As announced in May, Pirum has extended its collaboration with S&P Cappitech to provide a solution to the upcoming regulatory requirements under new rule SEC 10c-1a, which seeks to increase transparency in the US securities lending market.

The reporting solution, which leverages Pirum’s existing connectivity with securities finance, repo and collateral management ecosystems, facilitates compliance with the SEC’s incoming 10c-1a reporting requirements.

By combining Cappitech’s data validation, event creation and FINRA connectivity with Pirum’s UTI generation, matching and reconciliation abilities, the collaboration ensures an efficient and streamlined regulatory reporting solution.

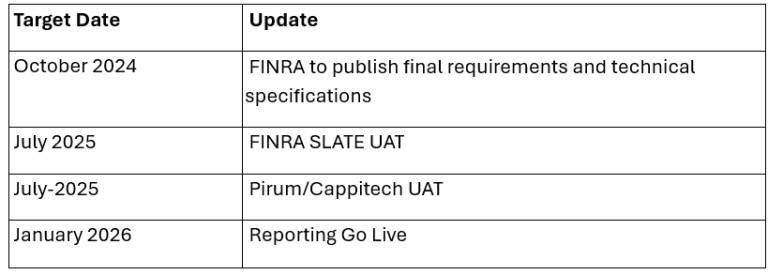

FINRA has delayed its publication of the final requirements to October 2024. Once confirmed, Pirum expects to update clients on the requirements and reporting solution.