Inventory management is a cornerstone of securities finance, funding and collateral management, but often gets little attention until it is too late. This should not be the case, as inventory management is the first thing that buy- and sell-side firms should pay attention to when getting serious about collateral and liquidity management. Inventory management is the foundation on which efficient businesses are built, and contextualizes a firm’s positions.

Theoretically, it should be possible to aggregate data easily, then buy or build technology to run reports and connect to counterparties later on. After all, there are many vendors with algorithms and reports that help a user select the right collateral to deliver. Likewise, there are many ways to connect to the market, such as point to point connectivity, FTP, SWIFT and cloud intranets. However, this plan does not always work out well in practice. The development of mono-line systems and use cases means that unless inventory and trade data is harmonized across the enterprise first, reports and counterparty connectivity largely falls short of expectations.

The common challenge that vendors and clients face is the level to which collected information is comprehensive and normalized. A collateral management system with only 50% of a firm’s available position and inventory data is less than 50% effective at its objective: successful delivery of the right collateral at the right time, incentivizing the right business behavior to reduce costs, and better risk management.

The natural response to this situation is to collect all pockets of inventory into one pool so traders and allocators of collateral can pull information on all activity and holdings from a single source. This is the point where most firms pause. For example, do they know where all their inventory information is held and in what form across products and geographies? Are all the pricing sources across inventory consistent, or did they grow up independently because of divisions or acquisitions. Do collateral managers know the details behind vast amounts of security line items, CUSIPs and ISINs to make smart decisions? The inventory management organization process can be the start of a sizable project.

Why invest strategically?

It often takes an external stimulus to get serious about strategic inventory management; recent mandates for effective liquidity and collateral management are good examples. But it can’t just sound good on paper: the benefits need to be impactful to the bottom line. As a result, it is often helpful to conduct a cost benefit analysis that shows what is at stake. As a one-off exercise, this can demonstrate the payback on inventory management. We have seen this in practice across multiple firms, when they initially looked at collateral management technology for reports and straight-through processing, then came to find that with more available inventory in the system, significant returns could be generated. These returns can reach beyond the cost of an inventory management and optimized collateral technology system combined.

Regulators across the globe have increased their scrutiny on collateral management as well. As part of the Recovery & Resolution Planning and/or Reg YY collateral management requirements, firms have to prove enterprise level collateral and liquidity management capabilities. Very few firms can claim compliance to these requirements in an automated way and will require significant changes in the overall platform. This could be a great opportunity for firms to invest in enterprise level, real-time inventory management capabilities that will help them comply to regulatory pressures but also provide significant business and operational benefits for the firm.

Tracking monetary value of collateral utilization

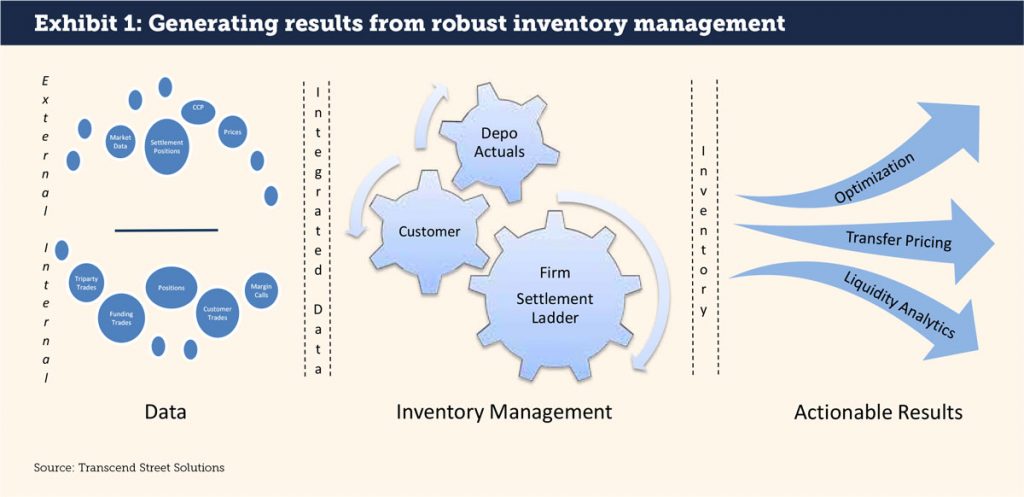

Proper inventory management requires the ability to efficiently utilize collateral by knowing what positions are available at any given time, as well as having rich context around each position (see Exhibit 1). The context includes: how long a position will be available; who the owner is; whether the position is owned by the firm or a client; rehypothecation status; and where it can be pledged at the lowest haircut. This enrichment process is still not conducted by most firms. More often, a lack of understanding about the value of collateral results in the asset owner simply losing out with no benefit to anyone else, and a net loss to the market as assets are tied up for the duration of a trade.

