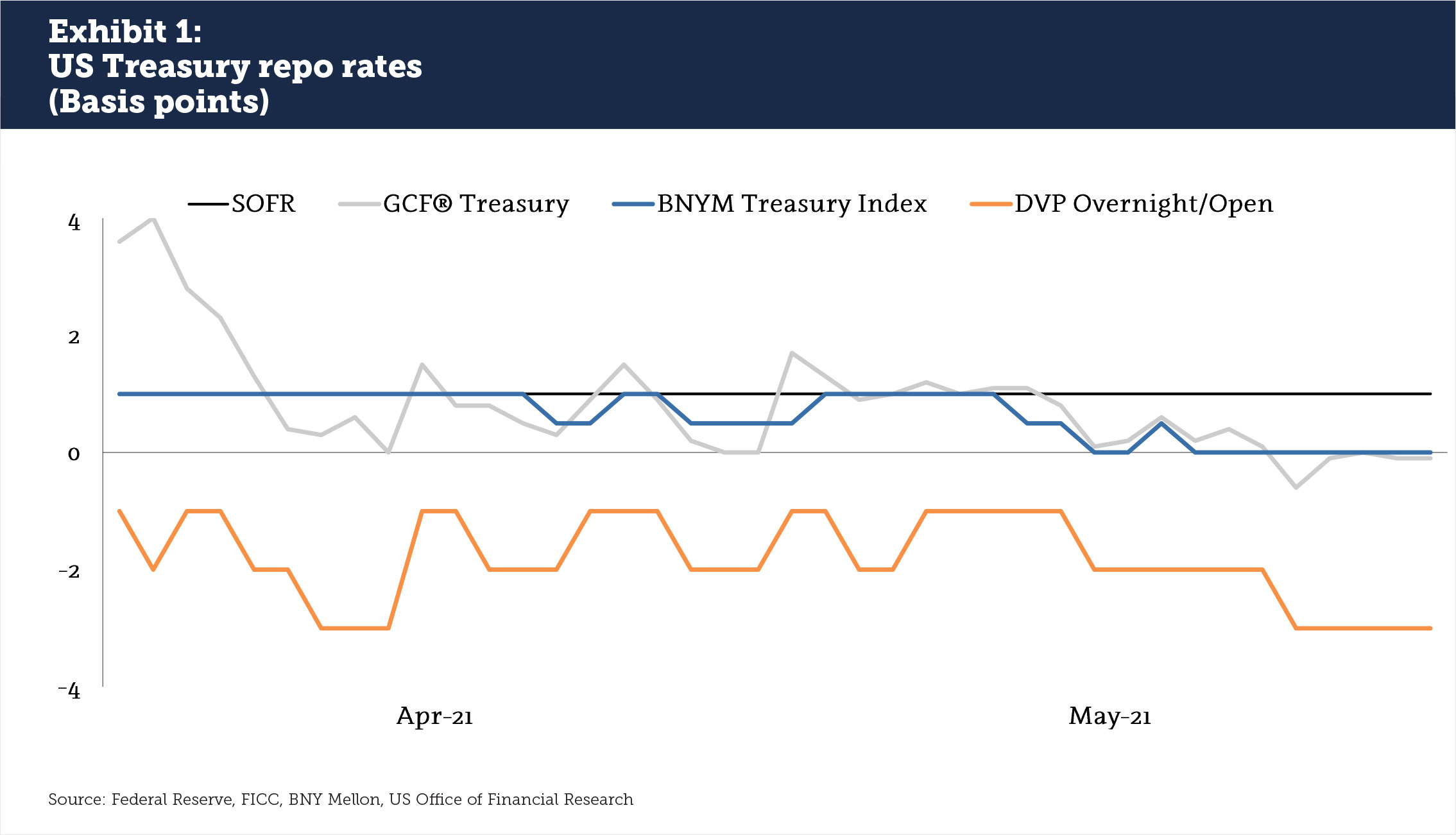

We now see some of the major implications from last year’s market and macro-prudential adjustments. Repo rates for US Treasury collateral on FICC’s GCF® have stayed close to 0 basis points in May 2021 from a high of 4 bps in early April 2021, and rates have been steadily negative on the FICC’s DVP platform (see Exhibit 1). The Secured Overnight Financing Rate (SOFR), a blended indicator of US repo market activity across multiple segments, is at just 1 bp. By these measures, the US is fast approaching the experience of Europe, where negative benchmark rates have been the norm since June 2014.

