Last month we saw a very well written piece in MarketWatch on the trend toward less and less liquidity in the corporate bond market. The article, by Ben Eisen, was called “Mile wide, inch deep, Bond market liquidity dries up”. We take a look.

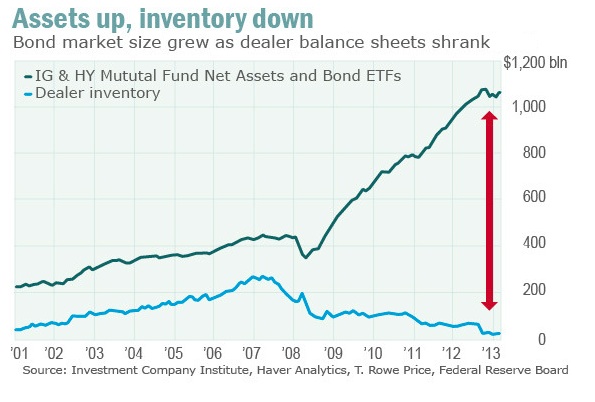

The story of deteriorating liquidity in the U.S. corporate bond markets is not a new one. While issuance has skyrocketed with low rates, trading volume has fallen along with dealer inventories.

The culprits have been the found: lower bank risk appetites that emerged post-financial crisis and the impact of the Volcker Rule in reducing proprietary position taking. The traditional structure of corporate trading businesses – client facilitation books as well as back books focused on longer term prop trading – simply doesn’t work in the current environment. But we think the story is a bit more nuanced than that.

The article made passing reference to the Trade Reporting and Compliance Engine a/k/a TRACE. It is the poster child for successful market transparency efforts. But, as the piece noted, dealers are hesitant to trade outside of the prices seen in TRACE. In an over the counter market like corporate bonds, transparency is not the dealer’s friend. It reduces the spreads in the market. A sidebar in the article said, “A study by Harvard and MIT professors published in September found that trading volume dropped off dramatically immediately after Trace transparency data was released, with the biggest drops occurring among the comparably less liquid high yield bonds…” We wonder if the reduced profitability isn’t the main driver for the shriveled market liquidity? Banks play a risk and reward game…and falling rewards result in risk being allocated elsewhere.

An interesting point made in the article was the increased premium put on illiquidity. Corporate bonds trade less and less as they season. Along with the reduced liquidity comes a risk premium that is necessary to keep investors owning paper that is more difficult to transact in.

“…A November Goldman Sachs report estimates that the premium that a bond pays over Treasurys is roughly 10% larger when a bond is illiquid, a large increase over pre-crisis levels. Shown the other way, liquid bonds on average yielded about 0.1 percentage points less between 2011 and mid-2013, according to BlackRock. That may not seem like much, but in a low-rate environment, every basis point counts over the life of a bond…”

We wonder how the repo market has been taking this into consideration? Less liquidity should mean higher haircuts. While IG and HY corporates were only 4.1% of the tri-party repo market (FRBNY, Nov, 2013) that still represented $66 billion of collateral value. Median haircuts for IG and HY corporates were 5% and 8% respectively. To put this in context, the US Treasuries median haircut was 2% and the median h/c for equities was 8%. The Fed started to publish data on the tri-party repo market in May, 2010 and median haircuts on corporate paper (IG and HY) back then were the same, 5% and 8%, respectively (and have been remarkably consistent throughout). In the period between May, 2010 and Nov. 2013, dealer inventories have continued to fall while IG and HY corporate bond funds kept growing. Tri-party repo in corporates has also gone down by almost half during the period. Something seems inconsistent here. Is all that paper going to non-leveraged investors?

The scenario some people focus on is that when investors start to sell – as they did when rates spiked in 2013 on taper fears – cash and repo liquidity simply may not be available. We don’t necessarily fully buy that one either. Banks will dedicate capital to where they can make money and a market in disarray is prime hunting ground. TRACE data won’t be very meaningful if prices are bouncing all over the place. If dealers have shifted toward a non-risk agency-like model, it means that forced sellers will have to execute at whatever bids can be found out there. Can you say “fire sale”?