In a Medium post, Nic Carter, founder of Coinmetrics.io, investigates the key drivers of the unrelenting cryptocurrency (aka crypto asset) markets, and explains why they aren’t likely to go away soon. In particular, he focuses on the incentives that cause ranking sites to uncritically include junk exchange volume in their data.

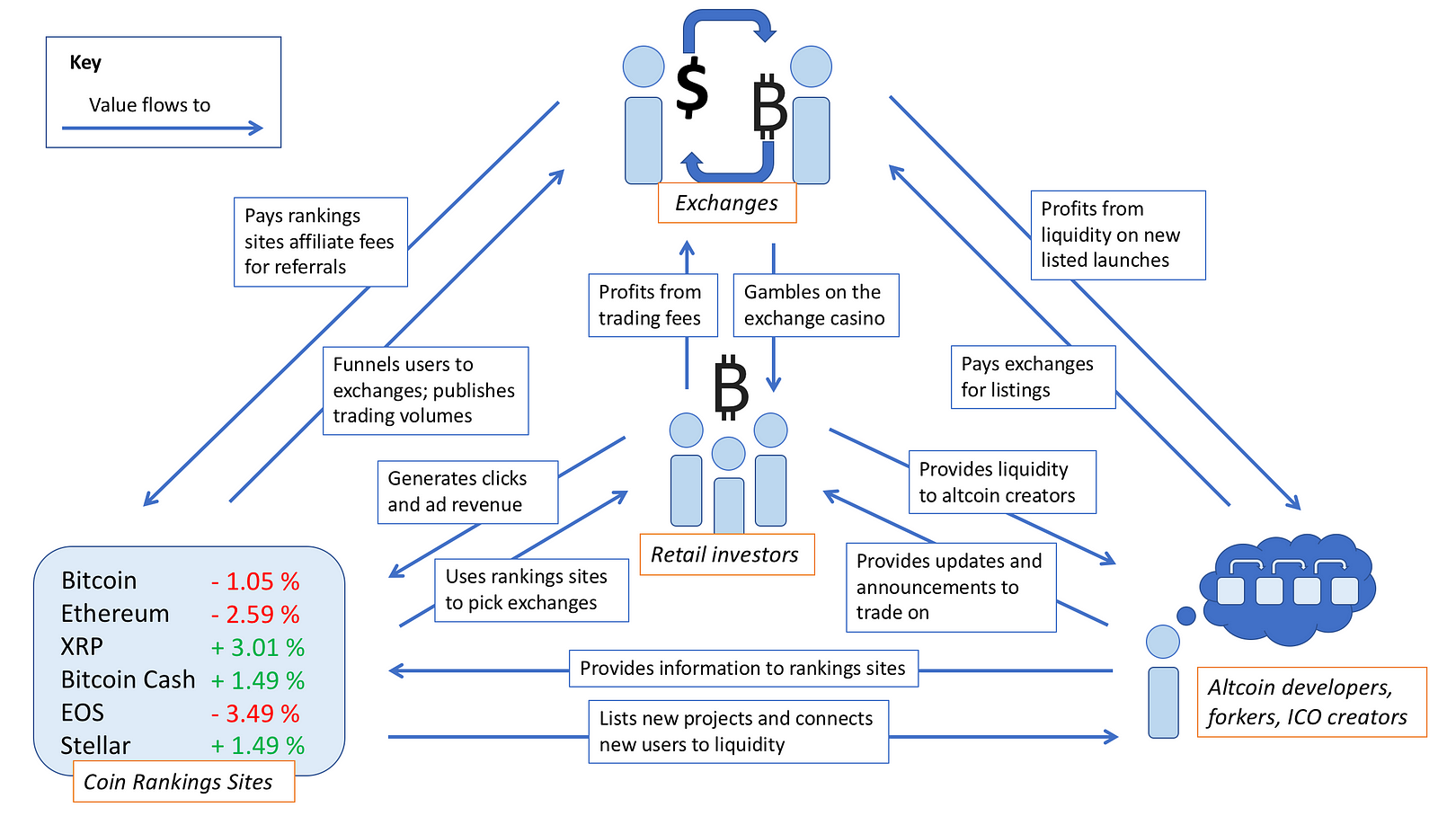

The major stakeholders in this market are exchanges (naturally), altcoin/cryptocurrency/fork issuers, and coin rankings sites, which mutually work together to extract value from one group: retail investors. Unwitting investors juice the whole operation with infusions of capital. While none of this is particularly groundbreaking, Carter felt that it was worth exposing these relationships so that investors might understand the nature of the game they’re playing.

The below graphic summarizes the essence of the relationships between the four groups.

Exchanges

You have two broad sorts of exchanges in this industry: the fiat onramps, and the altcoin casinos (I’ll leave aside p2p exchanges or DEXes for now). The fiat onramps tend to be regulated, comply with KYC/AML, may even surveil trading, and generally behave like full-reserve banks. Coinbase and Gemini are the archetypes. This piece is not about those exchanges — they generally play by the rules and are in the midst of a pivot towards regulator friendliness.

The other exchanges, the ones I’m writing about here, are the altcoin casinos. They tend to be un- or lightly regulated, domiciled in exotic places like the BVI or the Seychelles or Malta, and may hop around from jurisdiction to jurisdiction to avoid the watchful eyes of regulators. Binance is the archetype. They tend to have a devil-may-care attitude toward compliance, KYC/AML, wash trading, and reporting. They may not even deal in fiat at all — traders typically have to use BTC and ETH to get access to the rest of the casino.

Actually using these exchanges is often quite difficult. The great unmentionable in the industry is that no one interested in a “utility token” and the resources it might provide habitually uses these exchanges. These are not individuals these exchanges target as end users. Getting BTC at a fiat onramp, getting registered at a crypto-to-crypto exchange, sending the BTC, navigating the orderbook, making the trade, and juggling private keys and wallets; this is impenetrable to most neophytes. Instead, end users at these exchanges are day traders and gamblers who want access to the global, 24/7 altcoin casino. Some whales trawl the markets, but the majority of participants are retail investors looking for a 100x.

The con

So what’s the issue here? The chief problem has to do with the interplay between rankings sites, exchanges, and issuers, especially as it relates to exchange volume. It goes like this:

- Issuers want to list on liquid markets and exit or pump their positions

- Exchanges want to advertise themselves as liquid, so issuers will be more amenable to paying listing fees

- The “altcoin casino” exchanges are mostly unregulated and unmonitored, and can thus get away with virtually anything

- Many exchanges thus engage in wash trading to make their volumes appear greater and improve their perceived liquidity profile

- Rankings sites monetize through reference links and ads, and lack the resources to monitor each exchange, and hence uncritically publish exchange data

- Wash trading exchanges gain in the rankings on the rankings sites, successfully marketing themselves

- Exchanges profit, rankings sites profit, issuers profit, all at the expense of investors (who may win in the short term)