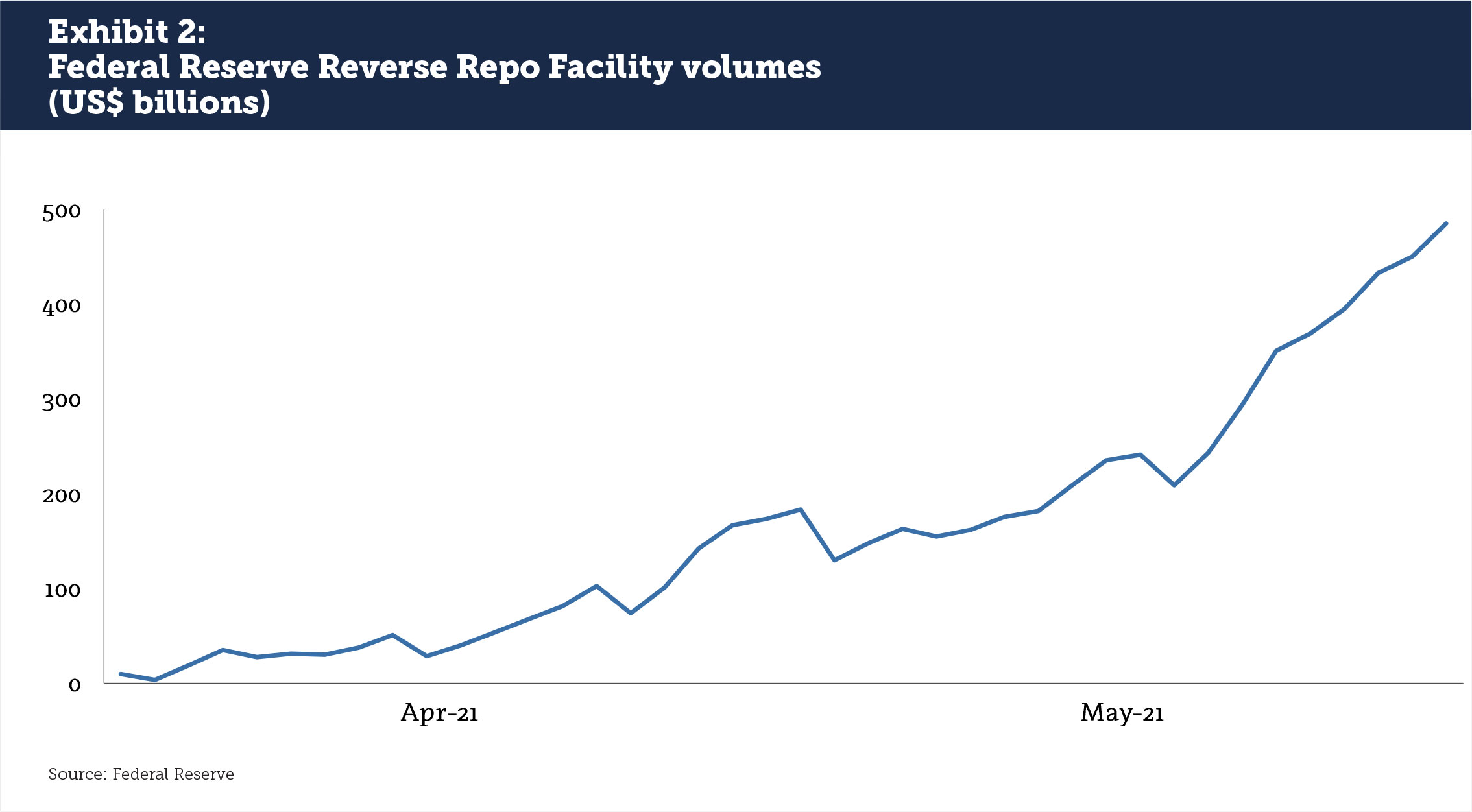

The behavior of money funds and government entities with access to the Fed’s RRP shows the stress that these actors are under to stave off negative returns. Starting April 5, just a few days after the SLR exemption expired, money funds began turning to the RRP in numbers not seen since late March and early April 2020, when the US Treasury market destabilized. By the end of May 2021, RRP-accepted volumes hit $480 billion (see Exhibit 2). Dealers don’t want or need extra cash, and may themselves be forced to charge negative rates for deposits. This makes the RRP an ideal safe haven even at a rate of 0 bps.

