This month, the US Treasury solicited input from market participants on what needs to be done to fix the growing imbalance in price spreads between older and newer treasury issues. We have been watching this for some time now to see how these kinds of imbalances would play out. What do securities finance markets have to say about the odd state of government bond markets, as reflected in our “prices”: rates on fixed income financing positions?

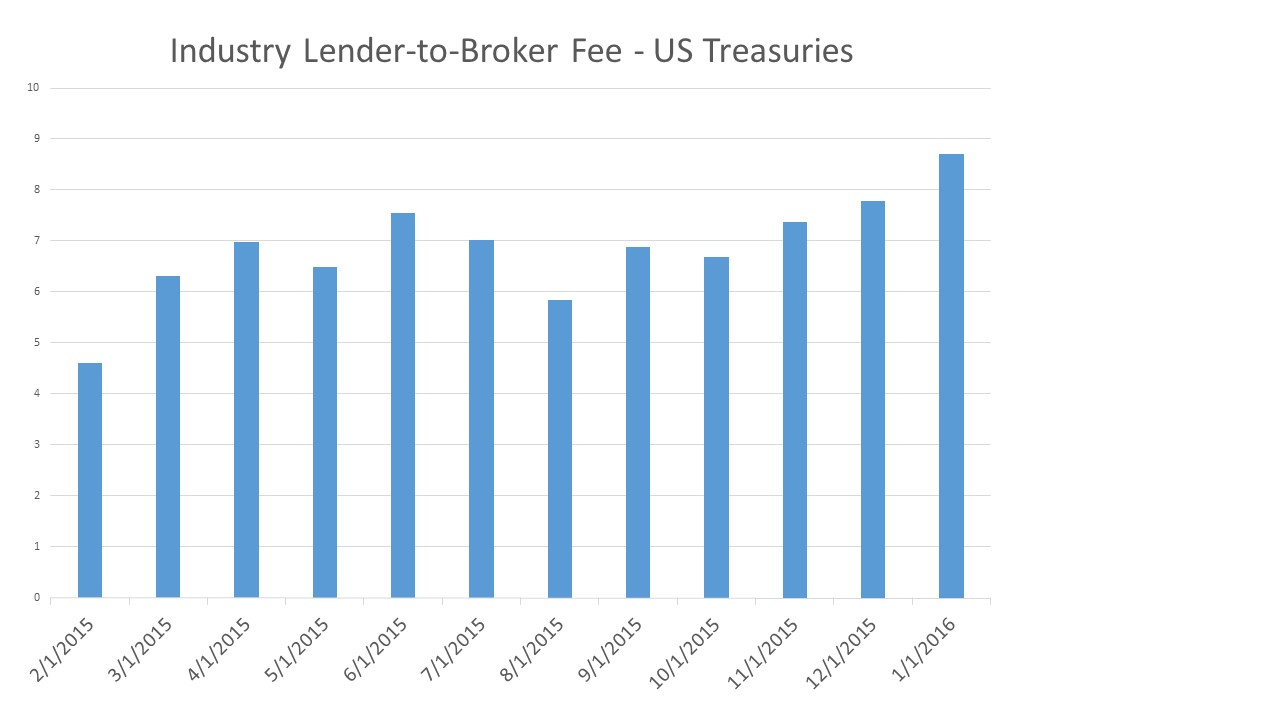

While securities finance rates do not always follow hard buy/sell prices, there is an important correlation between effective yields on treasuries and repo rates. We would expect that as effective yields increase (with the fall in buy/sell price), repo rates would follow. Datalend’s data on rates in fixed income markets strongly supports this assumption (see Exhibit 1). As we would expect, securities finance rates have sharply increased to follow increased yields in the secondary markets, which provide the majority of securities finance supply. In fact, rates on US Treasuries in securities finance markets have nearly doubled over the last 11 months (including GC and specials).

Exhibit 1

Fixed Income securities finance fees – US Treasuries

Source: DataLend

The question at hand is the increasing gap in prices and yields on treasury bonds that, apart from date of issue and date of maturity, should be essentially identical. Newly issued bonds are trading at a significant premium over older bonds – or, from a different perspective, older bonds are trading at an unexpectedly deep discount in the secondary markets from those coming fresh off the auction block into the primary dealer market.

As we wrote in Securities Finance Monitor earlier this month (ECB report shows more market instability as central bank policy is uncertain, January 18, 2016), this seems largely the result of the divergence in the paths that central banks are taking. Some economies look to be emerging from the Great Recession while others are still seeking growth through aggressive stimulus policies. Bond markets have by far been the most distorted by revolutionary central bank practices, such as quantitative easing, over the last several years.

In addition, bond markets have been sharply altered by the reclassification of sovereign debt into a collateral liquidity class only slightly better than corporate bonds. Regulation around balance sheet constraints and liquidity ratios continue to favor cash hoarding by regulated institutions, which can only mean that treasuries are no longer held over the long term as they once were – and are dumped at deep discounts into the secondary markets whenever cash is needed. We see this reflected in the very low demand for GC US Treasuries in securities lending.

In markets where QE programs remain in place, or whose currencies are viewed as less of a safe haven than US Dollars, the effects are very different. Those markets show a much less dramatic “regulatory yield enhancement” between primary and secondary markets, and therefore a much less dramatic change in securities finance rates.

We look forward to hearing the results of the Treasury Department’s inquiry. What market participants have to say will help determine how Treasury liquidity plays out.