Recently there has been significant stresses to the financial system and the degree of fixed income market liquidity as a result of the COVID-19 crisis. Decisive actions by the Bank of Canada, federal and provincial governments, and regulatory bodies have softened the blow and helped the functioning of many product lines, the Investment Industry Association of Canada (IIAC) said in a recent report.

The report noted that while traditionally liquidity is most commonly referred to as the ability of market participants to buy and sell quickly and efficiently without causing a material change in the price of the fixed income instrument in question, in the recent market turmoil as a result of COVID-19 crisis, at times liquidity could be described as the ability to transact at a price that is an acceptable spread to an indicative market price.

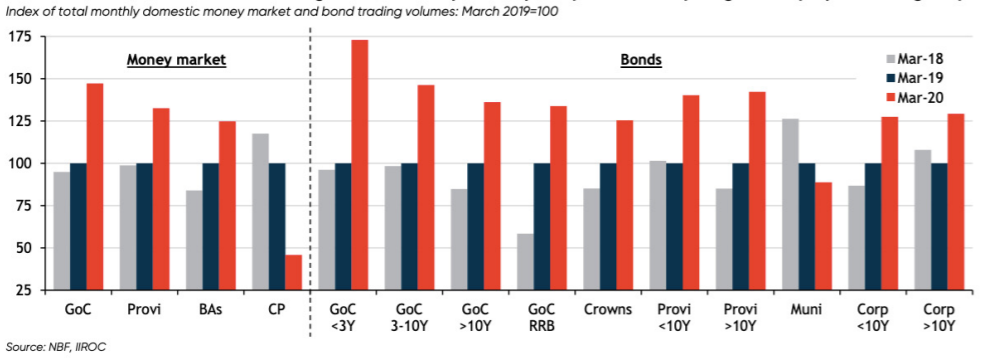

There have been changes in volume of trading activity across all fixed income products, but decisive actions by the Bank of Canada, federal and provincial governments and regulatory bodies have softened the blow and helped the functioning of many product lines. Impressively, IIROC’s (Investment Industry Regulatory Organization of Canada) Canadian monthly trading volume data for March shows that Canada’s money market and bond trading volumes have actually gone up. That is not to say that certain less liquid products such as high yield debt are actively trading.

Government spending and other programs that have been announced to offset the economic effects of Covid-19 have dramatically increased during the month of March and into early April resulting in a large increase in government debt issuance. This will require record issuance of T-Bills and bonds in the coming months that dealers and their customers will have to contend with.

In early March, there was extremely high volatility in both equity and fixed income markets resulting in sharp and unusual price movements and the flow of funds into safe haven government fixed income products and gold. Credit and bid offer spread spreads on provincial and corporate bonds moved wider, but these markets did continue to trade. Corporate spreads in particular widened dramatically as one might expect, but investment grade issues have since tightened back in to a degree.

The Canadian and US bond markets have resisted the movement towards negative interest rates that is found in a number of European and some Asian markets. At present it would seem that this is not a likely scenario for the Canadian market, but to be sure Canadian rates are close to zero and there exists a small possibility for a move to negative rates. The recent increase in government debt issuance would tend to make this move to negative rate all the more unlikely.

On a related note the COVID-19 crisis resulted in the Bank of Canada postponing a GoC market functioning (GMF) steering group that was considering a fail charge regime to help proper repo and settlement functioning in an ultra low rate environment.

Fixed income ETFs also experienced short lived disconnects where bid-offer spreads on actively trading bonds widened dramatically and market participants were unable to get satisfactory fills on their orders or were compelled to buy at wide spreads to meet mandates. This temporary situation resulted in a mismatch between certain fund’s net asset value (NAV) and the fair market value of the underlying instruments, resulting in erratic price movements. A positive spin on the disconnect that can and has occurred in related markets is summarized by Rich Powers, head of ETF product management at Vanguard, the world’s second-largest asset manager “Market prices for ETFs can move more rapidly than the net asset value. That is part of the price discovery process.” It is a positive outcome that pockets of illiquidity and disconnect, with a few exceptions, to date, have been short lived.

The IIAC also conducted surveys to gauge attitudes towards the pandemic and post-lockdown timing. On the former, from the early weeks of the pandemic the priority concern had been liquidity, and it remains so several weeks in. On the latter, the general expectation of most survey respondents is that present safety measures regarding the pandemic will continue into the late summer and that the return of remote employees to the office will be a gradual and cautious exercise, with many social-distancing measures continuing to be observed.