This situation becomes highly challenging, with balance sheet being deployed by dealers and rates navigating between -0.02% to +0.02% on most days. In addition to the disappearance of spread, the RRP safe haven is withdrawing liquidity from the inter-dealer community.

Europe in 2014

Europe’s experience with introducing negative interest rates in 2014 shows some potential paths forward for US investors, all of which test the limits of yield management and risk tolerance. The basic interest of clients in cash management has not changed: clients still want a reliable distribution of investment options, ranging from overnight to a few months, to be able to maximize the value of free cash. There are few things worse for a corporate treasurer than to sit on cash that has not been invested in at least overnight repo. However, in an environment where banks are discouraging overnight deposits and hope that clients will turn to money market funds instead, the problem is compounded. By investing in cash funds, investors are passing on the dilemma of what to do with cash to their designated money fund manager, who themselves have no good response.

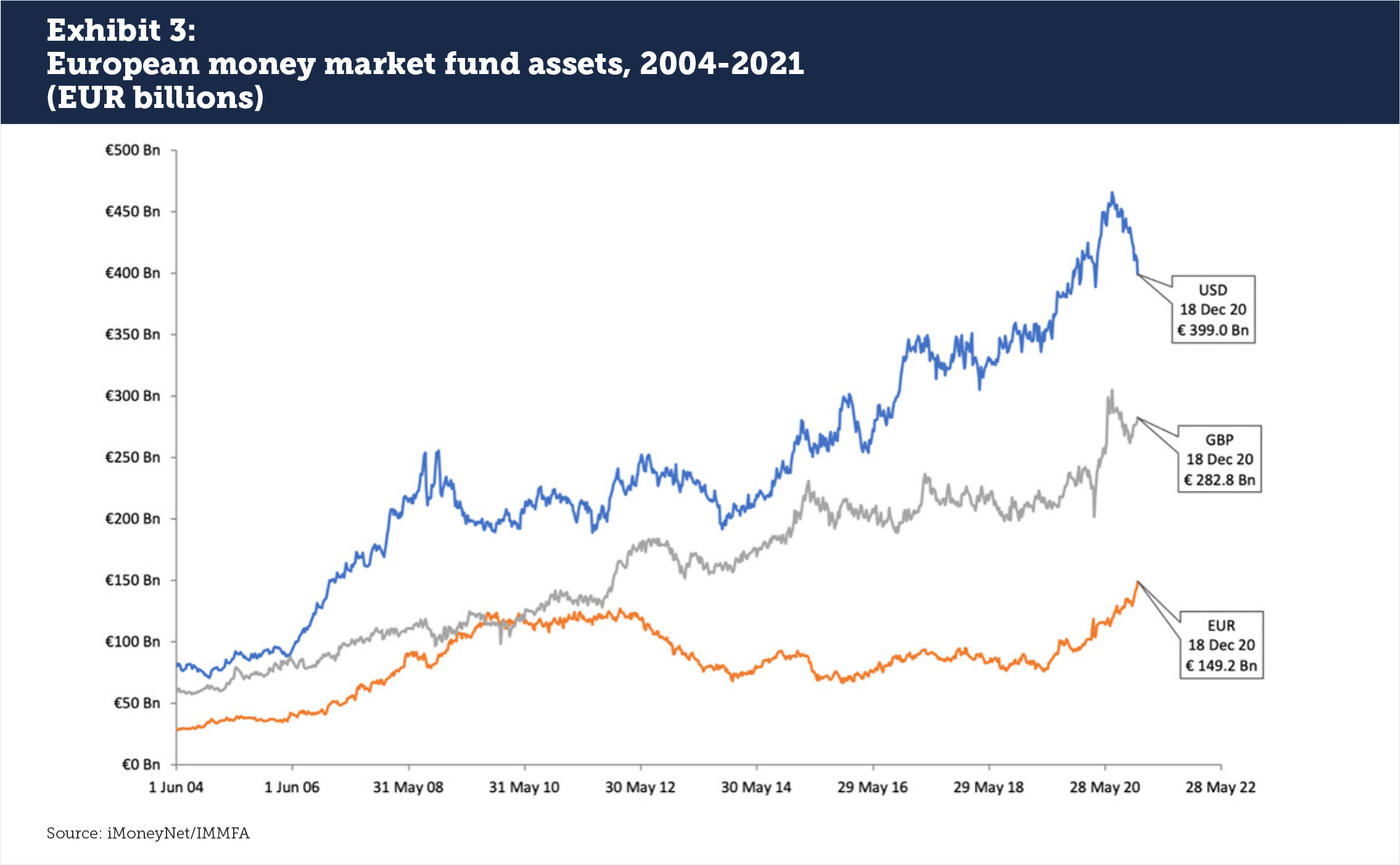

A similar chain of events in Europe in 2014 resulted in the same conversations, with expectations of a slow demise for money funds that did not happen in practice. While European investors did seek higher yields from USD and GBP investments with positive interest rates, EUR-denominated money funds have also seen an increase in assets, especially since 2019 (see Exhibit 3). The same cascade of risk tolerance that occurred in Europe starting in 2014 is now starting to happen in the US. This has important implications for global asset flows as investors find the equilibrium of a new normal.

