China’s money market is growing rapidly and playing an increasingly important role in the financial system. It serves as both a key channel for monetary policy and as a source of funding for a variety of financial institutions. In the past, smaller banks have been net borrowers in the interbank market while large banks have provided funding. However, recent data reveals a shift underway as non-bank financial institutions have emerged as the largest borrowers. This change has important implications for the development of China’s financial system.

The money market is part of the interbank market, which also includes a large bond market. Operation of the interbank market is managed by the National Association of Financial Market Institutional Investors (NAFMII), a self-regulatory organization which operates under the supervision of the People’s Bank of China (PBoC) and whose members are financial institutions. Trades are matched via the electronic order system operated by the China Foreign Exchange Trading System (CFETS).

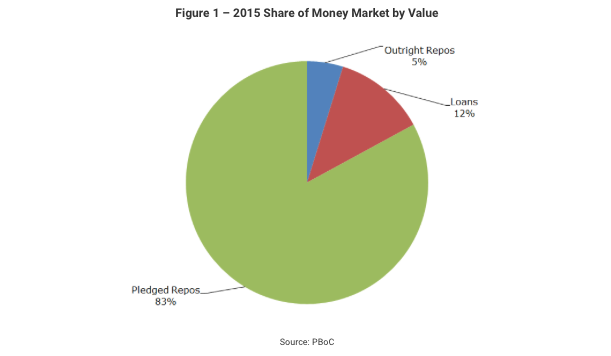

As Figure 1 below shows, the primary instruments traded in the money market are pledged repurchase agreements (repos), followed by interbank loans and outright repos. The repo market dwarfs the lending market because a wider variety of financial institutions and entities are allowed to participate. Instruments with overnight and seven-day maturities account for 96 percent of the total market.

The full article is available here.