Climate change is expected to have a dramatic impact on our environment over the decades and some of the effects are already visible today. They include an unprecedented loss in biodiversity, as well as worsening agricultural and ecological droughts. Increasing temperatures and changing weather patterns are also cited as one of the reasons behind a global rise in hunger and poor nutrition in certain parts of the world where people cannot grow or find sufficient food.

In addition to these environmental and health-related effects, climate change has significant economic and financial implications. These are tangible in the case of extreme weather events, which can cause substantial loss of life, in addition to enormous property and environmental damage. Over the long term, rising sea levels will likely have considerable financial implications, affecting both the value and the insurability of real estate in coastal areas.

Aside from these physical risks, additional types of risks are associated with the expected transition to a greener economy. This transition, which is a key area of focus in plans to slow global warming, poses a myriad of economic, strategic, legal and other risks – not only to industrial companies in carbon-intensive sectors, but possibly also to the banks and other financial institutions that provide their funding.

In light of the above, climate change is no longer being considered primarily an environmental issue, but a multifaceted source of economic and financial risks that might threaten the stability of the financial ecosystem. Several initiatives to better understand, address and mitigate these risks are starting to emerge. They include proposals to implement climate-related disclosure requirements, as well as efforts to explore the potential benefits of climate specific scenario analysis to assess the effect of climate-related risks on the financial services industry – just to cite two well-known examples.

Given these developments, and in accordance with its mandate, DTCC’s Systemic Risk Office (SRO) has included climate-related financial risk as one of the many potential systemic threats it actively analyzes and monitors. As part of these efforts, DTCC published this paper to share thoughts on how climate-related financial risk applies to DTCC and, by extension, other Financial Market Infrastructures (FMIs) – and how the industry currently has the necessary resources to address these risks in a proactive manner.

More specifically, the authors examine the exposure of FMIs to climate-related physical risk and transition risk, and identify unique aspects of these exposures as they pertain specifically to FMIs. Building on this analysis, they explore the interplay of regulation and FMIs, in the hopes of showing how existing regulatory frameworks and standards could be applied to effectively mitigate climate-related challenges. There’s also discussion of the growing green bond market, as well as an approach to mitigating climate-related financial risk.

Financing risks

There are two broad categories of climate-related financial risk: physical risk, which refers to risks resulting from climatic events, such as wildfires and floods, and transition risk, which results from policy action taken to transition the economy off of fossil fuels. Several studies have already been published that focus on the transmission of these risks from the economy to the financial ecosystem, but an analysis that focuses specifically on FMIs has not been performed yet.

While financial institutions face indirect exposure to transition risk through their financing activities of specific carbon-intensive companies, FMIs’ exposure to transition risk through such financial institutions is even more indirect. This third-order exposure of FMIs to transition risk appears to be well within the range of credit, liquidity, market, operational and other risks that FMIs already must currently navigate.

For example, under liquidity risk: banks’ access to stable sources of funding could be reduced as market conditions change; climate-related risk drivers may cause banks’ counterparties to draw down deposits and credit lines; there may be increased demand for liquidity as well as refinancing risk.

Green debt

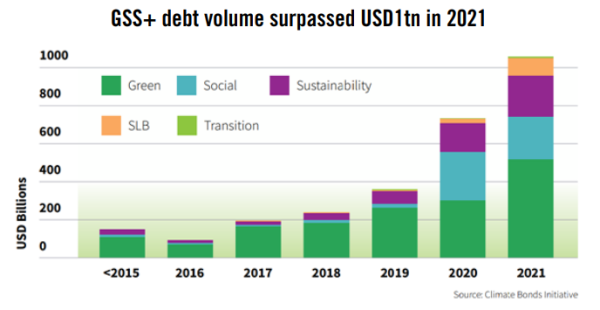

As the market for green bonds has grown over the past several years, additional types of debt instruments have been introduced to fund projects that aim to have a positive impact on society, as well as other initiatives that promote sustainability. While there is no single label that denotes this broader range of debt instruments, the terms sustainable finance bonds, GSS bonds, GSS+ bonds or GSSS bonds are often used in this context. While the lack of standardization makes it challenging to quantify the size of this market segment with precision, the growth of these financial instruments over recent years has been considerable and shows no sign of slowing.

Policy focus

Banks and FMIs have very different roles in the financial services ecosystem, DTCC writes: “While funding industrial and other economic sectors is a core part of a bank’s credit transformation processes, the key mandate of an FMI is to help safeguard financial stability in stressful circumstances. As such, this mandate should always continue to come first in any regulatory framework that might be applied to ensure that FMIs adequately address climate-related risks.”