Term and alternative US repo

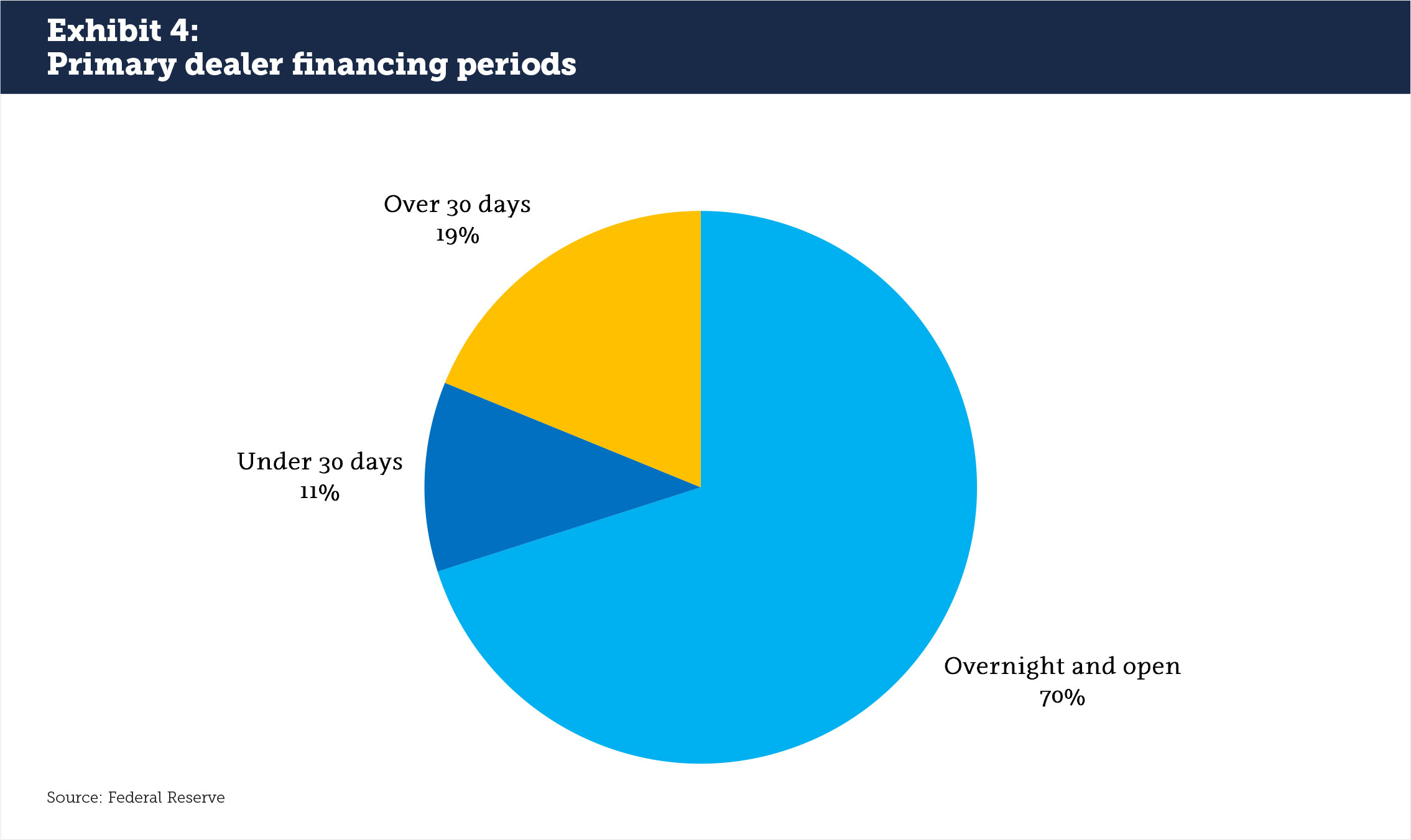

We see an increasing number of clients exploring new risk tolerances in cash investing. Overnight repo investments are moving to 1-month then 3-month repo, which can be attractive for dealers as well. As of April 2021, roughly 30% of primary dealer financing business was longer than overnight, according to Federal Reserve filings (see Exhibit 4). Of the remainder however, only 19% truly qualifies as value-added for dealers looking to extend their financing terms and gain balance sheet benefits. The rate improvement for term repo can be up to 2 or 3 bps for 3-month term, and up to 10 bps for one year. Building in term structures to recapture lost yield is a good idea as long as investors are certain that the Federal Reserve will not launch a surprise taper, and indeed, Fed Chair Jerome Powell has said repeatedly that the Fed does not plan to taper any time soon. However, shocks do happen, and investors should remain alert. Further, money market regulation limits the opportunities of regulated funds to engage in term.

