The Finadium article “RWAs and the new repo formulas in the US Basel III Endgame Notice of Proposed Rulemaking” (NPR) explained how this regulation is likely to result in increased risk weighted assets (RWAs) for many bank repo desks, particularly on repo leg exposures. Guaranteed Repo can mitigate a large proportion of the increase.

While the NPR applies to banks, increases in bank RWAs and capital requirements will have substantial knock-on impacts to non-bank repo market participants, particularly institutions that have historically acted as end providers of cash and collateral. This includes money market funds, securities lenders, corporations, insurance companies, and state and local governments. Many of these low risk counterparties will now attract the same risk weight as hedge funds as banks are precluded from internal credit assessments.

Guaranteed Repo, developed jointly by Sunthay, Bloomberg and Euroclear, is a highly efficient tool to alleviate the impact of the Basel III endgame rules on the repo market. Its efficiency substantially exceeds that of other structures such as clearing, pledge structures, Total Return Swaps (“TRS”) and unindemnified peer-to-peer trading that have been put forward. It has the potential to reduce RWAs for banks by 40%-100% compared to other repo trading models and offers no conflict to expected central clearing mandates for US Treasury repo.

What is Guaranteed Repo?

Guaranteed Repo allows banks to continue to perform their vital credit intermediary role in repo markets without using their balance sheets. Banks facilitate repo trades among counterparties that do not normally trade with one another (e.g. hedge funds and money market funds) by guaranteeing the performance of the low-credit quality counterparty. Unlike in uncleared matched book trades or principal model cleared transactions (such as FICC’s Sponsored Repo), banks are not counterparties to these trades. Rather, they are contingent obligors who will step in and perform if a counterparty/principal whose performance they are guaranteeing defaults. As a result, these transactions do not hit banks’ balance sheets.

Guaranteed Repo is a global solution. It conforms to Basel regulatory requirements and international accounting standards (US GAAP and IFRS) and incorporates standardized documentation (based on standard form MRAs and GMRAs). It also utilizes uniform electronic trading protocols and post-trade collateral management processes.

Guaranteed Repo results in lower RWAs than other repo trading models

Guaranteed Repo is structured so that guarantors only guarantee the performance of one counterparty – a “one-leg” exposure model. This model differs from “two-leg” exposure models – including uncleared matched book trades and Sponsored Repo – where banks acting as principals incur credit risk on both their reverse repo transactions (facing end users such as hedge funds) and repo transactions (facing end providers such as money market funds). In contrast, credit risk for Guaranteed Repo trades applies only to reverse repo legs, as only the performance of end users is guaranteed.

RWAs for guarantees of “repo-style transactions” – including those provided by Sponsoring Members in Sponsored Repo transactions – are identical to those for equivalent principal repo trades.

RWAs for repo legs can be disproportionately higher than RWAs for reverse repo legs

