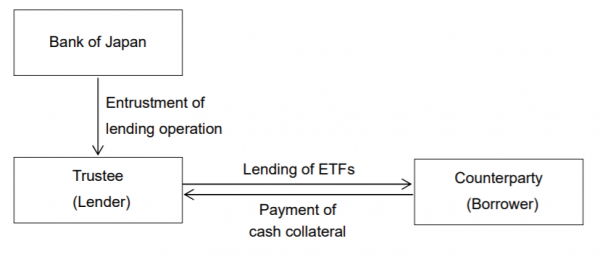

The Bank of Japan decided to introduce the ETF lending facility, through which it can temporarily lend its ETFs holdings to market participants, with the aim of improving the liquidity in ETF markets. The central bank will select the ETFs to be loaned as well as the eligible counterparties from major players in ETF markets that have a current account. The duration of lending will be within one year.

Lending rates will be determined by multiple-rate competitive auctions or by the Bank of Japan in advance. For each loan, the Bank of Japan will determine specifications necessary for lending, including the lending dates, the amount of ETFs to be lent, and the counterparties. While lending will be conducted daily at eligible counterparties’ requests, at first it is to be conducted periodically in order for the relevant parties to become proficient at the facility.

Cash collateral will be calculated by multiplying market prices of ETFs by margins and collected by the trustee, which manages ETFs held by the Bank as the trust property. The interest rate applied to cash collateral will be the rate applied to Policy-Rate Balances. The ETF lending facility will become effective on the date determined by the Governor after the date the Bank obtains authorization.