We recently completed a survey of collateral management technology providers and will soon publish a similar survey of collateral management service providers. Something that struck us was the points of competition and differentiation between the two groups. Here’s what we are seeing.

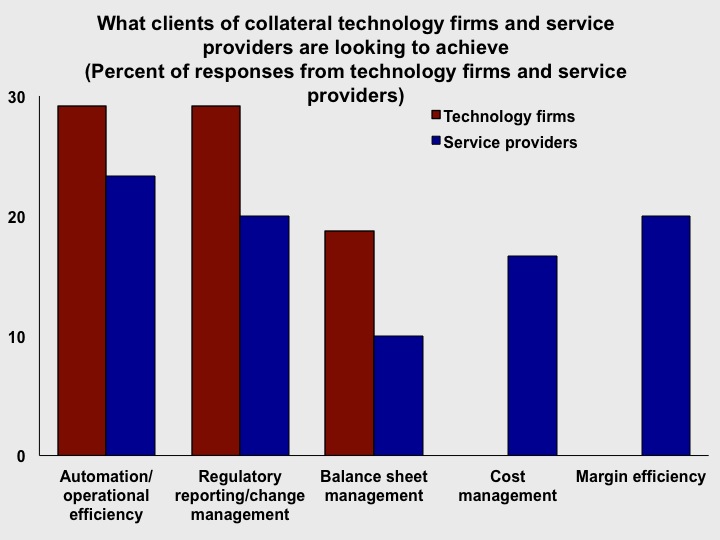

The biggest point of overlap is what problems that technology vendors and service providers report that their clients are trying to solve. Automation/operational efficiency is the single largest category for both groups: 29% of technology vendors said this was important while 23% of service providers cited it as a main goal. Of course, all clients of these firms are looking for operational efficiencies, but only a subset said that is was a top priority or the main problem that clients want to solve.

We found that regulatory reporting and regulatory change management were important but here the reasons diverged. Technology vendors were more focused on regulatory reporting, or using their tools as vehicles to send in a report once all the parameters were known. Service providers saw their clients asking them questions about regulatory change. In other words, service providers were helping uncover what should go into that report then providing the report itself. It seems to us that service providers, including custodians, Central Securities Depositories and a niche consulting firm or two, were seen as the centers of expertise. Collateral technology providers are seen as more of the execution arm once the knowledge of what needed to happen was sorted out.

Likewise, collateral service providers reported that their clients were looking to them for help with cost management and margin efficiency tools, areas where no collateral technology provider reported any specific interest. This suggests to us a greater degree of client handholding and process management; these are services that technology firms have traditionally been less excited to deliver.

It shouldn’t be missed of course that collateral management technology vendors are powering about 50% of the collateral service provider offerings we found in our survey. Their reported client needs include both end-users and intermediary service providers. Thinking this through, this suggests to us again that the IT providers are the brawn and the service providers are the brains of the collateral operation. We conclude that while technology firms and service providers do compete for clients, more often their services are complimentary.