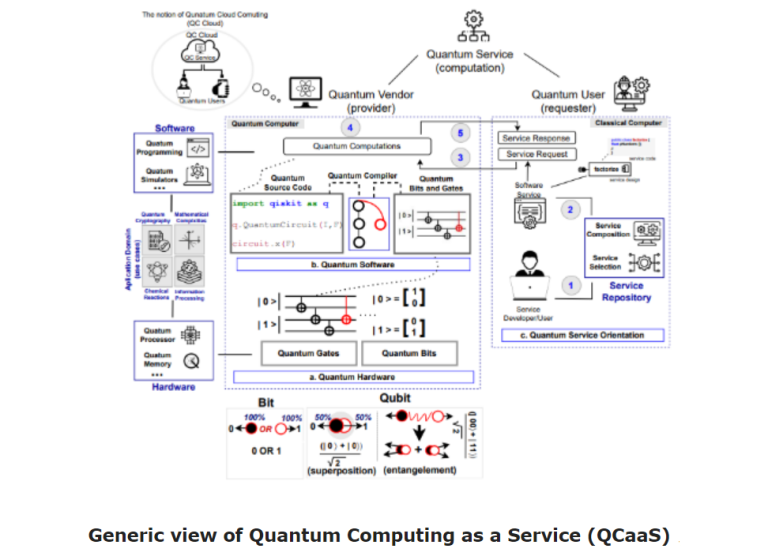

Quantum Computing, through Quantum Computing as a Service (QCaaS), has been evolving into a technology disruptor to offer superior quantum computational services over classical computing across different industries and applications, writes Arunkumar Sampath, principal consultant for Tata Consultancy Services (TCS), in an article published by the Banking & Finance Post.

As the finance industry has traditionally been an early adopter of advanced technologies, QCaaS has been making inroads along with artificial intelligence (AI) and machine learning algorithms and Generative AI to offer solutions to problems involving high computational complexity.

Though QC is still evolving, financial industry has readily adopted the technology and developed potential applications for portfolio optimization, risk modelling, natural language processing (NLP), credit card fraud detection, and derivatives pricing, to name a few.

The challenges for mass adoption of QCaaS include a) hardware limitations, b) lack of software ecosystems, c) resource constraint with relevant skills, and d) quantum error rate. The scaling up and mass adoption of quantum computing will definitely depend on commercial feasibility to address if a) quantum computing can deliver superior computational accuracy for a given application as we move from Proof of Concept (POC) to production-level solutions and b) superior quantum speed of delivery over classical computing can be justified along with investment in the underlying QCS infrastructure or in the pay-per-shot quantum computing.