The European Central Bank (ECB) has published the 12th TARGET2-Securities (T2S) Annual Report, which covers the activity, performance and main developments of the system over the course of 2022. The report also describes changes in T2S settlement data and confirms the continued operational stability and efficiency of T2S.

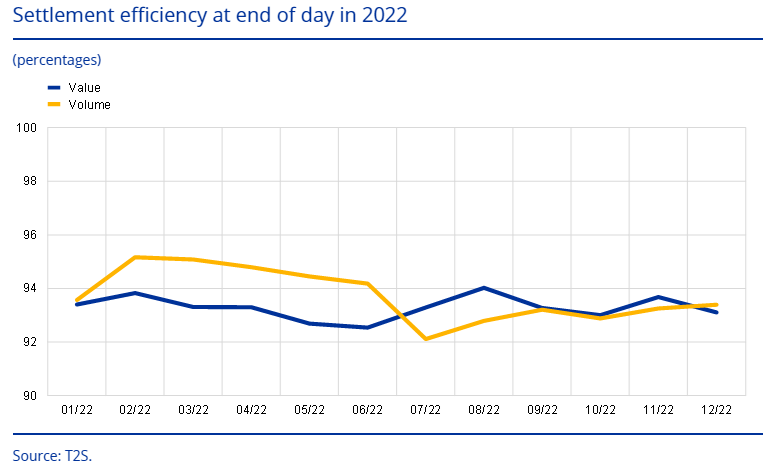

In 2022 settlement efficiency at end of day reached, on average, 93.74% in volume terms and 93.29% in value terms. These figures were 0.60 percentage points and 0.78 percentage points lower than the figures for 2021, when settlement efficiency at end of day averaged 94.34% in volume terms and 94.07% in value terms. In 2022 settlement efficiency in volume terms ranged between 92.11% and 95.16%.

In 2022, T2S settled over 181 million transactions with a total value of €184.19 trillion ($197.1bn). On average, the system settled 707,000 transactions with a total value of €716.67 billion each day. Compared with 2021, the data for 2022 show an increase of 3.30% in the value of settled transactions and a decrease of 2.91% in the volume of settled transactions.

An important milestone for T2S occurred on 1 February 2022, with the official introduction of the penalty mechanism after the Central Securities Depositories Regulation (CSDR) settlement discipline regime (SDR) entered into force. The penalty mechanism’s functionalities support the T2S central securities depositories (CSDs) in complying with their obligations under the settlement discipline regime, allowing for cash penalties for settlement fails to be calculated and reported to the connected CSDs and their communities.

In 2022, T2S participants paid an average of 1,075,222 cash penalties per month for late matching and settlement fails in relation to their euro activities. The anticipated improvements to settlement efficiency following the settlement discipline regime entering into force has not yet materialized. The reasons behind this, as well as potential adjustments, are being discussed between stakeholders and regulators.

Market commentary

Bill Meenaghan, CEO at SSImple, said in a statement: “The ECB’s T2S Annual Report shows that the average settlement efficiency has dropped again. In 2019 it was 97.63% in value terms, whereas for 2022 it was 93.29% – a drop of 4.34%.

“More worryingly is the amount of SDR cash penalties issued. There were, on average, over 1m cash penalties issued per month for late matching and settlement fails for instructions settled in the EU. These appear to have an average cash penalty value of ~€145. “If that is correct then for the 11 months of 2022 when SDR was live, that would be ~€1.7 billion in penalties.

“Standing settlement instructions (SSIs) currently play a significant role in security failures. Now is the time to reimagine how SSIs are stored, shared and enriched across the industry. We need to erase all manual processes if T+1 is going to be successful.”