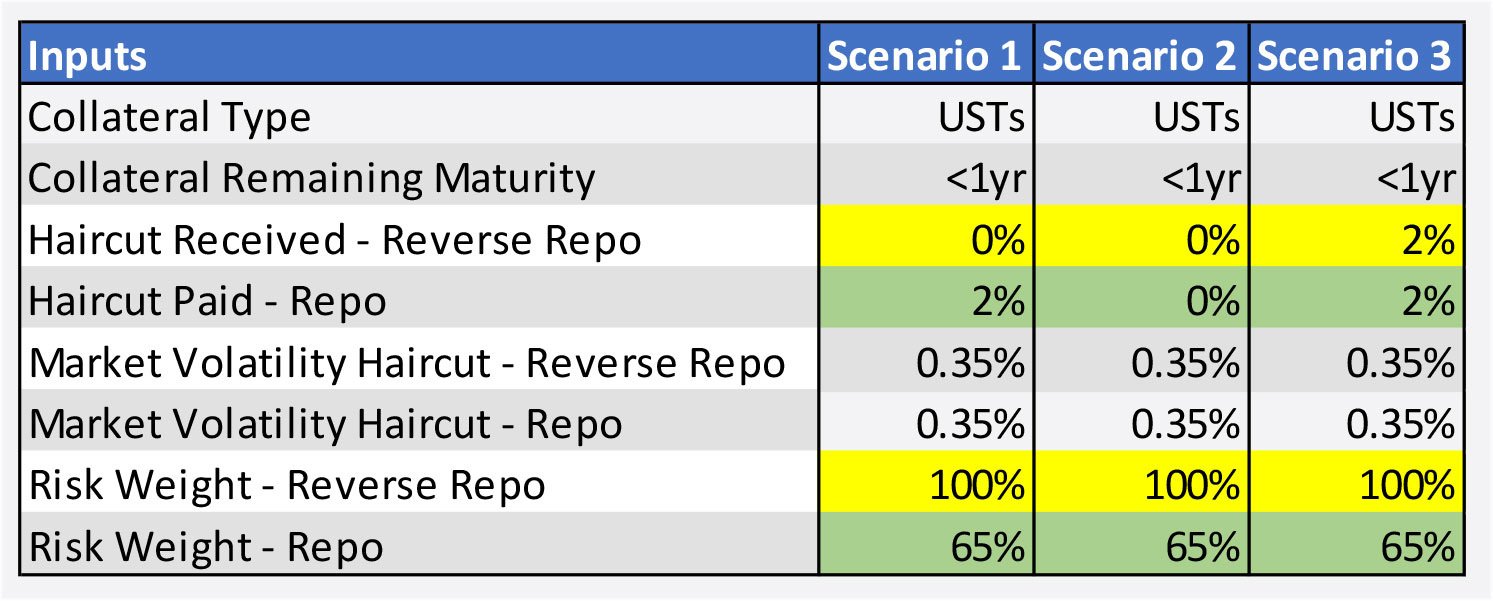

A number of factors can cause RWAs on repo legs to be substantially greater than RWAs on reverse repo legs. The below scenarios under two-leg repo trading models illustrate this somewhat counterintuitive result:

Scenario 1 represents a common matched book trade for a bank repo desk, where a 0% haircut is received on a reverse repo leg (for example with a hedge fund) and a 2% haircut is paid on a repo leg (for example with a money market fund). Scenario 2 has 0% haircuts on both reverse repo and repo legs, while Scenario 3 has 2% haircuts on both reverse repo and repo legs.

The risk weights on the counterparties on reverse repo legs are 100% (for non-investment grade corporate entities) while the risk weights for counterparties on repo legs are 65% (for investment grade corporate entities).

