Finadium’s Rates & Repo North America is coming up on October 29 in New York, and we’re highlighting a few early insights as a sneak preview. In the second of a series of articles, we hear from our expert panelists from BNY, Eurex and Sunthay about the catalyst for change that UST repo clearing represents and what that means for players and platforms of the repo market as the industry identifies gaps and weighs strategies.

Changes in the financial services industry, especially those related to collateral management activities, have gathered steam since triparty reforms in 2010 and are now punctuated by incoming mandates for clearing of US Treasury cash and repo transactions by end-December 2025 and end-June 2026 respectively, said John Morik, managing director at BNY and head of Product and Strategy for Government Securities Services Corp, who will be speaking on the Advances in post-trade, triparty and collateral panel.

Intraday repo, for example, was recently added to BNY’s triparty collateral management platform, which is among the largest of its types globally. This is critical for market liquidity and to lower costs, as clients seek to break down the business day from a funding perspective, with borrowers often needing funding for a few hours rather than overnight or term, and lenders seeking to mobilize cash over the same timeframe and have it returned by end of the day, he explained.

Another important change in the triparty space is an increasing amount of bank-fintech partnerships, and he highlighted ECPOConnect, a joint collateral optimization service developed in collaboration with Pirum Systems as a case in point.

Like many market evolutions, there are regulatory and service angles, and Morik said that as both a settlement provider and member of the Fixed Income Clearing Corporation (FICC), there will be meaningful changes for BNY from the UST cash and repo clearing mandate, along with dealers, buy-side, and market infrastructures.

“All the main broker dealers are clients of ours using our settlement service in our clearance and collateral management business,” he said, There are also lines of business within BNY that act as a sponsor and agent clearer, and the bank is an FICC participant, Morik explained. In other words, the bank maintains a unique position as settlement agent, agent clearer, and sponsor on transactions.

The new clearing rules are a huge undertaking and currently BNY is building out and introducing models to the market that are sufficient to meet the mandate, he said.

“Our focus over the next year and a half is that we service the market as we do today, but also coming at it from a sponsor angle, where we are a member of FICC helping our clients meet the demands of the mandate, whether we are their agent clearer or sponsoring them into FICC, to make sure their trades are centrally cleared in both a done with or done away model,” he said.

Europe POV

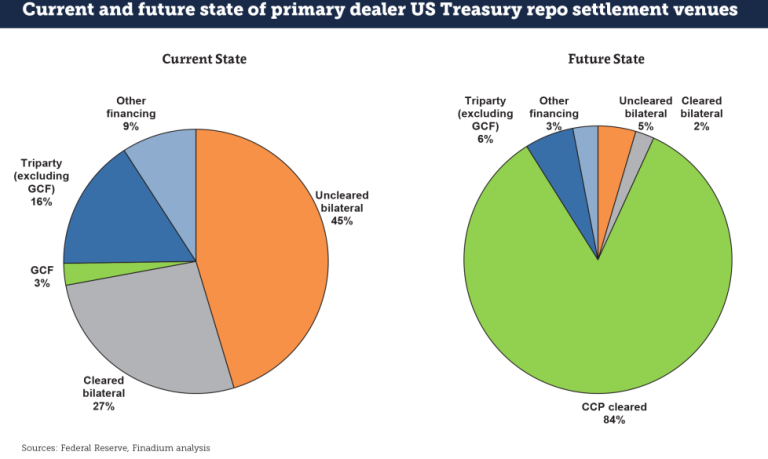

The US clearing mandate will drive a significant portion of the repo transaction value chain into electronic execution because of the need to automate trading, clearing and settlement in one place, and while it seems to be a lot of effort to “embrace” centrally cleared repo, there’s also great opportunity, said Frank Odendall, head of Securities Financing Product & Business Development at Eurex, who will be speaking on the Dealer to client repo trading platforms in a digital age panel.

“It will be a trigger to further growth in that area…In a few years from now, 80-90% of US treasury repo activity will be electronically traded,” he said, adding that the situation is analogous to how the interest rate swaps market adapted.

Odendall stressed that the trading layer is only part of the chain and he expects that, given the domination of UST clearing as a pool for securities financing transactions, the mandate will pull auxiliary products into some form of electronic execution and traders will have “two screens” – one for cleared and another for non-cleared business. It would make sense, for example, to use the same pipes even if they are not centrally cleared.

From a European perspective, the US has advanced in bringing important players to transact with each other, for example money market funds with hedge funds. But what seems to be missing in the liquidity channels is the wholesale participation of central banks and treasury financing agencies, sometimes referred to as debt management offices (DMOs).

“If you are surviving on overnight funding, because it’s cheaper than the term funding, then this can create a problem,” he said. “We will see, hopefully, a more spread-out sense of liquidity…The central bank community and also the treasury departments, they can provide a good mix into the game.”

3-way, all-to-all

Specific to the UST repo mandate, an alternative and complement to clearing is guaranteed repo: a model that moves risk around for balance sheet benefit while meeting the requirements for exemption as a non-cleared transaction. Guaranteed transactions are more efficient than any other secured funding model available, and electronic execution is an inextricable part of making it work, said Shiv Rao, chair at Sunthay, who joins Odendall on the panel.

“In our three-way guaranteed repo structure, It’s possible for banks to guarantee the performance of a hedge fund, for example, without being a principal to that transaction,” he explained.

The result is similar to an “all-to-all” platform, with hedge funds transacting directly with a money market fund as principal, but with the borrower’s credit being guaranteed by the bank. The sheer number of relationships implied means that electronic trading is essential to manage them: voice and email-based trading is not going to be sustainable, he said.

While tailwinds for Sunthay’s business can be expected from the UST repo clearing rules, the main regulatory driver for the guaranteed repo structure is the Basel Endgame proposal, which is expected to increase the risk weighted asset calculus dramatically.

“The US proposal is almost certainly going to be conforming very closely to the Basel consensus rules, which have been finalized and that other jurisdictions are using as the template on which they base their local application…And the consensus rules are sufficiently punitive to repo and other secured funding transactions. That’s what’s driving the interest in our structure because we are highly efficient under those rules,” he said.

John will be joining colleagues from the Euroclear, EquiLend, ISDA, J.P. Morgan, LSEG Post Trade and Transcend on the panel Advances in post-trade, triparty and collateral. Frank and Shiv will be joining experts from GLMX, LSEG Post Trade and Tradeweb on the Dealer to client repo trading platforms in a digital age panel.

Rates & Repo North America is a conference for cash investors, dealers, market intermediaries, technology firms and other service providers. Register here for the October 29 in-person panel discussions.

And don’t miss our first Rates & Repo sneak preview with J.P. Morgan, Euroclear and Transcend here