European regulatory requirements have led to a broad demand for reporting from banks and asset managers. This is true on a global level: rules are enforced if there is any trading with a European institution, or even a local branch of one. In considering their obligations under the new regulatory regime, non-European firms need an action plan. A guest post from UnaVista.

Regulation has gone global, or at least that what appears to be happening according to European regulatory announcements across equities, fixed income, derivatives, securities finance and even central counterparties. Between the European Parliament, the European Council, the European Commission and the European Securities and Markets Authority (ESMA), Europe has been issuing regulations and proposals that require firms worldwide to report to European authorities. While Europe’s regulators are acting with good intentions, the end result is an unusually large degree of regulatory data capture.

As an example of the range of counterparty reporting obligations, the European Market Infrastructure Regulation (EMIR) for OTC derivatives requires any European financial and non-financial counterparty to report an in-scope OTC derivative trade to an approved trade repository.

European firms already understand that their primary regulator requires reporting and that the scope has been expanding in recent years. This is nothing new, and any institution anywhere in the world would accept regulatory reporting requirements as part of the business. However, the obligation to report to another country’s regulator is a new element and one that introduces a range of questions and uncertainties to the process.

The decision matrix

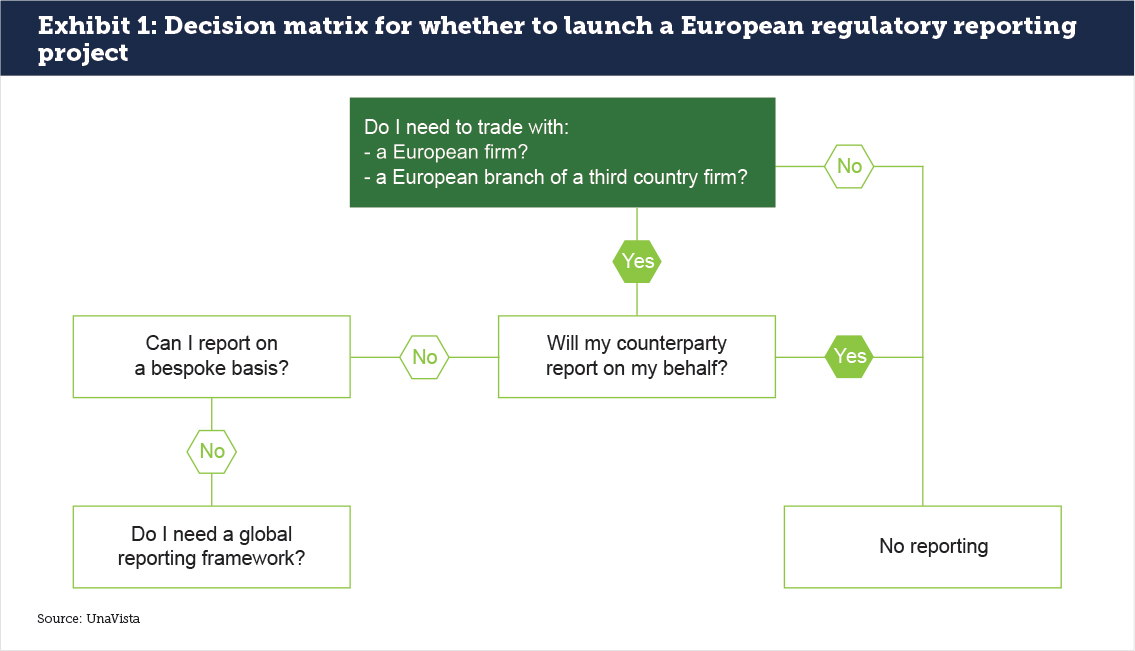

We have seen non-European firms go through a decision matrix to understand their reporting requirements and whether they have to launch a European regulatory reporting project (see Exhibit 1). The decision is often made from the negative position: can a firm avoid European reporting requirements at any point? The first choice is whether a firm can avoid trading with a European bank or branch of a European bank. Only a small number of firms, or smaller entities, can safely make this decision, while all others are too ingrained in the global financial system to turn off an important trading partner or source of liquidity.

The next question is whether the European counterparty will report on the firm’s behalf, or conversely if a trading platform will conduct the reporting. If so, then an international firm can stop there, but if not then they are required to establish a reporting framework. Lastly, firms get to the hard part: do they need to create a global reporting framework that encompasses all European and home country requirements? This means that the most complex reporting – in this case European – will drive global decision making for the firm.

Transaction reporting

Once the decision has been made to report, firms must then identify what must be reported. Each regulation has its specific requirements, and each requires fields that must be gathered from multiple internal systems and from reference data providers. Reporting must also be conducted across legal entities, currencies, asset classes and product types.

European regulatory authorities currently have two reporting requirements live, a third due in late 2019 or early 2020, and a fourth due at an undisclosed later date. Non-European firms should consider all at the same time; after all, they will be part of the same reporting tools, utilities and trade repositories at some point. Of these, firms are likely already engaged in EMIR and MiFID II reporting. They have heard more than they want to about SFTR with only rumors of a live date. And securitisations reporting is still on the horizon.

