Published by Stanford University, the AI Index Report tracks, collates, distills, and visualizes data relating to artificial intelligence. Here are some of the highlights related to finance.

When it comes to the largest and fastest growing sectors for AI-related investment, the AI Index report found that globally, 4,403 AI-related companies were identified that received investment during the last year. From 36 distinct sectors, top focus areas included Data Tools (5.5% of all companies); Fashion and Retail Tech (4.7%); Industrial Automation, Oil & Gas (4.3%); Financial Tech (4.2%); and Text Analytics (4.2%). During that time period, these funded startups received a total of $55.7B in private investment, or roughly $12.6M per startup.

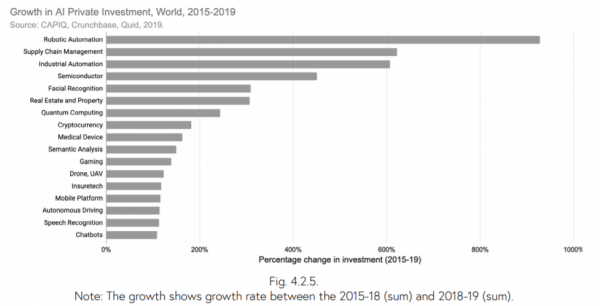

Autonomous Vehicles (AVs) received the largest share of global investment over the last year with $7.7B (9.9% of the total), followed by Drug, Cancer and Therapy ($4.7B, 6.1%), Facial Recognition ($4.7B, 6.0%), Video Content ($3.6B, 4.5%), and Fraud Detection and Finance ($3.1B, 3.9%).

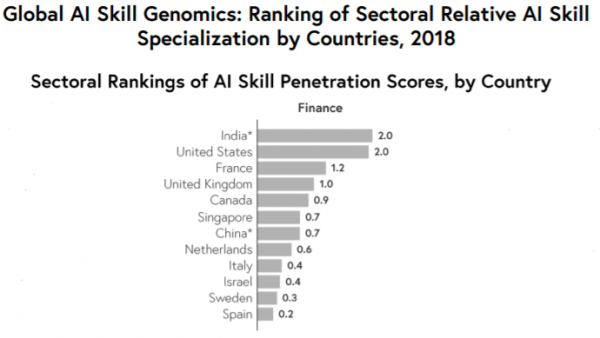

Among sectors, finance has the largest number of AI mentions in earnings calls from 2018 to Q1 of 2019, followed by the electronic technology, producer manufacturing, healthcare technology, and technology services sectors. Earnings calls data includes all 3000 publicly-traded companies in the US, including foreign-listed companies that also trade on a US exchange.

In terms of sectors in the US labor market experiencing stronger AI diffusion via AI job demand: tech service sectors like Information have the highest proportion of AI jobs posted (2.3% of the total jobs posted), followed by Professional, Scientific and Technical Services (over 2%), Finance and Insurance (1.3%), Manufacturing (1.1%), and Management of companies (0.7%).