The Alternative Investment Management Association (AIMA) released its Q2 2024 edition of its hedge fund confidence index, which surveyed some 250 hedge fund firms worldwide collectively managing about $2 trillion in assets.

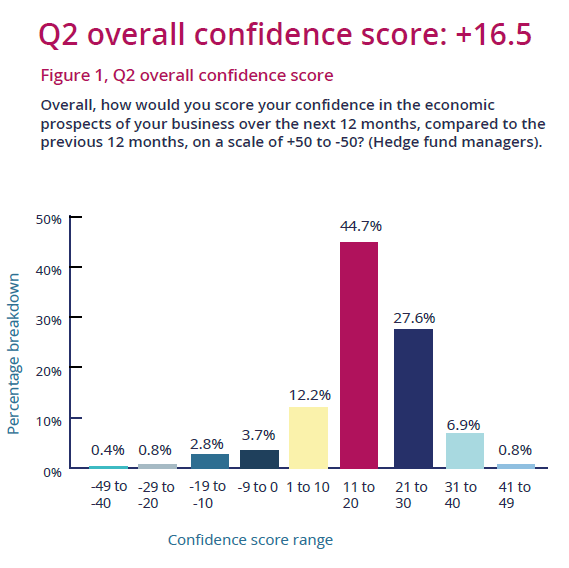

The results show an average confidence level of +16.5, down slightly from Q1 (+19) and below the rolling historic average of +17.7. The downturn in the overall average score since the first quarter comes despite the respondent pool being dominated 80/20 in favor of larger hedge fund managers, (those with an AUM greater than $1 billion), which are historically more confident than their smaller peers. Multi-strategy and global macro funds showed higher levels of confidence.

Smaller hedge fund managers who responded recorded a significant confidence downturn this quarter. Their average confidence dropped to +13, down from +18.9 in Q1. Overall, 92% of respondents reported a positive confidence score, but, broken down by AUM, 96% of larger hedge fund managers offered a positive sentiment score, compared to 77% of smaller firms.

An additional factor causing a drag on the overall performance level is the large portion of long-short equity respondents, who are once again the least confident group surveyed by strategy. So far, these hedge fund managers have failed to regain confidence despite the positive performance of major equity markets and the prospect of interest rate cuts later this year.