Earlier this month the US Treasury, Office of Financial Research (OFR) released their 2014 Annual Report. It’s 150 pages plus and full of interesting stuff. This post will focus on Section 6.2, “Data Gaps Initiatives”, and the joint effort with the Federal Reserve Board of Governors and New York Fed to collect data on securities financing trades.

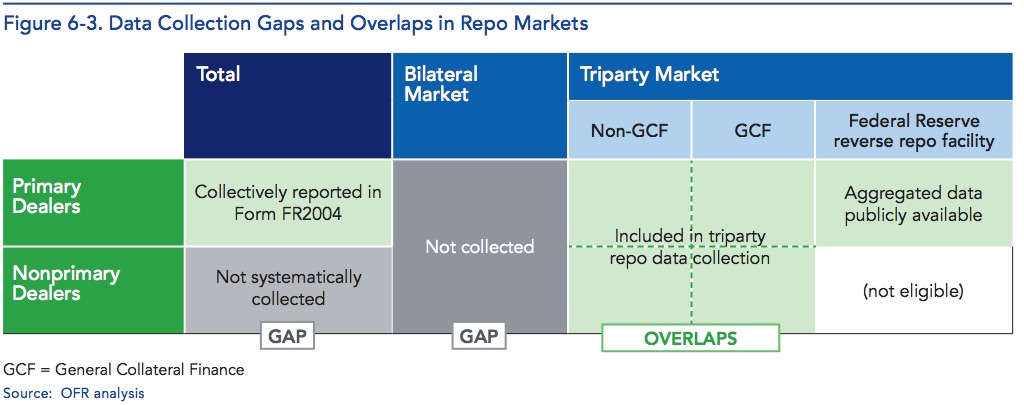

Some parts of securities financing are fairly transparent. Tri-party and FICC GCF repo data as well as consolidated dealer repo positions collected by the NY Fed (from Form FR 2004) are reported periodically. But there are huge gaps too. Bilateral repo trading data is opaque. Ultimately, the size of the repo market is driven by some data and substantial chunks of extrapolation and educated guesses. Double counting is hard to filter out. And it is a lot of data to make sense of. Regulators wanted the data but weren’t interested in driving the process (until now). Market participants weren’t handing over sensitive information to just anyone.

From the report:

“…Availability of data about repo and securities lending activities has improved since the crisis. But much of the available data is not collected in a consistent manner, which would allow for comparison and aggregation, and most is not available to the public. In addition, there are still segments of these markets not covered by existing data collections…”

The OFR, Federal Reserve Board of Governors, and the New York Fed will leverage off work done by the FSB in 2012 “Strengthening Oversight and Regulation of Shadow Banking A Policy Framework for Addressing Shadow Banking Risks in Securities Lending and Repos” to get a better understanding of bilateral repo. So far, submission looks like it will be voluntary and will start in the first half of 2015.

Data will include both trade and settlement level information.

“…Trade-level data show the dependence of individual repo market participants on short-term funding, counterparty exposure for repo and securities lending market participants, and interconnections among participants. Settlement-level data show types, loan maturities, haircuts (percentage discounts on collateral value), and quality of the securities used as collateral, as well as exposures of market participants to specific types of securities, market sectors, and geographies…”

The FR 2004 report has its weaknesses that the new data collection hopes to fix.

“…Form FR 2004 does not cover activities of broker-dealers that are not U.S. primary dealers, and it does not differentiate triparty from bilateral trades. In addition, the form does not include important information such as haircuts, rates, and the identity of the counterparty, and the information it does contain is highly aggregated. As a result, significant data gaps exist at the transaction level of these trades, particularly in the repo activities of dealers who are not primary dealers and the repo activities that are not settled on the clearing banks’ triparty settlement platforms…”

Securities Lending data is slightly better, but still lacking.

“…A substantial amount of data is available about securities lending markets, but those data belong to private vendors… However, these data collections are voluntary and do not include essential data elements about counterparties or collateral management. No systematic, targeted data collection is conducted for the benefit of regulators or the investing public. For that reason, these data are not necessarily complete or comparable for analysis…”

The report noted using Legal Entity Identifiers (LEI) would allow integration with other trade repository efforts and risk monitoring. We would note that along with Trade Type indicators, LEIs could go a long way toward allowing correcting for double counting.

“…Transaction-level data would not only offer insights into the dispersion of pricing across counterparties and asset classes, but with proper identifiers, such as the Legal Entity Identifier (LEI), transaction data can be consolidated with other data sources. This detail is critical for fundamental research projects that attempt to measure the market impact of a large liquidity shock and assess subsequent fire sales…”

Of course we would be remiss if we did not say that repo and securities lending is only part of the issue. Other trade types (for example, Total Return Swaps) need to be incorporated if regulators want to get a full picture of leverage. From the report:

“…Total outstanding repurchase agreements (repos) and the issuance of financial products with embedded leverage are below pre-crisis levels. However, we lack detailed information on derivatives-based leverage; it is an area that suffers from data opacity and warrants further analysis…”

But it goes farther than that. Special attention need to be paid to any balance sheet netted transactions to insure they are captured in the regulatory reporting. Prime brokers’ internalized financing trades represent leverage and should be tracked as well. Repo conduits and Collateralized Commercial Paper (backed by repos) should be included too. (Take a look at the Finadium paper “Collateralized Commercial Paper: Regulatory Arbitrage or Elegant Solution?“.) And collecting data only in the US doesn’t really capture the whole financial interconnectedness thing.

This is a great start by the OFR and the Federal Reserve Board and New York Fed. What they do with the data – well, that is another story.