EMIR (OTC Derivatives)

EMIR requires that all derivatives contracts be reported to a trade repository. EMIR provides 129 fields, and although many of these are instrument-specific, it will still mean that firms must ensure that all the data are in one place, available for reporting at the right time and include a Legal Entity Identifier (LEI) and Unique Transaction Identifiers.

MiFID II (best execution and pre-trade transparency)

MiFID II requires that firms report pre- and post-trade best execution statistics for liquid securities. Many of these words are loaded with background on what they mean, for example that firms must have a best execution policy in place and report on that policy, or document exemptions. The idea of reporting pre-trade is an innovation, whereas post-trade reporting is already well understood and accepted. When trading systems or client types vary, it may not be possible for a firm to trade on a quoted price in any event. In any case, covered firms in Europe or those trading with European counterparts must report their trades.

At a recent SEC Fixed Income webinar, panelists speaking on MiFID II noted multiple points of confusion on the definition of liquid, which is central to determining how to meet MiFID II pre- and post-trade reporting. While international markets understand post-trade reporting quite well, pre-trade reporting is a new introduction. Without clarity on the definitions of what instruments are in scope, meeting regulatory requirements can range from difficult to impossible.

SFTR (securities finance)

SFTR has generated substantial discussion, irritation, and lastly, urgency as firms recognise that SFTR requirements could result in a rethink about their fundamental business models. As we noted in an earlier article on big data in regulatory reporting, “Regulators are currently standing by their request for over 153 different data fields, including 99 fields for loan and collateral data, 16 fields covering re-use, 20 fields on margin data, and 18 fields allocated to counterparty data…. Public success of the SFTR will be measured by the accuracy and timeliness of the data provided, but the real test is if regulators can process and learn what the data is telling them.”

The Securities Financing Transactions Regulation (SFTR) is the very definition of extraterritorial, applying to any SFT conducted between a European entity, the European branch of a 3rd country firm and a 3rd country entity. While agent lenders and broker-dealers will manage the bulk of reporting, all firms must be certain that reporting has been executed and are responsible in case of error. This places end-clients in an uncertain position if their agent or dealer fails to report accurately on their behalf.

Securitisation Regulation (securitisations)

The European Parliament published their initial guidelines on securitisation regulation in December 2017, with the expectation that soon ESMA will require reporting to a securitisation repository as they have done with derivatives, best execution and securities finance. This is the fourth and final pillar, after which regulators should have sufficient information to track all levels of traded instruments for systemic risk buildup.

There is a strong argument towards taking a single approach for all reporting rather than leave each product type and repository requirement to individual project teams. This means internal work on big data management, in which the entire firm becomes able to produce and analyse data. Some firms are able to base big data on existing infrastructure to reduce costs and streamline processes while others are starting largely at the beginning. For reporting, the benefits are a central data platform that can be adapted regardless of the next product or jurisdictional requirement. But the bigger benefits accrue to individual firms that can now generate additional insights into their investment, trading strategy, risk management and compliance activities. European regulatory reporting may wind up being the spur that individual firms have needed to get their data houses in order.

Familiar lessons: Start Planning Early and Pick Your Partners Well

The experience of market participants from EMIR and MiFID II reveals the same lessons for SFTR and securitisations: start early in planning for reporting. Non-European firms will have a harder time than European ones, as they are managing across regulators and cultures while figuring out new reporting regimes. This is no easy task even when regulations are straightforward and the market is experienced. It is compounded by the complexity of managing external reporting while ensuring that internal data sources are accurate. However, there are also similarities, like the use of trade repositories and the ISO 20022 format, as well as a reliance on LEIs.

One of the most important decisions for non-European firms in European regulatory reporting is selecting a trade repository. Firms will need to understand what they need to report and ensure that systems interface with their preferred trade repository. At UnaVista, we consolidate all EMIR, MiFID II, SFTR and multiple global derivatives reporting regimes into a single operational view; this helps clients understand their universe of reporting activity. Trade repositories can also help firms proactively troubleshoot their reporting, which feeds back to helping firms manage their internal big data challenges.

One tool at UnaVista is the SFTR Accelerator, which provides early access to technical field specifications, a gap analysis tool and early access to a user acceptance testing (UAT) environment. In the end, it’s not just about data reporting. The real effort of Europe’s reporting framework for covered firms is the process of data management.

Andrea Ferrise is the Compliance Officer for UnaVista at the London Stock Exchange. He is a subject matter expert responsible for both assisting clients with the reporting of OTC and ETD derivatives and ensuring UnaVista Trade Repository complies with EMIR regulation. In addition, Andrea holds the primary responsibility of helping UnaVista become an approved SFTR Trade Repository and supporting clients to cope with a continuously changing regulatory landscape.

Andrea Ferrise is the Compliance Officer for UnaVista at the London Stock Exchange. He is a subject matter expert responsible for both assisting clients with the reporting of OTC and ETD derivatives and ensuring UnaVista Trade Repository complies with EMIR regulation. In addition, Andrea holds the primary responsibility of helping UnaVista become an approved SFTR Trade Repository and supporting clients to cope with a continuously changing regulatory landscape.

Prior to joining the LSEG, Andrea was an ESMA officer on the TR policy and Data reporting team where he was engaged in the drafting of the Technical Standards and Regulatory fees under SFTR. Andrea holds a master’s degree in economics from Solvay Business School in Brussels.