DTCC’s Fixed Income Clearing Corporation (FICC) and National Securities Clearing Corporation (NSCC) work to solve problems for market participants that are best accomplished by central utilities. DTCC’s CCP services have changed over the past 40+ years in line with client feedback, market evolution and regulatory requirements. Clearing solutions do not arrive on their own, nor do they succeed in isolation: they require continued engagement and feedback from market participants.

The introduction of a number of new, significant regulatory proposals, including the Basel III Endgame proposed rules, new U.S. Securities and Exchange Commission (SEC) proposals around recovery and wind-down planning and mitigating governance conflicts, and, perhaps most significantly, the SEC’s proposed expansion of central clearing of U.S. Treasuries and U.S. Treasury repo, may require yet another reevaluation of clearing requirements for in-scope entities, as well as a fresh look at the value of clearing services for U.S. repo and securities finance transactions (SFTs).

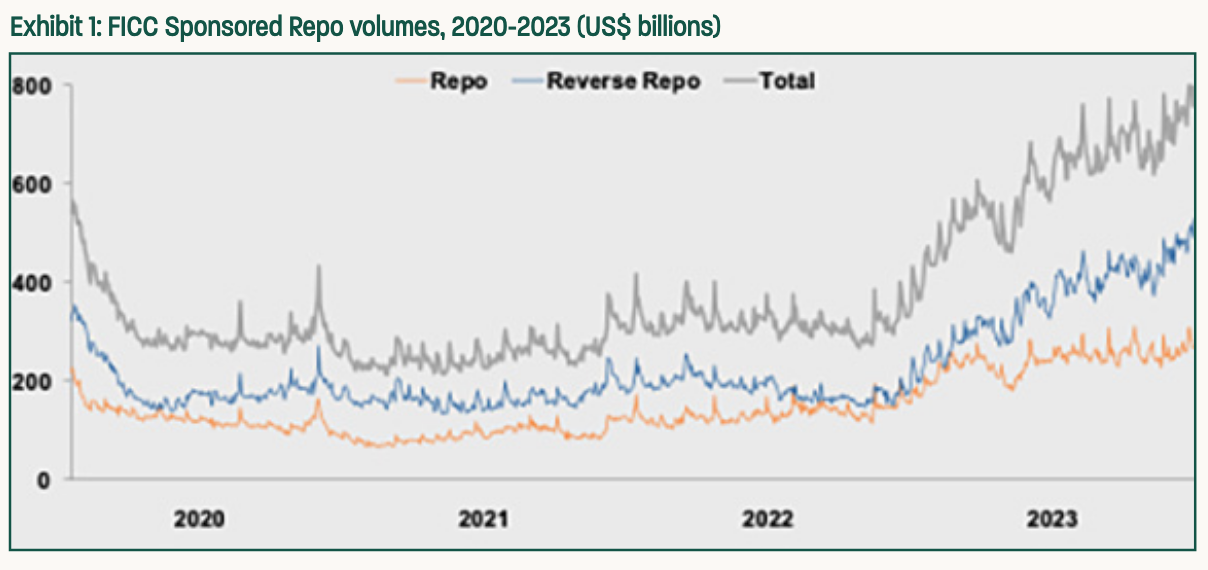

FICC has seen success in recent years with its Sponsored Repo clearing. FICC’s Sponsored Service was a referendum on clearing and the market decided that change was worth the effort. The results are in the numbers: FICC now typically clears between $700-800 billion daily in sponsored repo activity (see Exhibit 1).

Source: DTCC

Assuming the SEC’s proposed rules for expanded central clearing of U.S. Treasury repo and cash activity becomes final and takes effect, a recent survey by DTCC estimated that an additional $1.63 trillion may need to be cleared daily by market participants. If the proposal for expanded clearing is implemented as currently written, Treasury cash and repo clearing will likely become much less optional than it is today, and firms that currently trade bilaterally, outside the guarantees of central clearing, will likely need to integrate further with the CCP.

In contrast, NSCC’s Securities Finance Transaction (SFT) CCP has not yet seen the same type of voluntary adoption and momentum as the sponsored repo activity. Industry participants note that the math does work on the CCP for some equity loan and borrow transactions and for some counterparties, but this has not yet been enough to drive deep integration and go-live for many firms. One commonly cited challenge to the NSCC SFT CCP, although well-known since the beginning of the effort, is the fact that the default management contributions for cleared equity loans and borrows are typically significantly higher than for treasury repo given the relatively higher volatility of the underlier. To help ease the burden of such contributions, NSCC has made specific accommodations to allow for those contributions to be satisfied in a mix of cash and Fed-eligible securities, but such accommodation has yet to drive broad adoption. Culture and client behavior, as with any change in the financial services markets, are additional hurdles: the CCP requires a new way of doing business for some firms, where future benefits are sometimes difficult to foresee in real time.

