CME published a presentation outlining its proposal to provide US Treasury (UST) and UST repo clearing services. It will support both “done with” and “done away” clearing and provide cross margin opportunities by allowing participants to manage interest rate risk across cash, repo, futures, options and swaps. This is in addition to $20 billion in daily interest rate margin savings already available, with potential for continued growth.

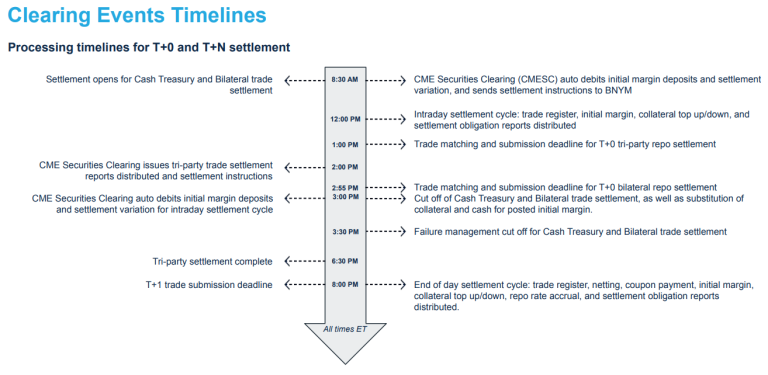

The initial launch will include products and features such as repo or reverse repo collateralized by USTs (overnight, term ≦ 2 year, and tri-party). For settlement, securities submitted on T will be settled on a gross basis and tri-party repo trades will settle net on T in line with existing market practices and T+N settlement will be netted by CUSIP.

In the backdrop is anticipation of regulatory approvals for CME to provide the service, with Risk reporting the exchange has filed an application with the Securities and Exchange Commission (SEC) and FOW reporting that there are active talks with US regulators.