The three European Supervisory Authorities, which includes the European Banking Authority (EBA), European Insurance and Occupational Pensions Authority (EIOPA) and European Securities and Markets Authority (ESMA), issued their Spring 2024 Joint Committee update on risks and vulnerabilities in the EU financial system. The risk update shows that risks remain elevated in a context of slowing growth, an uncertain interest rate environment and ongoing geopolitical tensions.

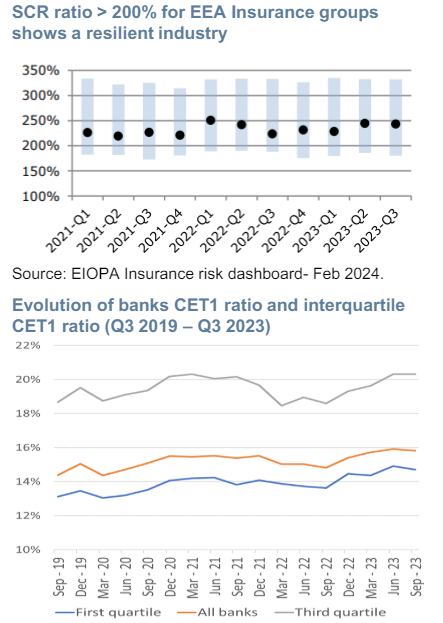

In the banking sector, capital and liquidity positions are solid with CET1 ratio of 15.8% and a liquidity coverage ratio above 160% amid high profitability in 2023. However, the outlook is more challenging, as banks face the repricing of liabilities and assets with prospects of lower interest income, slower loan growth, high costs and the challenging macro environment. Insurance solvency ratios are well above 200% and insurers have ample availability of highly liquid assets, but liquidity positions slightly diminished.

In the outlook for 2024, ESAs noted that for banks, challenges driven by repricing of liabilities vs assets with prospects of lower interest income, slower loan growth, high costs and a challenging macro environment. For insurers, challenges come for potential repricing of risk premia and subdued growth combined with potential second round effect of inflation.

Fund performance and flows have been volatile as the interest rate environment has changed. While funds have managed the transition to higher interest rates, concerns remain regarding the valuation of real-estate fund assets, and liquidity risks in these funds could have wider spillover effects.

In recent months, financial markets have performed strongly in anticipation of potential interest rate cuts in 2024 in both the EU and the US, despite the significant uncertainty surrounding these. This strong performance entails elevated risks of market corrections linked to unexpected events. Credit risk is also expected to continue to increase as refinancing needs grow, particularly for high-yield debt and real estate. While asset quality has remained robust in the banking sector, it is expected to deteriorate as economic growth slows further. The real estate slowdown could also drive impairments at banks.

Heightened geopolitical instability and increased reliance on digital solutions are raising the stakes linked to cyber security. The number of attacks and cyber threats is increasing, and while the impact of these attacks so far has been limited, cyber-related insurance claims keep increasing, and the (re)insurance industry is further strengthening pricing techniques and risk-transfer mechanisms. In the banking sector, the findings from the cyber resilience testing currently underway will be important.