A new survey of leading institutional investors released by The Risk Management Association (RMA) revealed that 95% of respondents believe that securities lending activities can coexist with Environmental, Social, and Governance (ESG) principles.

Sustainable investing and the value of assets managed with ESG considerations is a growing segment of the investment

universe. As of June 2020, ESG funds’ assets under management totaled $1.06 trillion, accounting for approximately 13% of the funds industry. A recent BNY Mellon survey of 27 pension and sovereign wealth funds (representing $4.7 trillion of assets under management) found that more than 90% have specific ESG investment policies in place or are in the process of developing them.

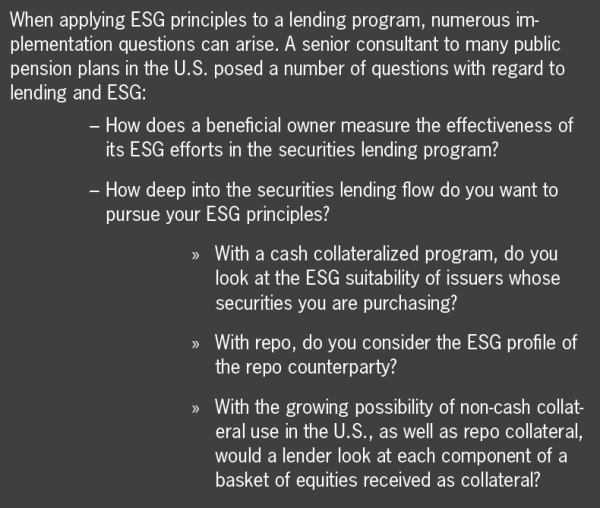

RMA’s survey found that securities lending needs to evolve in order to integrate investors’ ESG principles with their securities lending programs – and highlighted the opportunity for the industry to help asset owners better understand their options for managing ESG factors in securities lending.

“Our research shows that securities lending and ESG investing can be complementary, not conflicting,” said Fran Garritt, RMA’s director of Securities Lending and Global Markets Risk, in a statement. “This paper shows how this important balance can be achieved – and is being achieved. It also identifies the challenges for the securities lending industry in further integrating ESG factors into securities lending programs. RMA believes that greater transparency and more standardized processes will benefit everyone who uses the securities lending market. We will continue to work with all market participants to ensure the market’s continuing compatibility with ESG investing, which continues to gain momentum.”

To inform the paper, the Council held detailed interviews with nine institutional investors and surveyed 44 firms. Respondents included five of the top 10 global asset managers, two of the top 10 US retirement plans, and two of the top five global sovereign wealth funds. The priorities highlighted by the paper include the need for engagement with portfolio companies as a means of expressing ESG principles, the importance of proxy voting, questions concerning participation in the short side of the market, and the benefits of lending to shareholders and other stakeholders.

Key survey findings

- 95% of survey respondents said ESG investing and securities lending can coexist. But only 18% always apply ESG principles to their securities lending programs. Another 25% do so on a case-by-case basis, 18% don’t but are planning to, and 39% simply don’t.

- A lack of timely information about proxy record dates and voting questions complicates the process of recalling stock that is on loan. When survey participants were asked to name “measures that might facilitate the application of ESG principles to their securities lending program,” 43% said that they want more transparency around proxy record dates and questions.

- Just 20% of respondents said that there is “regular” interaction in their institution between those who manage securities lending and those who manage ESG issues. Another 44% responded that interaction occurs “from time to time.”

- 55% of participants ranked “greater education about available options” as the top priority when it comes to applying ESG principles to their lending program.

“RMA is making this paper available at a time when ESG is taking on greater importance in securities lending, which generated $8.66 billion for lenders in 2019 at the same time as serving its customary function of enhancing liquidity, the availability of collateral, and efficiency in the markets,” said Glenn Horner, chair of RMA’s Council on Securities Lending. “With climate change, diversity, equity, and inclusion efforts, and regulations around data privacy taking on more significance daily, ESG will only become more integral to every institution.”