Multiverse Computing announced a new Fair Price solution to its Singularity financial quantum computing solution, delivering a higher accuracy in fair price calculations for financial institutions over current classical computing methods.

To reduce risk, financial institutions determine the fair price of a stock by calculating the theoretical value of companies using Monte Carlo simulations on classical computers. Requiring extremely high accuracy to minimize losses, institutions commonly run simulations on supercomputers that take up to 24 hours or more to complete.

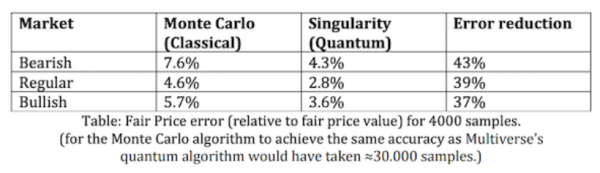

Using trapped ion quantum computers from IonQ with common PC-based software tools, the Singularity Fair Price solution can reduce error rates by 43% without increasing the number of runs or runtime. To achieve the same accuracy on a classical computer would take over seven times the number of runs, enabling financial institutions to achieve a more accurate valuation more quickly.

Below is a chart from a paper by Multiverse Computing’s scientific team, titled Quantum Portfolio Value Forecasting, showing the reduction in Fair Price errors in different market categories:

“The Fair Price feature on our Singularity platform is designed to give financial institutions an edge in portfolio optimization using quantum computers from our preferred partner IonQ,” said Enrique Lizaso, CEO of Multiverse Computing, in a statement. “This new feature is a perfect complement to our Singularity product, making it easy for the financial community to leverage quantum computing today for demonstrated value even at this early stage of the industry.”

Developed by quantum scientists with finance industry professionals, Singularity offers intuitive, simple front-ends and plugins for common PC-based applications such as Microsoft Excel to enable financial professionals to access the power of quantum computing without requiring previous expertise or knowledge. The platform determines the optimal hardware and type of algorithm to deliver immediate business value.

Multiverse currently works with Crédit Agricole CIB, the corporate and investment banking arm of Crédit Agricole Group, the 12th-largest banking group worldwide, BBVA, one of the world’s largest financial institutions, and other major firms in the financial industry.