Finadium’s Rates & Repo Europe conference is around the corner and over the last week, we’ve highlighted early insights from our Market Conditions in the UK and Europe and Big Data, Big Technology, Big Opportunities panels. In this last article of our Rates & Repo Preview series, we hear from our expert panelists from BNY Mellon, DTCC and LCH RepoClear, about the global scope of mandatory clearing for US Treasury Repo and how European market participants are viewing the impacts so far.

The Securities and Exchange Commission’s (SEC’s) rule to expand central clearing needs to be seen as part of a broad regulatory strategy to boost the US Treasury market’s resilience, including expansive efforts to improve intermediation, increase transparency, strengthen trading venue functioning, and reduce the risks of leverage, said Nate Wuerffel, head of Market Structure at BNY Mellon.

“Central clearing is a part of a broader plan, but it’s probably the biggest part of that plan, in so far as it’s going to dramatically reshape and reassemble the way the Treasury market operates,” he explained, stressing that while it is widely considered the safest and most liquid market in the world, it still has settlement and counterparty credit risks, which means cracks can appear in times of extreme stress.

In cash markets, the SEC has expressed concern about interdealer trading where principal trading firms now represent a majority of trading activity, he noted. For repo markets meanwhile, the SEC has indicated that it aims to mitigate the risk of disorderly unwinds related to highly leveraged players, and additionally, wants to see the largely bilateral repo market manage risk with margin.

Wuerffel stressed that central clearing will have global impacts. For example, foreign entities using UST repo transactions for USD funding purposes are likely to get captured in the clearing rule. Most repo transactions run through dealers and CCP members, and nearly all of those transactions will now be centrally cleared and margined.

“There will be a long line of market participants that need to get into central clearing, (and) gaining access to central clearing for a US Treasury cash or repo transaction is a lengthy process and one that will require a lot of analysis, legal documentation and operational changes in order to complete smoothly,” he added.

Global transformation

While there are yet some aspects of the SEC’s rule to be finalized, in broad terms the market participants that will be included are firms buying, selling, or intermediating in the UST market as well as any UST-collateralized repo transactions via direct participants of the Fixed Income Clearing Corporation (FICC), said Michalis Sotiropoulos, head of Government Relations for Europe at DTCC.

“There has been a very long discussion about the benefits of central clearing for the US Treasury market,” he said. “The final rule that came out in December, which is a culmination of those efforts, will bring about a very extensive and transformational change to this market.”

On the repo side, the SEC has designated specific exemptions for central banks, retail customers, multilateral and clearing organizations and state governments. He describes the clearing obligation impact as a “three-legged stool”, with one leg being the clearing requirements and scope; another the segregation of margin between margin belonging to FICC’s clearing members and margin belonging to those clearing members’ underlying customers; and the third being the need to have a variety of access models.

Margin segregation for clearing members’ customers will be optional, and this may give the Treasury market a similar structure to derivatives due to the Legally Segregated, Operationally Commingled (LSOC) model, Sotiropoulos noted. The implementation schedule, he added, provides sufficient time to perform the testing, integration, and performance checks as well as onboarding procedures required, but the transformation effect on the broader repo markets across the globe should not be underestimated.

“Even if we cannot quantify the impact right now in the UK and the EU markets, this is definitely something that they, we and the market participants will still have to prepare for,” he said.

The view from Europe

Whether or not European Union regulators take a cue and mandate clearing for government bonds is a big open question, but what can be observed now is a consistent market behavior, which shows that during times of stress, participants are turning to clearing, said Olivier Nin, head of RepoClear & Collateral and Liquidity Management (CaLM) risk at LCH RepoClear’s Paris-based CCP.

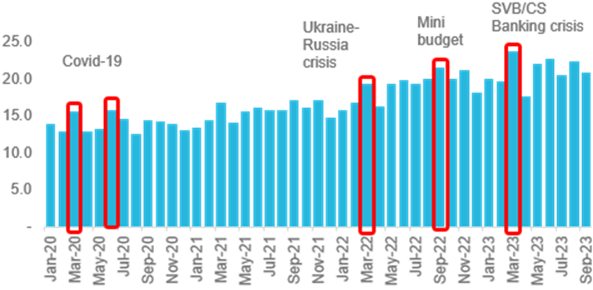

Over the last few recent crises since 2020 – the pandemic, geopolitical upheaval, the LDI crisis spurred by the UK’s mini-budget, and the US SVB and Switzerland Credit Suisse banking crises — volumes at LCH spiked and liquidity provision not only was not interrupted but on the contrary it increased, he explained.

Graph: RepoClear SA Clearing Volumes

That has translated to increasing interest in clearing, which is at least partly explained by firms being cautious to have CCP connections in place before the SEC’s mandated clearing rule comes into force. In other words, it’s better to have those connections established and not use them rather than the other way around, he noted.

The major sell-side banks are already connected to the CCP and represent a big portion of the business, but smaller banks are expanding their cleared activity as well. On the buy-side meanwhile, pension funds, insurance companies and money market funds are keenest to evaluate access models as an option for some of their activity, as they are starting to appreciate the benefits of clearing more. Hedge funds, particularly those that have come in scope as part of the US SEC’s dealer rule, are also increasingly inquiring.

What the UST and UST repo clearing evolution in the US is flagging up to the European community is that there is a direction of travel for systemically important markets, Nin said: “Do we think that every single market in the world has equal weight and needs to be extremely robust (and) liquid? Probably not. But when people want to make sure that extremely important markets such as US Treasuries (are) well managed, then the way to go, as indicated by past and recent regulatory actions, is clearing.”

Michalis, Nate and Olivier will be joining Andy Hill from the International Capital Market Association (ICMA) on the panel “Mandatory Clearing for UST Repo – Impacts for Europe” at Rates and Repo Europe on March 14. Rates & Repo is a conference for cash investors, dealers, market intermediaries, technology firms and other service providers. Register here for the in-person panel discussions.