The International Capital Markets Association (ICMA) has released the results of a survey-based study intended to assess the impact of the CSDR mandatory buy-in regime on the European bond secondary markets. The regime is due to go live in September 2020, but is expected to be extended to November 2020 due to a technical issue related to CSDR cash penalties.

The study sets out to answer five key questions: (i) What is the general preparedness of firms both

from an operational and trading strategy perspective? (ii) How will sell-sides adjust their pricing and liquidity provision across a range of bond sub-classes? (iii) What are the expectations of buy-sides with respect to pricing and market liquidity? (iv) What are the likely impacts for repo and securities lending? (v) What possible refinements or enhancement to the framework could help to mitigate the risks of unintended consequences?

In total, there were 44 responses to the survey, representing buy-side firms (16), sell-side firms (16), and repo and securities lending desks (12).

More than half of respondent firms have plans to adapt their operational processes as well as their approaches to trading and risk management, with repo and securities lending businesses leading the field: In terms of adapting risk management and trading strategies, repo and securities lending desks seem to be more advanced (with 83% already preparing). However, the general view across all constituents is that there is limited or little market awareness of the regulatory requirements and likely impacts.

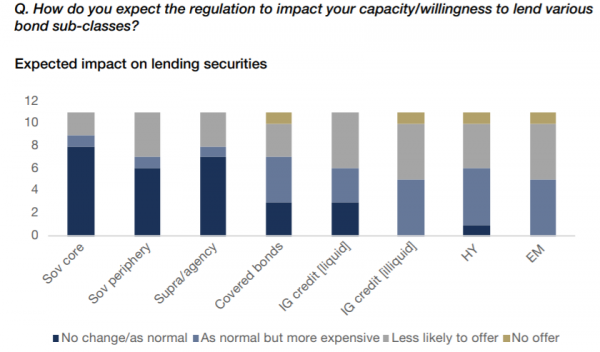

The survey responses suggest that for the most part, lending and repo activity will continue as normal for SSAs (sovereigns, supranationals and agencies). For other sub-classes of bonds, however, the indication is that borrowing securities will become both more expensive and more difficult.

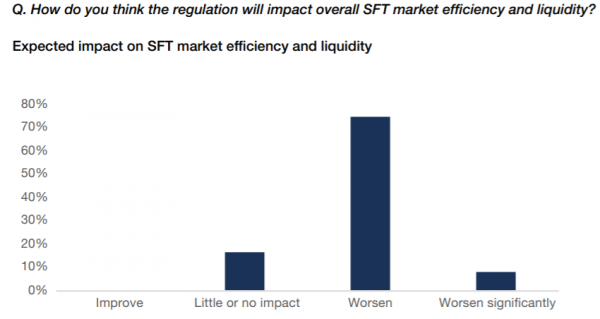

In terms of price impacts of the regulation, bid-ask spreads of all bond sub-classes are expected to more than double, with covered bonds and illiquid IG credit seeing the biggest impact. In absolute price terms, the impact is most notable at the lower end of the credit spectrum, with significant increases for emerging market, high yield, and illiquid IG corporate bonds.

The cost of widening bid-ask spreads and diminished market liquidity will be directly borne by buy-side, including UCITS, insurance companies, and pension funds. Furthermore, reduced secondary market liquidity will likely have an indirect impact on the cost of issuance and even access to the capital markets for certain issuers, not least smaller corporates and emerging sovereigns. The anticipated market impacts of the EU’s mandatory buy-in regime suggest that the real economic consequences are likely to be profound, while the benefits remain unclear.