The International Capital Market Association (ICMA), supported by the Hong Kong Monetary Authority (HKMA), has published the third edition of its report, The Asian International Bond Markets: Development and Trends.

Interviewees noted that a functional and liquid repo market is essential for the health of the underlying market. This is particularly the case in bear markets or during episodes of heightened volatility, when demand increases both for short-covering specific ISINs and to transform collateral into cash to meet margin requirements.

Interviewees also suggest that liquidity in the Asia cross-border repo and securities lending markets continues to improve and held up well during the market moves of 2022. This is attributed to more use of repo and securities lending as a result of the introduction of uncleared margin rules (UMR) and the greater involvement of international asset managers who lend securities as a matter of course.

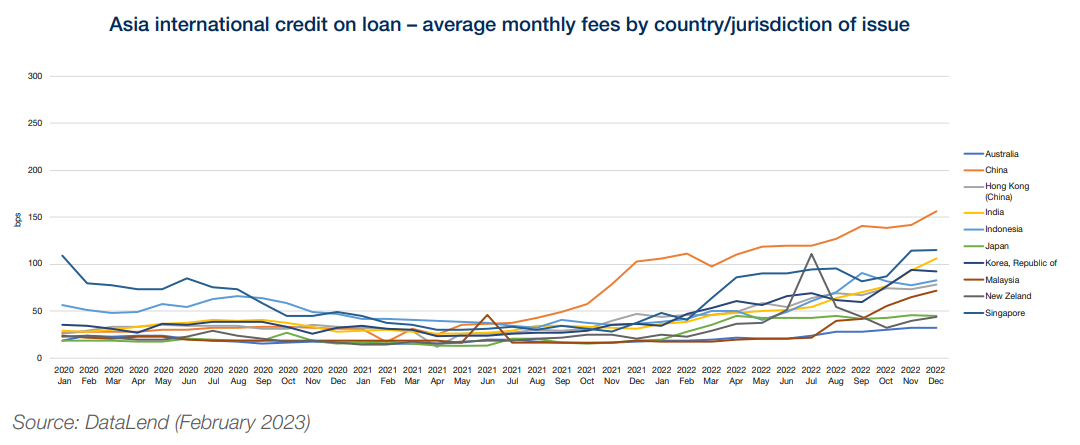

While there is little available data for repo activity in the Asia region, data from DataLend (EquiLend’s market data product), which shows the value and fees of securities being loaned by lenders to broker-dealers, provides a good gauge of overall market activity, as well as underlying positioning. The value of bonds on loan increased toward the end of 2021 and stayed elevated well into Q2 of 2022, which corresponds with the market sell-off starting in early 2022.

For the remainder of the 2022 we see volumes on loan trend lower, which is also consistent with the observed trading volumes in the underlying market. A further observation from the data, and consistent with interviewee feedback, is a richening of repo rates (as seen in the form of increased lending fees), which again correlates with moves in the underlying market. As bonds sell off, and credit spreads widen, repo rates should richen as demand to borrow the securities (driven by short-selling) increases.

One interviewee reports that while most liquid investment grade USD bonds in the Asia market can be borrowed at a repo spread of around 20bp to general collateral (effectively the “specialness” of the specific bond), over the course of 2022 this widened significantly for many bonds, particularly for high yield names, most notably China, especially following the collapse in the property market. This saw some bonds trading at repo rates of -10% or lower as shorts tried to avert settlement fails and the risk of being bought-in.

While the repo market appears to have worked well during 2022, interviewees suggest that more could be done to develop and internationalize the regional market. This includes greater regulatory alignment across jurisdictions, especially with respect to tax treatments, as well as broader adoption of standardized documentation, in the form of the Global Master Repurchase Agreement (GMRA), particularly in supporting access to local onshore markets, such as China.

Overall trends and developments

The report shows that annual issuance of cross-border bonds from Asia amounted to $346 billion in 2022. Despite a year-on-year decline in issuance volumes in tandem with the global market , due to interest rate hikes by many central banks across the globe, geopolitical tensions, and sectoral credit events, certain market segments exhibited resilience and continued to fuel the growth of the international bond markets in Asia.

Looking at markets across Asia including China, India, ASEAN, Japan and South Korea, the report identifies trends in both issuance and trading of international bonds in the region.

China accounted for 33% of Asia international issuance in 2022 and continued to be the largest overall source, followed by Japan and South Korea. International issuance volume by South Korean issuers remained relatively resilient compared with other jurisdictions, with $40 billion in 2022, only a 25% decrease from 2021.

Green, social, sustainability and sustainability-linked (GSSS) bonds also experienced a 22% decline in issuance to USD 80 billion during 2022, though as a proportion of all international issuance in Asia, GSSS bonds rose from 16% to 23%, evidencing the attractiveness of sustainable bonds as a financing instrument for issuers. The growth of international bond markets in Asia has been fueled by the steady entry of new issuers and by a diverse investor base, with Asian financial centers playing a larger role in arrangement and listing.

As with the primary market, secondary market conditions were challenging in 2022, with overall traded volumes lower than 2021 and with regular episodes of illiquidity and heightened price volatility. These were in part a response to higher yields and widening credit spreads, which increased uncertainty for investors and risks for market-makers.

The use of electronic venues to transact in the secondary market continues to become more entrenched. Historically this has been mainly prompted by efficiencies, with most e-trading in smaller trade sizes and in more liquid, investment grade names. More recently, however, this increasingly has been driven by the need for price discovery and the search for liquidity. 2022 also saw a growth in the adoption of protocols other than RFQ, including all-to-all and portfolio trading.

ICMA chief exec Bryan Pascoe said in a statement: “While macroeconomic headwinds in 2022 have dampened issuance growth, Asian financial centers continue to play a significant role in the development of international bond markets. Indeed, beyond the headline numbers we see foundational work in the area of digitalization that should drive strong growth”.