We’ve been wondering for a while now how important money market funds remain in financing banks. Of course they are heavily involved in repo, but with decreasing repo supply and the availability of alternatives like the Federal Reserve’s Reverse Repo Facility, we thought we’d dive deeper to see what the data show.

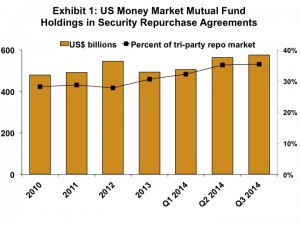

US money fund holdings are pretty transparent if you know where to look. The Federal Reserve publishes money fund data in its Z1 report, available quarterly. The last filing was December 11 covering data through Q3 2014. The line item, Security Repurchase Agreements, covers repo. The Fed also publishes tri-party balances by asset type and has estimated the size of the bilateral repo market as of mid-2014. We’ve excluded the bilateral market since money funds are generally not active here. We find that the participation of US money funds compared to reported tri-party figures has risen from 28% in 2010 to 35% in Q3 2014 (see Exhibit 1).

Some clarifications on these figures. First, US money market fund repo holdings could potentially include bilateral repo not included in tri-party. Rare, but it could happen. Second, there is no accounting for asset types in the Fed’s reported data and barely any in the SEC filings of money market mutual funds themselves. So we know that “participation” has risen but not the collateral or tenor behind that participation. Lastly, the Fed’s Reverse Repo Facility can take up anywhere between US$90 billion and US$190 billion in demand, much of which comes from money market funds. The Fed does not publish details on what funds received what types of allocations.

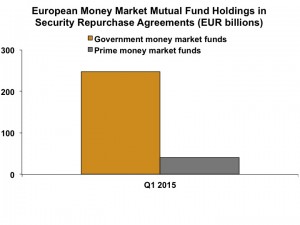

In Europe, the most recent data we found show government money market funds with 53% of their assets in repo. Prime money market funds have just 9%. The data come from the Institutional Money Market Funds Association (IMMFA), which is a group of Constant NAV money market funds with about EUR 450 billion in AUM. We reviewed multiple data sources to find the AUM of government vs. prime money market funds including imoneynet, but were not confident that we had captured the universe of funds. What we have suggests that the prime universe is EUR 458 billion while the government universe is EUR 467 billion. Taken together, we estimate that European money market funds have EUR 289 billion (US$326.5 billion) invested in repo as of January 2015 (see Exhibit 2). (As a side note, Variable or Floating NAV funds have an additional EUR 494 in assets, for a total money market fund universe of EUR 927 billion (US$1.05 trillion).

Compared to the latest European Repo Council survey that found EUR 5.78 trillion in outstanding positions, the holdings of European money market funds, at EUR 289 billion, is 5% of the European repo market. While there are methodological considerations here, including the counting of repo and reverse repo positions in the ICMA survey, the basic idea is that European money market funds hold a much lower percentage of repo than US money market funds.

Where do things go from here? US money markets have already been affected by repo reform. European funds may soon face their own version. According to the IMMFA, “The European Commission has proposed that MMFs aggregate the risk exposure of the collateral with that of the securities held within the investment portfolio. This would be operationally impossible to implement and would effectively mean that MMFs would no longer be able to use reverse repo for managing liquidity.” That’s enough for a headache right there. But suffice to say, there will likely be more regulatory activity surrounding European money market fund repo utilization.