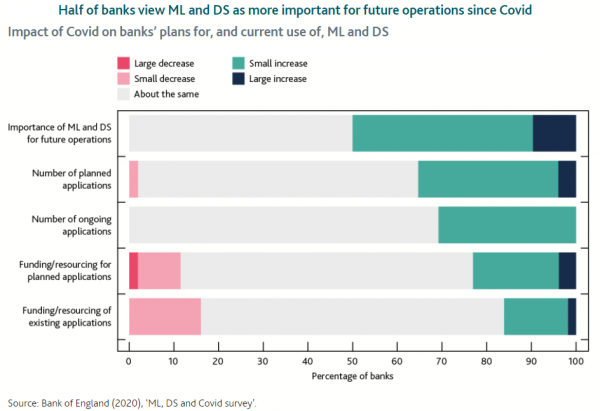

Researchers from the Bank of England’s Fintech Hub conducted a survey that suggests the COVID-19 pandemic has continued to stimulate interest in and adoption of ML (machine learning) and DS (data science) in UK banking. In addition, ML and DS now also sit higher on the priority list for policymakers because of their increasing use and, alongside their benefits, their potential risks.

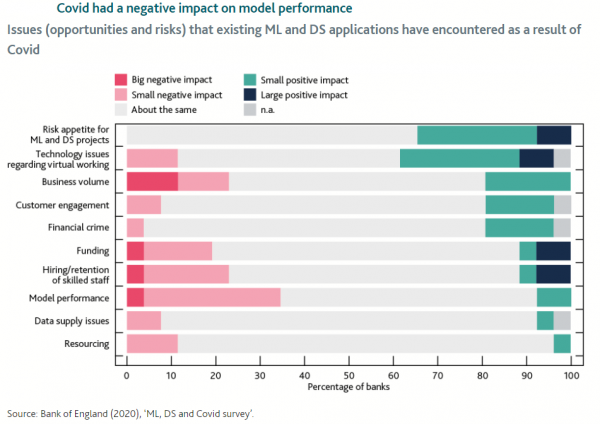

The survey showed that around 35% of banks reported that ML and DS had a “positive” impact on technologies that support remote working among employees. The same percentage also reported a “positive” impact on their overall risk appetite for ML projects, meaning these banks are more willing to use these techniques.

At the same time, around 35% of banks reported a negative impact on ML model performance. This is likely because the pandemic has created major movements in macroeconomic variables, such as rising unemployment and mortgage forbearance, which required ML (as well as traditional) models to be recalibrated. Other areas where banks noted a negative impact were in “resourcing” and in “hiring/retention of skilled staff”.

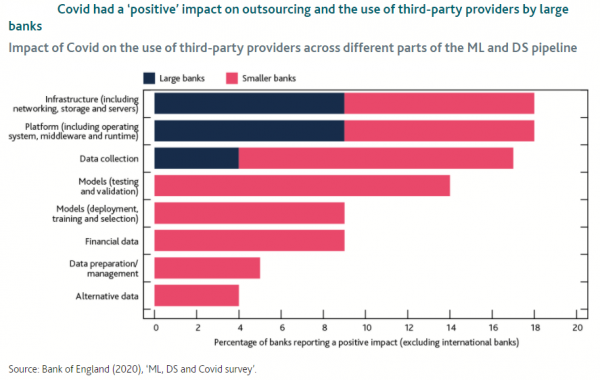

Alongside the usual risks associated with outsourcing, the use of ML and DS can pose additional risks and challenges. For example, outsourced ML models may be more difficult to interpret because detailed knowledge in terms of how they were developed resides outside the bank. This can make it more difficult for banks to understand how the model works and to monitor performance, which could result in unexpected or unexplained performance, and risks materializing.

If multiple banks use the same third-party provider and ML model, this could also potentially lead to an increase in herding, concentration and even the possibility of systemic risks where methodologies are common.

The Covid survey showed that banks’ investment and interest in ML and DS has held up. The strategic imperative to drive efficiency through automation and has perhaps been reinforced by the low interest rate environment. Furthermore, the nature of this shock means that demand for banking and other financial services may not have suffered to the same degree as other industries given the extent and impact of lockdown measures.

Researchers noted that the increasing use of ML and DS will bring benefits to banks, consumers and the economy, however there are associated risks and challenges that need to be mitigated. Banks and other financial services firms have already highlighted that risk management and governance frameworks will have to evolve in line with increasing maturity and sophistication of ML techniques.

Banks and other firms are aware of a widening gap between innovation and governance, and between the demand for data science skills and their supply. These gaps may persist in the near term as the pace of adoption increases.

The BoE’s Fintech Hub said it will continue to monitor risks and encourage the safe adoption of these new technologies, as well as consider whether new policy initiatives may help firms realize the benefits and more effectively manage the risks of AI (artificial intelligence), ML and DS.