- The financial sector is among the most exposed to the benefits and risks of AI.

- Benefits include improvements for lending and payments; risks include more sophisticated cyber attacks.

- The increased importance of data as a cornerstone of the AI revolution hastens the need for central bank cooperation.

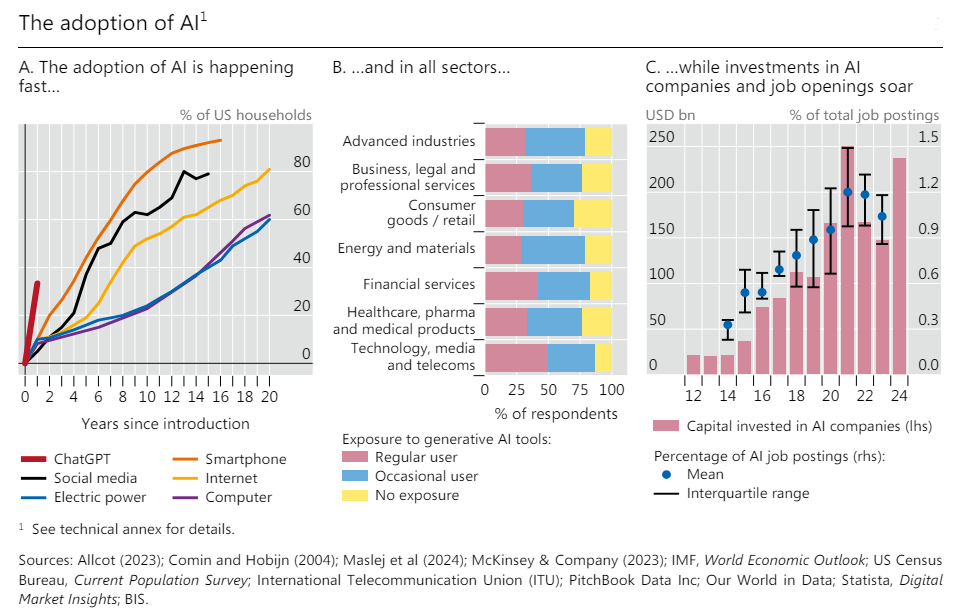

The rapid adoption of AI requires central banks to embrace the new technology, the Bank for International Settlements said, urging policymakers to anticipate the transformative effects of AI on the economy and to use it to sharpen their own analytical tools in pursuit of financial and price stability.

The special chapter of the BIS Annual Economic Report 2024 (not yet published) lays out the implications of new AI applications for central banks. AI is poised to impact the financial system, labor markets, productivity and economic growth. With widespread adoption, it could enhance firms’ ability to adjust prices faster in response to macro-economic changes with repercussions for inflation dynamics. The job of central banks as stewards of the economy will also be directly affected as frontline users of AI tools.

Central bank use cases for AI include enhancing nowcasting by using real-time data to better predict inflation and other economic variables and to sift through data for financial system vulnerabilities, allowing authorities to better manage risks. Data have become an even more valuable resource with the advent of AI and will be the cornerstone of central banks’ use of the technology.

“New generation AI models have captured our collective imagination through their uncanny abilities, but they also have a direct bearing on how central banks do their jobs. Vast amounts of data could provide us with faster and richer information to detect patterns and latent risks in the economy and financial system. All this could help central banks predict and steer the economy better,” said Hyun Song Shin, head of Research and Economic Adviser at the BIS, in a statement.

The effects on demand and therefore on inflationary pressures will depend on how quickly displaced workers can find new jobs, and whether households and firms correctly anticipate future gains from AI. In the short-run, supply could outstrip demand, which could lower pressures but those effects could reverse over time as demand also catches up through higher incomes. Central banks will need to stay attuned to these dynamics in their monetary policy.

In the financial sector, AI can improve efficiencies and lower costs for payments, lending, insurance and asset management, the report said. The BIS cautioned that AI also introduces risks, such as new types of cyber attacks, and may amplify existing ones, such as herding, runs and fire sales. The BIS Innovation Hub is testing AI’s capabilities in several areas together with central bank partners.

“Central banks were early adopters of machine learning and are therefore well positioned to make the most of AI’s ability to impose structure on vast troves of unstructured data. For example, Project Aurora explores how to detect money laundering activities from payments data and Project Raven uses AI to enhance cyber resilience, to mention just two from our portfolio,” said Cecilia Skingsley, head of the BIS Innovation Hub, in a statement.