Canadian money markets are undergoing a significant change due to the disappearance of Bankers Acceptances (BAs), which will cease to be issued with the cessation of CDOR, after which the BA-based lending model, which has existed since the 1960’s will be discontinued.

To help with this effort, the Bank of Canada’s (BoC’s) Fixed Income Forum (CFIF) has formed a working group to support the transition away from BAs. The BA Transition Virtual Network (BATVN) is co-chaired by Elaine Lindhorst (TD Asset Management) and Charles Lesaux (RBC Capital Markets). One of the key objectives of BATVN is to review potential alternative products to BAs and take actions towards educating, promoting, or removing barriers for market participants, where appropriate.

Based on discussions with BATVN members, Canadian Asset-Backed Commercial Paper (ABCP) was identified as a product that could benefit from an educational primer. This primer has been created by the BATVN to fill that educational need and to provide background information on the structure of the Canadian ABCP market, including how it has changed since the global financial crisis (GFC).

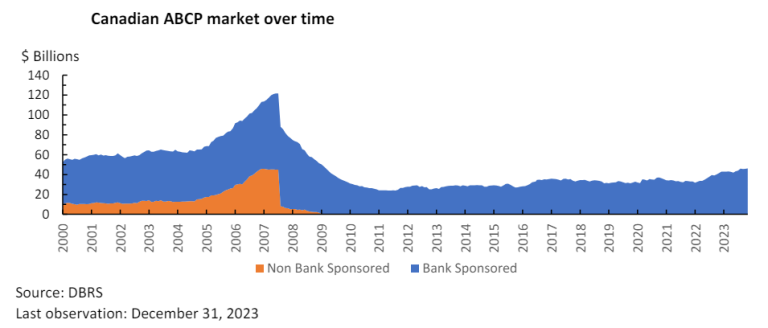

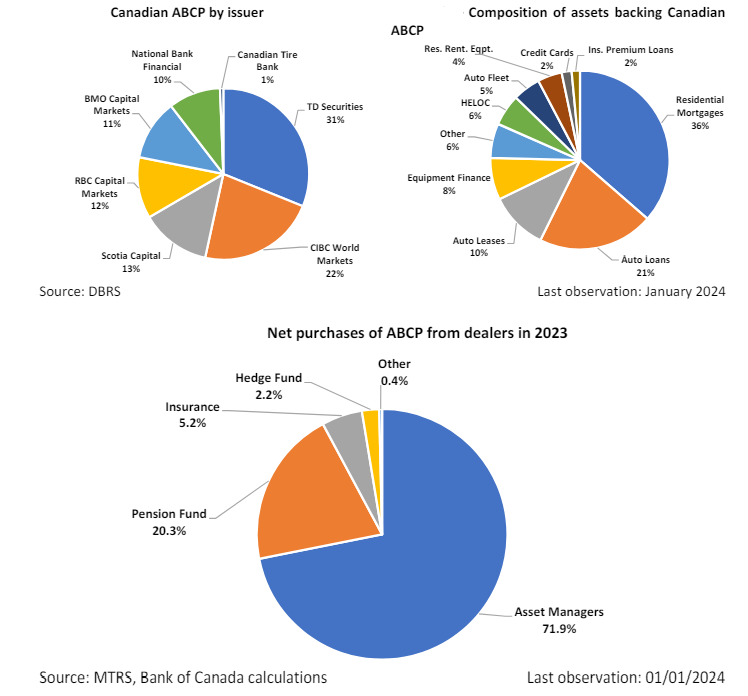

ABCP is a type of commercial paper (CP) secured by specific collateral or pools of varied collateral, originated and sold by single or multiple sellers. The size of the Canadian ABCP market has ranged from $33-$46 billion over the last five years.

Although Canadian ABCP has existed for decades, the type of ABCP issued in Canada has changed significantly since the GFC due to more stringent regulation and improved transparency. The paper begins with an overview of why some Canadian investors choose to invest in ABCP. It then provides an overview of the size and composition of today’s ABCP market as well as an overview of how the market is structured, traded and regulated.

Read the full paper

Read the full paper