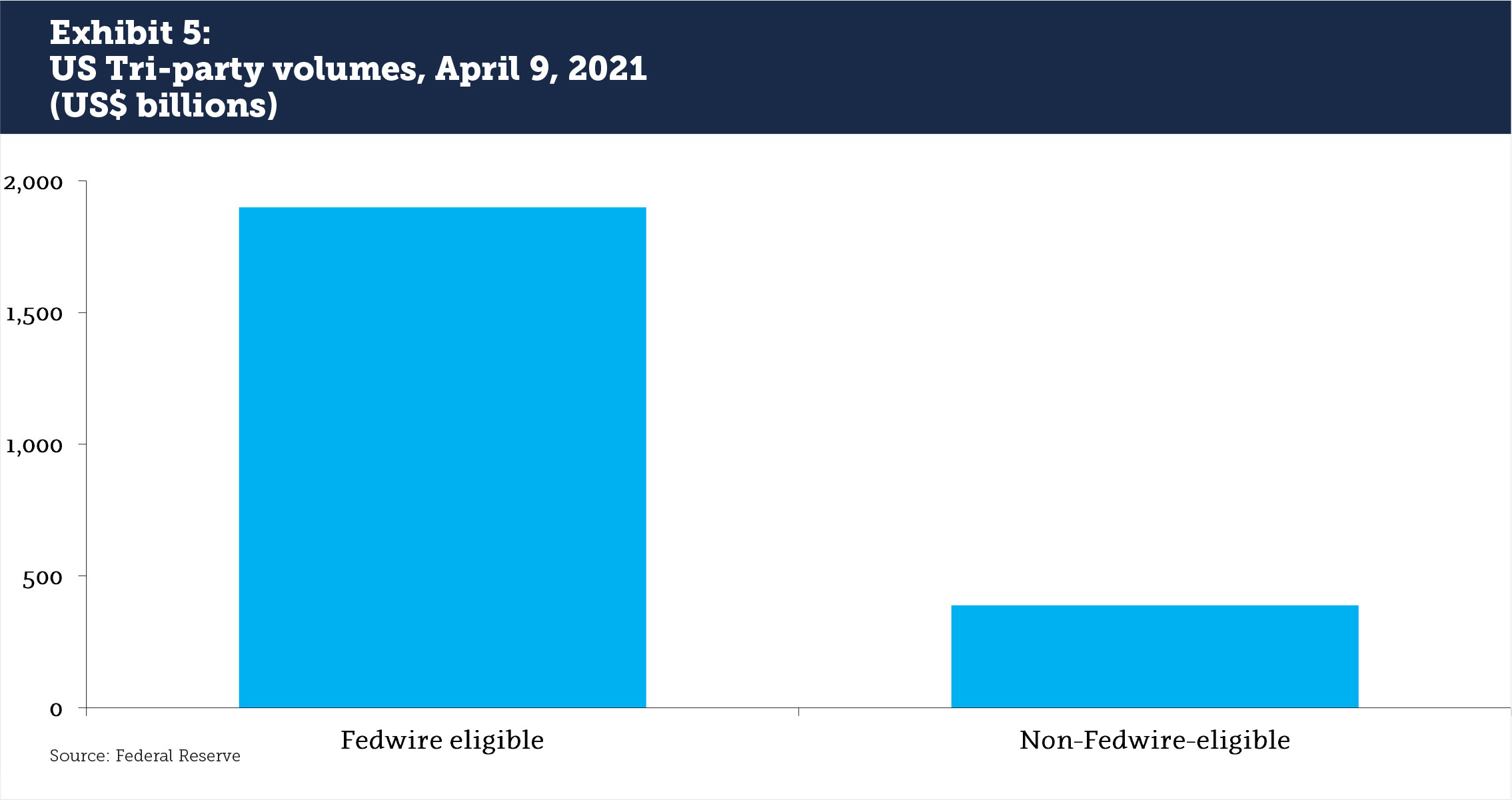

Other clients are investing in alternative repo – repo backed by equities, ETFs, convertibles bonds, corporate bonds, even high yield and securitized papers – to earn returns that can be 25 to 50 bps higher than overnight US Treasury repo. This can be worthwhile although there is again a limited supply: according to the Federal Reserve, the value of non-Fedwire-eligible tri-party repo, including equities and corporate bonds, was $388 billion in April 2021 compared to $1.898 trillion in Fedwire-eligible securities (see Exhibit 5). There will always be dealer demand to finance credit products but unlikely enough to replace the nearly $2 trillion US Treasury and Agency tri-party repo markets.

A potential opening for emerging market and digital assets

The European experience since negative rates were introduced in 2014 suggests that US investors will seek the next-least risk option as 2021 continues, including term and alternative repo. These options have limited capacity however. Some investors will respond by accepting the very low returns on money fund assets and cash deposits. Others will explore innovative options ranging from equity-linked or corporate repo transactions to high yield and securitized papers in emerging markets.

A few emerging markets have opened for securities lending and repo, and this may be of interest in the search for return. Structuring arrangements and legal agreements may pose obstacles, but early adopters could benefit from yields not typically available in developed markets. Credit intermediaries may be helpful to investors in these cases; regulation can constrain even the biggest pockets of liquidity. The ability to transform exposures into eligible wrappers is essential.