At the same time, across every major financial region, Basel III Endgame rules will have a major impact on the balance sheets of financial market participants; this applies whether the rules stay close to the 2017 and 2019 original Basel III finalizations or are the new additions found in the U.S. Notice of Proposed Rulemaking. The U.S. version of the final rules propose changes to how large banks calculate their risk weighted assets and prefers much more standardization than the Basel Committee originally proposed. The new U.S. Expanded Risk-Based Approach means that balance sheet costs for U.S. banks are likely to increase by about 19%. Repo and securities finance may see some localized benefits from lower counterparty risk weights in the bilateral market, but many parent banks will see increased GSIB charges that may eliminate any business-level savings. On top of this, operational risk capital requirements are increasing. This has been mentioned recently by several member firms as one of the main drivers of the increase in regulatory capital requirements at the top of the house.

The introduction of U.S. Basel III Endgame rules, in some form, may mean that regulated entities in securities finance may need to reevaluate the NSCC SFT CCP offering and further explore utilization of the FICC Sponsored Service, and market engagement will demonstrate that FICC and NSCC services are meeting a market need. For the NSCC SFT CCP offering, a lack of market engagement may mean that the problem set is not difficult enough yet for firms in the bilateral market to make a move to clearing in the absence of a regulatory requirement, in which case the CCP needs to consider whether it is making the right choices in resource allocation.

Participants in FICC’s Sponsored Service have shown that voluntary adoption makes sense and may soon see some version of a clearing requirement. Potential clients of the NSCC SFT CCP may want to get engaged now to start clearing and work to evaluate their business model; this is the way to safeguard their balance sheet interests alongside the Basel III Endgame.

The Value of CCPs

Of course, leveraging CCPs comes with a cost, and market participants must find a cost offset in terms of capital expense, risk management or transaction rates in order to voluntarily participate. It can be frustrating to some to hear a good argument for clearing, but then be faced with the reality of default management contributions in the form of margin and guaranty fund requirements. This is how CCPs work – there can be no robust risk management without risk waterfalls, and the default management contribution is a central mechanism in this process.

CCPs play a critical role in financial markets, acting as intermediaries in trades to mitigate counterparty risk. The robust risk management processes employed by CCPs instill confidence in market participants which fosters a healthy and liquid market environment. Regulatory authorities closely monitor CCPs to ensure their risk management processes are sound and adhere to established standards. These standards are in place to help mitigate systemic risk and foster financial stability.

FICC’s Sponsored Repo clearing members know that the default management contributions required for government bonds generally comprise more than margin in the bilateral markets, but FICC’s sponsored repo volumes show that the balance between cost and delivering benefits leans on the side of the CCP.

For non-government bond products like equities that are more volatile than government bonds, a hypothetical default management contribution could be 7% to 10% or even more in extremely volatile periods. On the flipside, it could be argued that the 102% collateral level for a bilateral U.S. equity loan against cash collateral, while market standard, does not reflect the true, higher market risk of that transaction, which a Qualifying CCP (QCCP) like NSCC must accurately account for in its risk models.

Even if a volatile equity warrants a 10% default management contribution, the counterparty risk exposure of the QCCP drops to 2% for lenders and borrowers alike. For some lenders and borrowers, this makes good economic sense. For others, it may not. But for a market that is deeply concerned about the cost of counterparty default indemnification and the risk exposure to certain types of lenders, there is an argument that the CCP’s value proposition makes sense.

Could anything else deliver a benefit that would allow market participants to obtain a 2% risk weight against any counterparty and not contribute default funds or margin?

The Power of Participation

DTCC is here to help the industry, standing at the center of global trading activity and processing trillions of dollars of securities transactions daily. The question that DTCC and market participants share is what industry challenges are most pressing that they should work on together.

FICC and NSCC have gone far to create solutions for market participants that bring efficiencies, standardization, risk reduction and cost savings. Following the finalization of new mandatory clearing rules for U.S. Treasuries and U.S. Treasury repo, if adopted, the door remains open to create new FICC rules if circumstances require it; existing clearing models are never set in stone. Likewise, any viable industry plan about how to mitigate the impact of clearing fund contributions for securities finance transactions would be heard.

CCPs will never be the only game in town, nor should they. Even with a potential regulatory mandate, there is no reason to think that clearing will be the only service that market participants use; there will always be room for bilateral, triparty, and any new options that may appear later (such as potential application of Distributed Ledger Technology). For any solution, market participation in solving problems is an essential part of how product development happens, and real change is achieved that benefits the industry.

Laura Klimpel is Managing Director, General Manager of Fixed Income Clearing and head of SIFMU Business Development at DTCC.