A robust view of collateral also means that front to back office communications become more precise and efficient, especially across global firms with different pools of assets. A successful inventory management process can reduce operational duplications, as one operations team can now see and manage one aggregated set of information about the firm’s holdings. More information on inventory means that front office traders can have a real-time window into what collateral is available to trade or post. This is a central tenet of the collateral trading business and serves to augment a trader’s opportunities in the marketplace.

Enhanced optimization opportunities

As firms create central collateral funding desks, reliable inventory management enables the efficient allocation of collateral for proper matching of sources and uses. This means matching the right asset with the right liability. Doing so could mean real savings to both capital and liquidity. But having the best model is only as good as one’s ability to see the full collateral picture. A robust inventory management platform should improve the visibility into the quantity of collateral held across an organization, and the confidence and ability of the organization to take actions based on that improved transparency. Superior information will motivate trading behavior to maximize financial efficiencies comprehensively across balance sheet, funding and liquidity. Conversely, a collateral shortfall or poor data means that a funding trader is more likely to look outside the firm to access supply, likely resulting in increased balance sheet costs and capital usage.

In a real-world example of how collateral optimization works best with effective inventory management, a collateral manager may want or need to post G7 government bonds as collateral. Presuming five different collateral pools, there are multiple scenarios that can occur:

- With visibility into one collateral pool:

- The manager would have a limited inventory to source, resulting in few options and the potential need to look outside the firm.

- The manager may need to use cash, which would remove the firm’s investment options in other business areas.

- The manager could elect to repo in government bonds or borrow in a securities loan to post as collateral. Depending on the scarcity of the government bonds, they could either be paid to lend cash or be obligated to pay to borrow.

- With visibility into all five collateral pools:

- The manager could evaluate the cost of collateral pre-trade at an affiliate and borrow that collateral in exchange for a known fee that can be priced into a transaction in advance.

- This pre-trade analysis can become part of the daily operational trading activities of the firm.

- The manager and a collateral operations team have a better opportunity to allocate cheapest to deliver collateral across all pledge requirements. Avoiding the need to go outside the firm helps minimize balance sheet and RWA costs.

- The manager could evaluate the cost of collateral pre-trade at an affiliate and borrow that collateral in exchange for a known fee that can be priced into a transaction in advance.

Real-time operational efficiencies

Aggregating collateral yields operational benefits that may be difficult to quantify up front, but result in long-term benefits to the firm. A visibility into position breaks and errors in real-time means faster response times to fails. In an era where repeated and unresolved fails have a direct financial impact, faster resolution of fails means money saved in the form of reduced operational RWA, better customer satisfaction, a reduced number of delivery instructions, and a faster escalation when greater risks are identified.

Inventory management provides a framework to address typically buried settlement and operations risk. The ability to see and think through potential pitfalls that may have been hidden as a result of clarity on the lack of inventory gives both the front and back office more precise decision making capabilities. This allows for root cause analysis of breaks and errors, ideally leading to a virtual elimination of the most frequent causes of fails.

The result of improved operational efficiency means lower collateral turnover and the costs this entails. Our clients also report an improved experience for their clients and counterparties in the collateralized trading process. Greater operational efficiencies have a direct and positive outcome for the trading process.

A wider benefit to the firm

Inventory management projects can often be a starting point to greater benefits for a financial services firm. I have already mentioned operational and pricing benefits, but these are just the start. Once an inventory consolidation project is underway, firms may find duplicate vendors and functional roles that can be reorganized as cost savings measures. They may also find that additional trading and portfolio management opportunities appear as a result of better information flows. Inventory management can be difficult to consider, especially for complex institutions, but the financial, operational, and risk management benefits are nearly always worth the effort.

Bimal Kadikar is a founder and CEO of Transcend Street Solutions, an innovative technology company focused on building next generation collateral and liquidity management solutions. Prior to founding Transcend Street Solutions, Bimal served in several senior roles at Citi Capital Markets Technology Division, where he managed global teams and projects with budgets of $500+ million in supporting multi billion dollar businesses.

Bimal Kadikar is a founder and CEO of Transcend Street Solutions, an innovative technology company focused on building next generation collateral and liquidity management solutions. Prior to founding Transcend Street Solutions, Bimal served in several senior roles at Citi Capital Markets Technology Division, where he managed global teams and projects with budgets of $500+ million in supporting multi billion dollar businesses.

Bimal led the technology organization for Citi’s prominent Fixed Income Currencies and Commodities businesses globally. He was also tapped to build Prime Finance, Futures & OTC Clearing business technology platform as part of Citi’s push to expand these business areas. Many of these technology platforms have won industry accolades and client recognition, helping Citi grow in these businesses significantly over the years.

Bimal also led a high profile initiative of driving Collateral, Liquidity and Margin strategy globally at Citi, partnering with multiple business and cross- functional areas such as Global Treasury, Repos, Securities Lending, Prime Finance, Futures & Clearing, Margin Operations, Securities services and Technology.