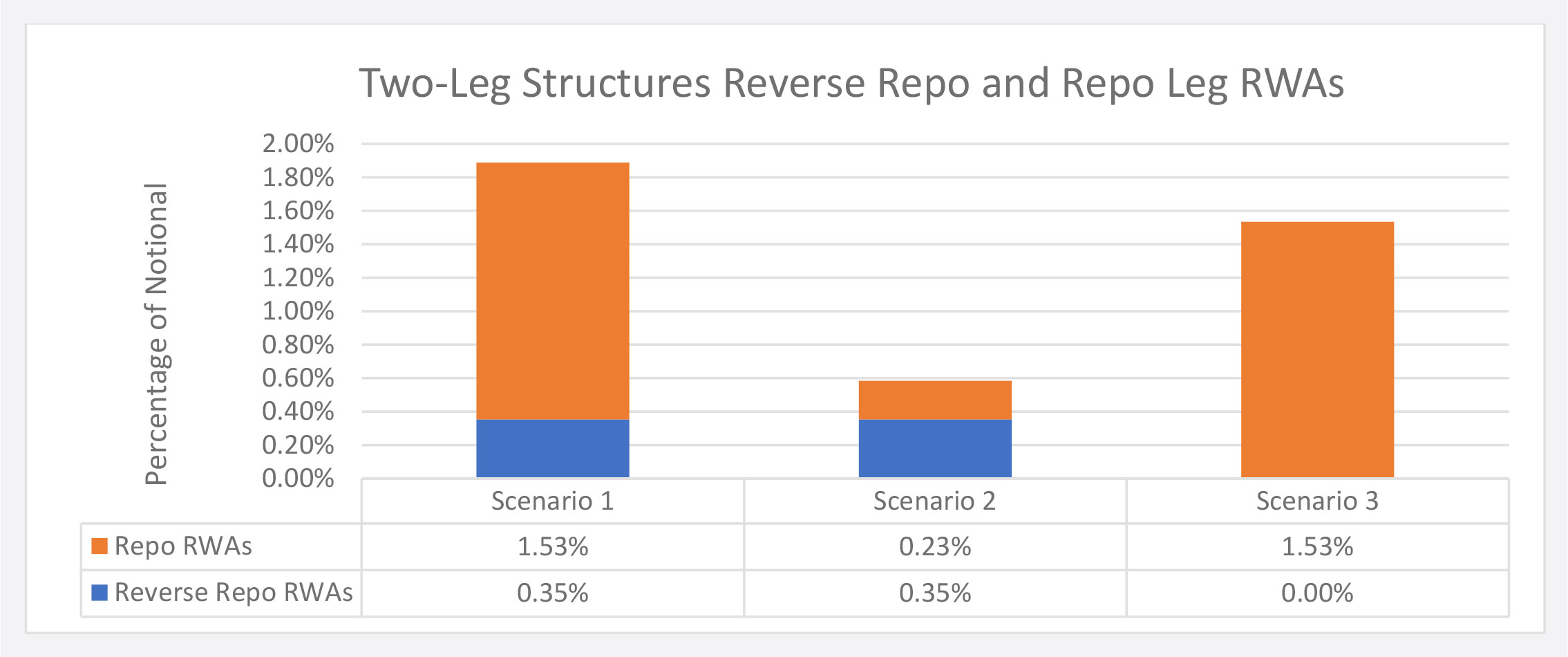

The resulting RWAs for two-leg structures (under the single transaction exposure formula) are shown below:

In Scenario 1, the repo leg RWA is more than 4x the reverse repo leg RWA.

Only in Scenario 2, in which both reverse repo and repo leg trades are executed with 0% haircuts, are repo leg RWAs lower than reverse repo leg RWAs.

Note that in Scenario 3 – in which haircuts on both reverse repo and repo legs are 2% – reverse repo leg RWAs are zero as the haircut received is greater than the market volatility haircut required (0.35%).