Likewise, new baskets of digital assets that replicate a cash fund across multiple currencies may become interesting. This could take one of many forms including exposure to digital currencies like bitcoin or ether as a basket, or a collection of stablecoins that are linked to short-term rates across multiple jurisdictions. Investors could then choose whether to tie their investments to US, European, Chinese or a variety of other venues. While this may seem a bit risky to traditionally conservative investors, there are already multiple firms that have publicly purchased digital assets as a core part of their Treasury strategy. Digital assets are not for everyone but they are considered viable in some parts of the market.

As the attractiveness of US overnight Treasury repo dims, other options will take its place for investors willing to accept a variety of greater term, risk and yield characteristics, starting with term and alternative repo and potentially extending from there. This will require challenging conversations for firms new to these ideas, and means that capacity constraints will need to be overcome for a successful strategy rollout. Some firms will elect to stay in safe but low performing US money market and overnight cash funds. But new opportunities await with their own risks for firms with an interest in exploring the possibilities.

Simon Sourigon is Head of GSF Americas and GSF Global Head of Securities Optimisation at Natixis. He is responsible for the Securities Lending, Collateral management and Single stock trading teams worldwide (US, Europe, Asia). Simon has spent more than 14 years in Equity Finance, including 13 years at Natixis. He holds a Master’s in Finance from ESLSCA Business School.

Simon Sourigon is Head of GSF Americas and GSF Global Head of Securities Optimisation at Natixis. He is responsible for the Securities Lending, Collateral management and Single stock trading teams worldwide (US, Europe, Asia). Simon has spent more than 14 years in Equity Finance, including 13 years at Natixis. He holds a Master’s in Finance from ESLSCA Business School.