The International Swaps and Derivatives Association (ISDA) published its survey on document negotiation, which shows the average time taken to negotiate key derivatives documents hasn’t fallen since 2006, with some negotiations taking longer due to resource constraints, regulatory pressures and operational challenges.

The ISDA Documentation Negotiation Survey collects and reports data on the composition, negotiation and digital automation of ISDA documentation. The results, which are based on responses from 42 institutions, most of which are banks or broker-dealers, suggest there has been no improvement in negotiation times for ISDA Master Agreements and related credit support documentation since 2006.

The survey highlights delays in the negotiation of initial margin (IM) credit support annexes (CSAs) that have been caused by the requirement to segregate IM with a third-party custodian. Practical challenges in setting up custodial arrangements were cited by 25 respondents as a cause of delays in negotiating IM CSAs, account control agreements and eligible collateral schedules. Other factors causing delays include provisions governing the relationship with custodial documents and eligible collateral.

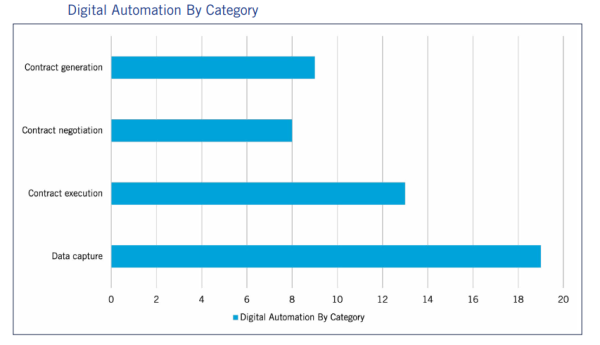

The survey also asked participants about their use of digital automation tools, in order to identify progress in transitioning contract lifecycle management systems and processes to new technologies and automated data solutions. While 30 respondents – more than 70% – reported using some form of digital automation, with data capture being the most frequently cited use case, nearly half of respondents said they still exclusively use manual processes for data capture. Many other firms still use manual intervention in combination with digital automation.

Respondents were also asked about their use of certain ISDA platforms, with 20 firms stating that they use the MyLibrary digital documentation platform during negotiations, and 13 confirming they use the ISDA Clause Library. However, the survey confirmed that manual intervention continues in many documentation processes. The ISDA Create contract negotiation platform can address key issues such as negotiation times, data capture and resource constraints.

“The ISDA Document Negotiation Survey truly underscores the business case for greater digitization of derivatives documentation. Firms can realize significant efficiencies and savings by embracing digital platforms, which in turn enables them to onboard new business more quickly. By moving negotiations to ISDA Create, they can reduce negotiation times, capture contractual data and free up precious resources,” said Katherine Tew Darras, ISDA’s general counsel, in a statement.