Canadian banks have expanded global prime brokerage offerings over the past decade, motivated by client demand and supported by stable balance sheets and a strong capital base. However, balance sheet alone does not sustain a prime brokerage franchise; to build this offering requires breadth of product, a strong culture and a willingness to innovate. A guest post from Scotiabank.

Canadian banks punch above their weight. Their reputations as stable, global institutions have made them a preferred counterparty for both traditional and alternative managers. During the financial crisis, when concerns about concentrated banking markets led to alarm about bailouts and the “Too Big to Fail” concept, Canadian banks were seen as a safe harbour. Since that time, Canadian banks have expanded their global footprints, especially in the securities industry.

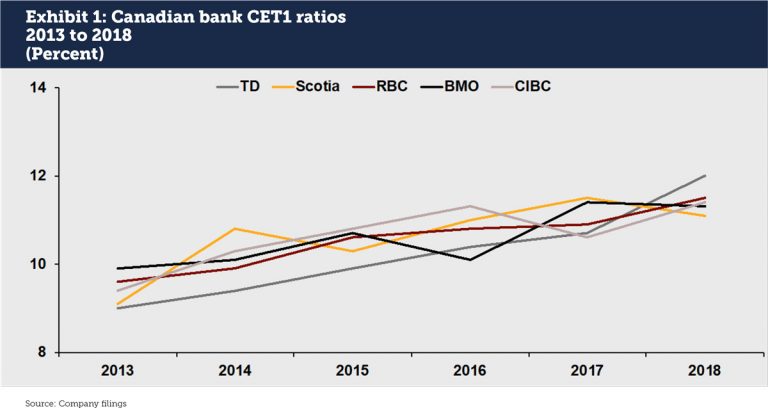

In 2018, the average Common Equity Tier 1 ratio across the top five Canadian banks was 11.46%, which safely beats the Canadian Office of the Superintendent of Financial Institutions required minimum of 8% (see Exhibit 1). These banks also have an average Leverage Ratio of 4.28% and an average Liquidity Coverage Ratio of 130%; these are also well above their required Canadian and regional standards.

The mindset is also changing. Before and immediately after the financial crisis, there was a tendency across financial institutions to build in capital cushions. More recently, a Bloomberg article reported a new perspective on capital flexibility that could include expansion and even acquisitions. The article estimated that the top Canadian banks had US$11 billion in excess capital for business development purposes.

Our view of prime brokerage

Prime brokerage is a balance sheet and financial resources intensive business, and the provision of funding is an early area where there is demand from hedge fund counterparties. 2008/2009 marked a turning point in global considerations, as international market participants sought out the stability of Canadian bank funding when other sources became less available.

Domestically, the Canadian market offers limited prime brokerage opportunities. Of the top 250 hedge funds worldwide by AUM, only two are headquartered in Canada, with US$11.3 billion in assets. Likewise, the Canadian OTC derivatives market is sized at roughly US$22 trillion in gross notional value, according to a 2016 report from the Bank of Canada. Recent tax law changes in the local OTC derivatives market have both shrunk the business and made it less attractive to domestic banks. Outside investors have diversified into Canadian assets but the size of the equity and bond markets are still a fraction of North American and global totals. Global expansion is an increasingly important necessity for Canadian banks to participate in prime brokerage.

When considering a global expansion into prime brokerage, the biggest concern for most banks has been the credit risk profile of hedge funds. Hedge funds are different types of entities than the typical corporation that relies on bank financing, and senior managers at Canadian banks have worked to better understand the new risks that their banks are assuming. This is a cultural change as much as a technological or operational process. From a competitive landscape this has meant different paths of progress for prime brokerage business lines.

For years Scotiabank has supported global trading desks in equities, fixed income and commodities, which are world leaders and trading partners to the top tier of asset managers, pensions and corporations. Leveraging trading and financing sophistication made the expansion of prime brokerage and extension of credit to a new type of customer a natural fit.

