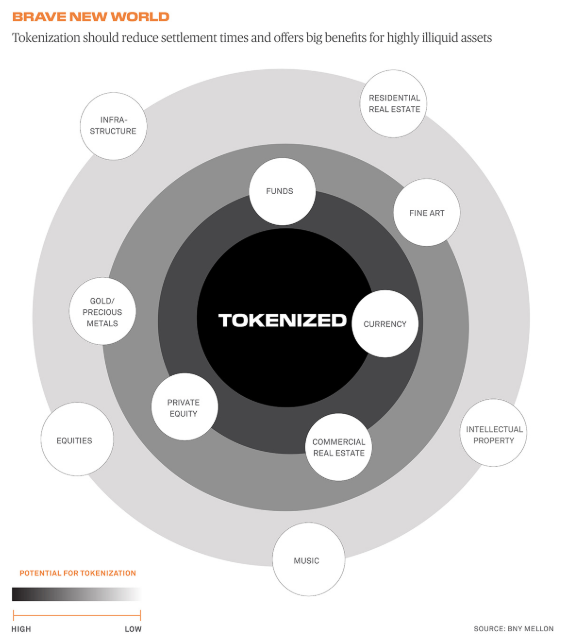

In a recent article, BNY Mellon takes a look at what it is and where it’s headed, and how the traditional world of finance is colliding with new blockchain technology, as well as the potential results for issuance, collateral optimization and more. The article focuses on industry efforts to speed up trade settlement and collateral transfers with digital tokens recorded on the blockchain.

As one of the world’s largest custodian, BNY Mellon has a series of tokenization development projects underway to learn about different use cases, any risks to its adoption and what marketplace frictions it can remove for clients. For example, the bank is working to issue bonds and syndicated loans on a digital ledger.

As one of the world’s largest custodian, BNY Mellon has a series of tokenization development projects underway to learn about different use cases, any risks to its adoption and what marketplace frictions it can remove for clients. For example, the bank is working to issue bonds and syndicated loans on a digital ledger.

Another such project is the bank’s participation as one of 15 shareholders in the Fnality Global Payments initiative, formerly called Utility Settlement Coin, a digital payments system designed to leverage the tokenization of cash. The idea is for banks in the network to deposit cash with the central banks governing any one of five currencies (CAD, EUR, GBP, JPY, USD) and then exchange digital settlement assets referencing those deposits instantaneously, without middlemen. The project is set to be extended beyond the initial 15 stakeholders in due course, according to Rhomaios Ram, CEO of Fnality.

“This is the evolution of money,” says Lucien Foster, head of digital partnerships at BNY Mellon, in the article. “We’re going from the old days of stock certificates being run across Wall Street to digital tokens that can be moved and settled with a keystroke.”