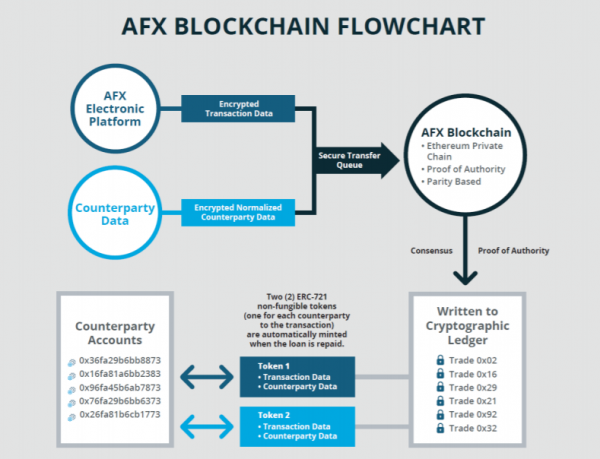

American Financial Exchange (AFX), an electronic exchange for direct lending and borrowing for American banks and financial institutions, announced the launch of its AMERIBOR on the blockchain. AFX now mints two ERC-721 non-fungible tokens for each AMERIBOR transaction on the AFX platform (for each counterparty to the transaction).

The pair of tokens is automatically minted when the transaction is repaid by the borrowing counterparty to the lending counterparty. Each token contains encrypted transaction data and encrypted counterparty data. The counterparty data is normalized prior to encryption to further preserve counterparty anonymity.

Tokens are transferred via secure queue to a private, proprietary, parity-based AFX Ethereum proof-of-authority blockchain. Tokens are then written to a cryptographic ledger to each counterparty’s account and are owned by the respective counterparties to the AFX transaction.

“This is AFX’s first major blockchain initiative,” said AFX chair and CEO Richard Sandor, in a statement. “We learned a great deal about this new and exciting technology and believe the blockchain has the potential to transform electronic trading and financial markets. AFX is committed to remain in the forefront of this new technology.” Richard Sandor is also the recent author of a book about financial markets and the blockchain titled, Electronic Trading and the Blockchain: Yesterday, Today and Tomorrow.