The target market tier

Competitively, there is significant opportunity to build new products that meet evolving customer needs. Canadian banks are part of a prime brokerage peer group that includes European regional banks, second tier US banks, and Asian banks that look to be regional or financing specialists. The use of balance sheet will open doors, but the objective is to work with the top 300 hedge funds with multi-prime platforms, for which Canadian banks are able to add jurisdictional diversity and be valued partners.

Canadian banks are at different stages of their prime brokerage development and product offerings, while credit risk considerations still proscribe the amount and types of business they can conduct. Scotiabank and its advanced prime brokerage franchise is beginning to eye a competitive tier of prime brokers including bulge brackets UBS, Bank of America Merrill Lynch, and Barclays. Meanwhile, smaller Canadian firms continue to gain introductions to the top hedge fund accounts and consider what business is comfortable.

From the hedge fund perspective, Canadian banks continue to offer an attractive credit diversification from the big US and European prime brokers. This stems from a jurisdictional element: Canadian banks operate under different rules than other prime brokers globally – a difficulty in the UK market for example will not impact Canadian banks as much as local banks. The opportunity to create solid partnerships with banks in each jurisdiction offers a level of protection to hedge funds in the event of a credit squeeze elsewhere.

Growing past the balance sheet

While many new entrants to prime brokerage assume that balance sheet capacity will gain them market share, this cannot be assured. As an early Canadian market entrant to the global market, Scotiabank learned that aggressive balance sheet pricing may open the door in some market environments, but prime brokerage requires a bigger commitment and build out to retain and grow market share.

As Scotiabank and other Canadian banks seek to further expand our footprints in global prime brokerage, securities finance intelligence becomes the next strong approach to building successful client relationships. Our perspective is different than the bulge bracket prime brokers, and we are able to see market developments that incorporate a range of other considerations and counterparties. We have found that the ability to provide color from global financing desks enhances client confidence that their prime broker can add value to their activities.

Next Steps for Canadians, and Scotiabank

In 2019, Scotiabank will target specific opportunities in the global prime brokerage landscape. Across the market, generally speaking, balance sheet and funding capacity has become more accessible, and the approach that many banks took in the early 2000s – to lead with balance sheet – may not withstand scrutiny as the decade closes. Rather, the next challenge is deepening relationships with key accounts to create a more diverse market franchise, beyond financing, across our capital markets footprint.

Across the Canadian landscape, some are just getting into prime brokerage and looking to add headcount, build product lineups and catch up to market leaders. Meanwhile, more mature players like Scotiabank are looking to grow market share and be more efficient in balance sheet management, stay focused on financial resources utilization and expand on our overall client capital management discipline. Growth will naturally cede opportunities to some of the smaller players, as more established prime brokers are able to select their preferred opportunities.

As the Canadian bank with the largest global prime brokerage platform, Scotiabank has participated in the evolution of Canadian bank thinking and been on the leading edge of client engagement. Our history in the market has taught us that Canadian banks are well suited as counterparties for targeted market participants; we are an ideal prime broker for the “right” funds. This is the next phase of our market growth for Scotiabank in the global prime brokerage market.

Robert Zekraus, Scotiabank Global Banking and Markets, Prime Services

Robert Zekraus, Scotiabank Global Banking and Markets, Prime Services

Managing Director, Global Head of Client Capital Management & Funding

Robert (Bob) Zekraus is responsible for Client Capital Management & Funding for the Prime Services division. This mandate focuses on managing the asset and liability profile of the business, client pricing, and the strategic deployment and oversight of scarce financial resources. In addition Bob works on developing customer-focused financing solutions that align with Prime Services risk appetite, liquidity, capital and balance sheet strategies.

Bob is a member of the Prime Services Executive Committee and global management team. He chairs the weekly funding and balance sheet forum and sits on the bank’s US ALCO and liquidity and market risk committees.

Prior to joining Scotiabank in 2014, Bob was Director, Prime Services, at Barclays where he was a member of the Global Equity Finance management team. He held various senior leadership roles in equity financing and prime brokerage. He was part of the original team that established the Collateralized Finance Group at the firm. Bob started his career at Daiwa Securities Inc. in Prime Brokerage.

Bob received a B.S. degree in Economics and Business Management from Cortland College.