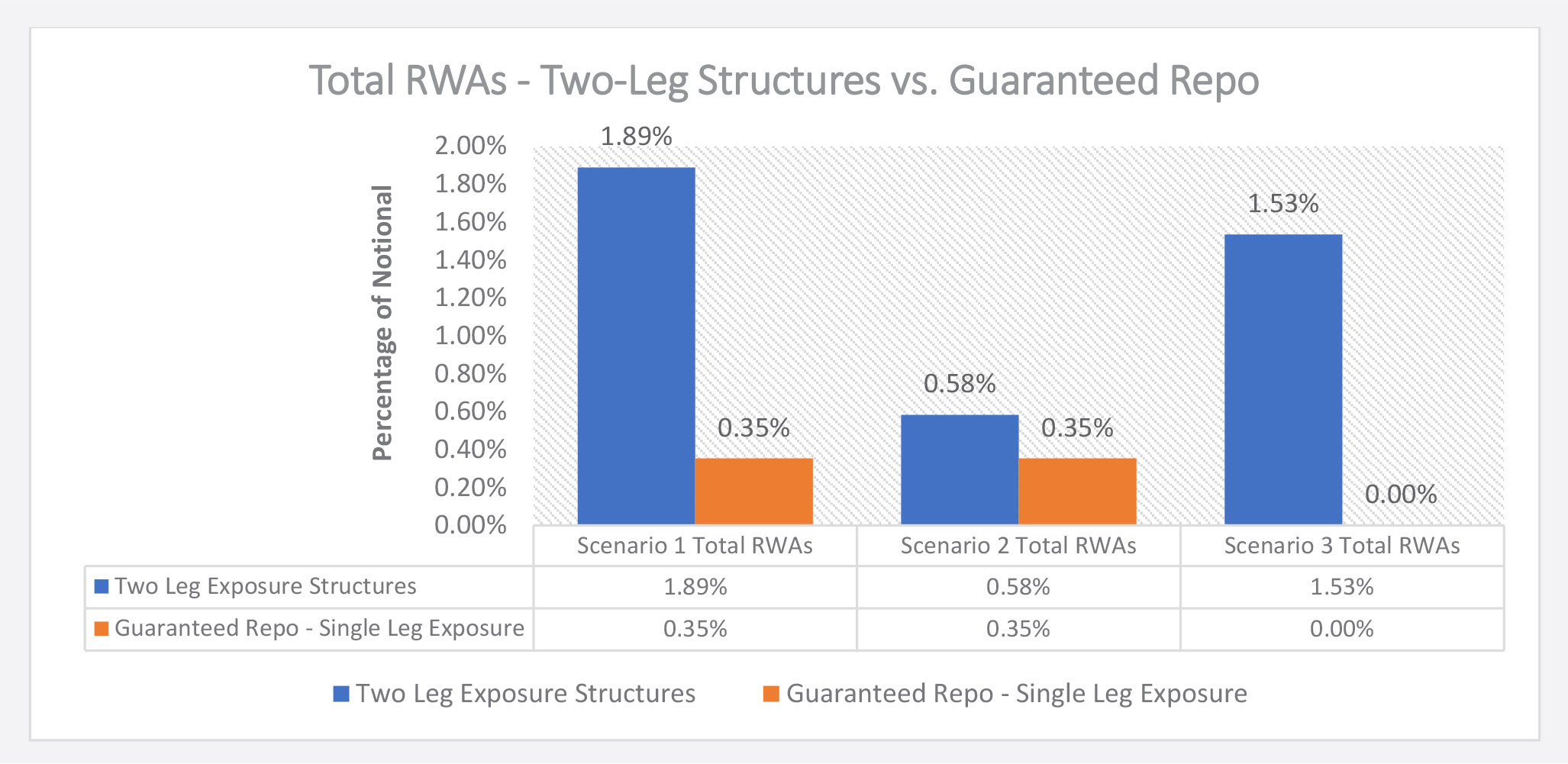

Guaranteed Repo results in lower RWAs than any two-leg repo trading model

Guaranteed Repo trades can meaningfully reduce bank repo desk RWAs – by 40%-100% – compared to two-leg repo trading models.

Total RWAs for Guaranteed Repo trades in Scenario 1 are approximately 20% of the RWAs for two-leg structure trades. In Scenario 3, repo leg RWAs fall away and reverse repo leg exposures are zero (as the haircut received exceeds the required market volatility haircut). As a result, Guaranteed Repo RWAs for Scenario 3 are zero.

While the above analysis applies to repo-style transactions, directionally similar outcomes will result for two-leg TRS structures. In addition, RWAs for TRSs are calculated under the rules for derivative transactions, which generally result in higher RWAs than under the repo-style RWA calculations. (While a single-leg TRS structure may have lower RWAs than a two-leg structure, it will result in balance sheet usage; as a result, it is inefficient compared to Guaranteed Repo and Sponsored Repo).

Guaranteed Repo complements other proposed solutions to support the smooth functioning of the repo market

Events over the past few years have underscored the importance of the repo market to the global financial system and the need to develop additional structures to ensure its smooth functioning. Given the complexity of the repo market and the diversity of its participants, there appears to be no single universal solution that can achieve this goal. Rather, multiple solutions that can address the needs of different market participants, jurisdictions and transaction types are required.

Guaranteed Repo is one solution that market participants can immediately deploy that results in substantial benefits. While Guaranteed Repo may not be suitable for all transactions in all jurisdictions, there are several use cases that can immediately deliver significant benefits.

In the scenarios above, eliminating repo leg RWAs can be highly beneficial for trades between banks and repo leg clients like money market funds.

In another example, Guaranteed Repo can result in more efficient outcomes where banks and their clients enter into offsetting reverse repo and repo trades to net down bank balance sheets. These netting transactions result in unnecessarily increased gross exposure (and resulting RWAs) and increased costs and operational demands on all parties. Guaranteed Repo results in more efficient outcomes on all these metrics than other solutions.

The systemic benefits of Guaranteed Repo

Guaranteed Repo not only results in benefits for individual repo market participants, it also reduces systemic risk:

- It reduces system-wide leverage compared to two-leg models, which create leverage on each leg. In Guaranteed Repo, each transaction is legally distinct.

- It reduces banking system risk by eliminating repo leg credit exposures and associated RWAs. The repo leg credit exposures are borne by repo sellers, resulting in a diffusion of risk among a large number of counterparties.

- It reduces operational requirements and cost compared to other models.

- It reduces system-wide intraday liquidity usage.

- It increases transparency by incorporating a form of all-to-all trading.

- It is a global scalable solution.

Guaranteed Repo is a complete solution that can be rapidly deployed globally by market participants seeking to efficiently navigate Basel III Endgame rules regarding credit intermediation, balance sheet usage, optimal capital allocation and cost. Its efficiency results from the integration of the proven existing capabilities of Bloomberg and Euroclear with standardized documentation and trading protocols from Sunthay.

About Sunthay

Sunthay Holdings, LLC is a specialty finance firm focused on developing solutions for secured funding markets. Sunthay’s principals have extensive experience in financial markets, particularly fixed income. For information, please contact Shiv Rao at shiv.rao@sunthay.com.