Often people taking about collateral management gloss over that most collateral held against OTC derivatives is cash. We wonder if there are reasons for this that go beyond systems and zero interest rates.

The 2014 ISDA Margin Survey shows that for non-cleared OTC derivatives nearly 75% of all collateral received is cash, 78% of all collateral delivered is cash. Those numbers have gone down by a couple percent in the past few years – but cash still represents the lion’s share. Corporate bonds, for example, show up as less than 3% of total collateral received, 1.3% of collateral delivered.

Composition of collateral received and delivered against non-cleared OTC derivative transactions (USD billions) as of December 31, 2013

Source: ISDA Margin Survey 2014

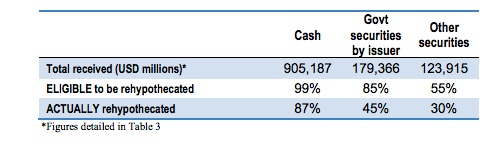

Dealers like getting the cash they receive on non-cleared derivatives. They can use it to finance and hedge their positions (although a portion of that will eventually change with the new IOSCO non-cleared derivatives rules, for more on that, see Finadium’s most recent paper “Preparing for Risk-Based Margining of Non-Cleared Derivatives“). Of the $905 billion in cash collateral received on non-cleared OTC derivatives trades, 99% is eligible for re-hypothecation and 87% actually is re-hypothecated. Those numbers are a lot lower for non-cash collateral. To monetize non-cash collateral requires trading with the repo desk. This might be done automatically via a daily sweep of the derivatives desk’s positions or some other arrangement. Repo desks charge for the monetization service and rates may or may not be competitive.

Amount of collateral assets received eligible versus actually re-hypothecated as of December 31, 2013

Source: ISDA Margin Survey 2014

Source: ISDA Margin Survey 2014

Using cash as collateral for central cleared trade stops the re-hypothecation, but not the tendency to use cash. Variation margin is always cash, but the same does not hold for initial margin.

How does cash work for the buy-side? Anecdotal evidence points that cash is king there too. Some buy-side clients manage collateral in an operations group. Moving cash has been a fundamental activity there forever. Settlement of securities – including the tracking of paper, understanding eligibility, making sure the paper wasn’t sold & substituting if necessary, and all the other tasks involved on the securities side – is a lot more complicated. Bond settlement groups are not often built for the flexibility, market-driven judgement, and speed necessary to maximize collateral use. Cash is just a whole lot easier for everyone involved.

Are there non-price reasons driving the use of cash? Do advanced collateral management systems adequately model those preferences (which admittedly are difficult to quantify) when rating which asset to post as collateral or do they simply assume the answer is just about picking the cheapest to deliver bond given the applicable CSA rules? 66% of initial margin on cleared derivatives is cash, according to ISDA. Is it ironic that 63% of the ISDA Margin Survey respondents say they optimize collateral. Or could the optimal asset, more often than not, be cash?

Many larger buy-side investors are all over collateral management. They look at collateral optimization for derivatives as an opportunity and will invest in the technology and organizational & cultural changes necessary to make the leap. But that doesn’t mean that cash won’t still make sense to post — it may be that the analysis is more sophisticated, but could the result still end up the same?

There is also a critical mass issue here – a $2 billion hedge fund won’t invest in a multi-million dollar system when they can avoid it. The smaller investor’s lost marginal spread on the cash over time may be less than the technology’s long term cost. (There are cloud-based systems out there oriented to small investment managers that may change the cost trade-offs. Finadium wrote about these in “Emerging Technologies in Securities Finance and Collateral Management”.)

Zero interest rates are often cited as the reason there is so much cash used as collateral. Rising interest rates will change the cost to post cash (assuming that the return the CCPs give on the cash remains low — that is a big “if”). But higher rates are a necessary condition for change, but not sufficient. Institutional momentum, systems and silos (both business to business & front to back office) are among the biggest blocks. The custody cost to hold securities at CCPs shouldn’t be ignored either. In the U.S. CCPs have to maintain liquidity facilities on securities held as collateral (including US Treasuries) and that expense is built into fees. The cost for facilities on less liquid paper — corporates come to mind — are going to be higher and so will the costs passed on.

Ironically, negative rates on cash likes those in Europe, might be the strongest incentive to post securities as opposed to cash (as long as the cost to hold onto the collateral isn’t more punishing). No one likes to give money away allocating a portion of a portfolio to cash and investment managers will hold less of it — leaving securities as the collateral of choice.

Parenthetically, if cash remains the prevalent form of collateral, then the chances of securities shortages fueled by the need to post on derivatives exchanges and CCPs goes down accordingly.