A February 20th research piece in the Liberty Street Economics blog at the NY Fed “Primary Dealers’ Waning Role in Treasury Auctions” caught our eye. It is worth a read.

The study looks into why the percentage of US Treasury securities bought in auctions by the Primary Dealers has fallen. Ten year notes, for example, fell from 68% of the auctions being taken up by dealers (from study done in 2007) to just 33% in a recent auction. Overall, primary dealers bought 70% of new US Treasury issuance in the 5 or so years before the Lehman bankruptcy but only 56% in the years following.

One could imagine that with prop trading on the wane, overall market liquidity falling, and rates so incredibly low that the US Govie trading business would be shrinking like the secondary corporate bond business. But US Treasuries has been a growth business – there has been a lot of issuance to finance the deficits. So what does the study find?

First of all, there are a couple ways to buy US Treasuries at an auction besides going through a Primary Dealer. An investor – say a foreign central bank – could put in a bid directly to the Treasury (a “direct bid”), an investor could ask a Primary Dealer to place a bid on their behalf (an “indirect bid”), or a buyer could put in a non-competitive bid to the Treasury (“noncompetitive bid”).

Cutting to the chase, the study found that it was a change in behavior from other bidders who were not necessarily buying paper from the Primary Dealers anymore (and hence reducing the need for PDs to buy paper in the aucion), but going in a more direct path to the US Treasury that is driving the shift. There are some technical reasons impacting the numbers – the Treasury changed how it characterized some bids, moving them outside the “Primary Dealer” bucket – and that may explain part of the shift as well (see link below).

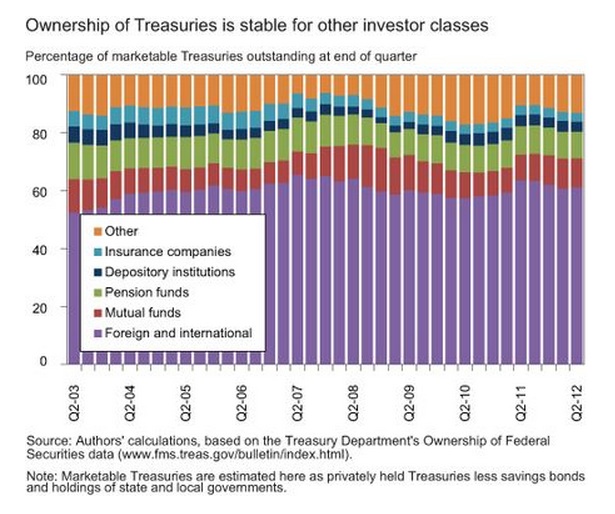

We read a lot about the ever-increasing portion of US Treasury debt owned by foreign countries, in particular China. It turns out that the percentage of UST debt owned by foreign countries has been pretty stable, hovering around 60% (see chart below). While increased deficits and stable ownership percentages imply larger absolute holdings – and those are big numbers these days – it does not create the dire situation that some pundits have claimed.

Primary dealers make money from information. They need market share and customer flow to inform them about where prices are going and how to trade the markets. Anything that reduces that flow of data will make dealer position taking a riskier proposition. While the Primary Dealers are at no immediate danger of losing their grip on the market, the world did change post-Lehman and their role is diminishing.

A link to the Liberty Street blog post is here.

A link to the rule change mentioned is here.