March was a volatile period with the failure of US banks and UBS/Credit Suisse consolidation in Europe, which happened at a time of active global monetary policy and regulatory changes. We hear from macro, trading, and cash collateral reinvestment experts on the signals they are keeping an eye on in securities financing markets.

In mid-March, Fed data showed some concerning trends in the banking industry with deposits flying out of the banking system to money market funds, and ultimately parked in the Fed’s RRP facility. There was a slight offset from Federal Home Loan Bank issuance but that got quickly subsumed by increased money fund inflows.

One macro strategist noted that “if we see deposit flight starting to decline and decelerate, that would be a good sign.” Since March, deposit flight has slowed to some $49 billion in the first week of April, although total money market fund assets remain elevated at $5.25 trillion, according to Investment Company Institute data for the first week of April.

The other worrying sign in mid-March was the level of borrowing from the Fed’s discount window as well as from the new Bank Term Funding Program (BTFP). Since then, emergency borrowing has decreased as a whole, with the discount window dropping and BTFP rising, according to Fed data. Meanwhile, the Fed’s Standing Repo Facility (SRF) continues to see minimal use, including during the mid-March period.

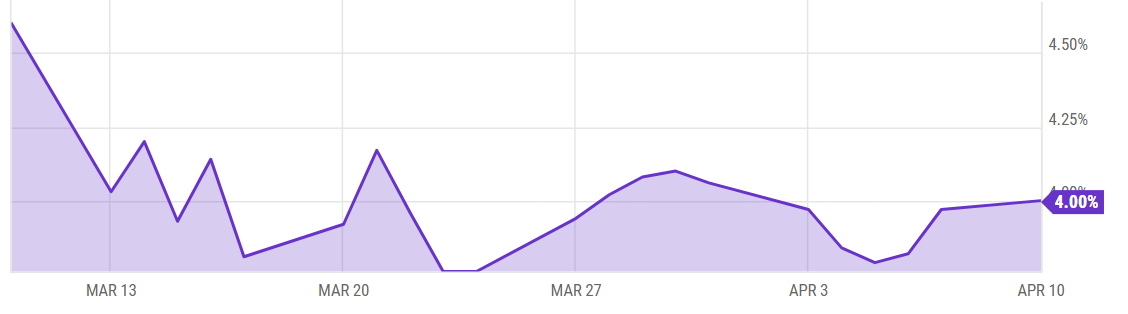

The markets have seen significant bond market volatility, with swings in 2-year yields averaging over 20 basis points per day, making it difficult to take meaningful positions in the market, said an expert. While month and quarter ends are part of the explanation, they added that “uncertainty associated with current scenarios is keeping high conviction trades elusive right now.” Since mid-March, this volatility has also moderated.

Source: Ycharts

Source: Ycharts

Rates and credit

While these signals are going in the direction that experts hoped they would, the backdrop remain the same: the Fed’s “trilemma” of inflation, growth and financial stability – three issues that complicate one another.

In the Fed’s view, the tools for dealing with financial stability are separate from those dealing with monetary policy – emergency borrowing facilities for financial stability, and interest rates and balance sheet to deal with monetary policy and inflation. This also seems to be the message from the European Central Bank, noted the macro expert.

The prediction is that the combination of factors and data will result in a 25 basis point interest rate hike for the Fed’s next meeting in early May: “The market said about 50-50% odds for a hike, after that we expect no change in rates for the rest of the year, including no cuts this year, although the market sees as many as three cuts by the end of 2023,” the expert noted. “The only way that (rate cuts) thinking can be valid is that the market foresees either a very deep recession requiring monetary stimulus to combat and/or resumption of banking sector stresses that would cause the Fed to abandon its tightening policy altogether.”

However, the level of credit conditioning tightening is being closely watched through April, they added: “We don’t know how long these stresses will persist and how deeply and quickly they will impact the real economy. We can expect some deceleration in growth and maybe a mild recession in Q3, but the next four weeks are going to be crucial in terms of economic data and for the developments of the banking sector.”

The macro expert added that one “rule of thumb” measure indicating credit constriction is the drop in the target level of the Fed Funds rate – from an expected 5.4%-5.5% to 5.1% at the last FOMC meeting on the back of the banking sector stress, which can be translated to about 40-50 basis points of additional tightening on the economy that would have happened had the Fed raised rates without a banking sector crisis.

“The Fed’s calculating that the tightening credit conditions (and) financial conditions are going to have an effect on the economy and inflation outlook…The odds have increased of a recession (but) I don’t think the odds are very high that it will be a deep prolonged one and one that would cause the Fed to go back towards super accommodative monetary policy while inflation is still high,” they said.

Globally, demand for credit is growing significantly, as funding costs have become more challenging with rates moving higher, said a trading expert. Signals from the biggest market – US equities – show widening spreads for both investment grade and high yield. “Companies are struggling now to raise some funds after enjoying years of cheap funding…We anticipate we are going to see some companies moving to distress, and there’s also going to be some interesting debt restructuring that is going to occur that we are going to need to keep an eye on.”

In the hedge fund space, securities financing traders are seeing that long boxes at prime brokers are not as stacked, and cash is king, said a trading expert: “In 2023, we are seeing some pockets of equity collateral start to resurface, that could be driven by the tech craze that we’ve seen this year, but it’s not widespread. And I think until we see a risk-on environment again, those long boxes stay more focused on supporting HQLA term upgrade trades, and becoming just a regular part of [hedge fund] financing needs.”

Cash collateral reinvestment

Early 2023 found cash investors flocking to the front end of the market place, and the events in mid-March have put pressure on the short-end of the fixed income markets, said a cash-collateral reinvestment expert.

US regional bank issues had “very little effect” for large global banks, which the expert noted were well capitalized and well-funded, metrics that also held up after the consolidation of Credit Suisse, despite it being a larger entity.

“We have seen returns to a more normal market, not fully out of the woods, there’s still some challenges ahead in the marketplace, but we are definitely seeing good demand from investors – broad-based, across the yield curve,” they said. “We returned to the marketplace slowly, investing in short duration securities and 1- to 3-months initially, and a little bit out in 6-months.”

The team is now looking at portfolios and stressing them to test how they react to various interest rate environments and spread widening events. Resetting to a higher rate environment includes a higher degree of exposure to floating rate securities. But the expert noted that Canada is unlikely to raise rates further, and the Bank of England and European Central Bank are also expected to come towards the end of a hiking cycle as inflation data eases.

“Coming up this year, we may pivot somewhat, as central banks around the world move towards a change in their rate environment and moving rates lower,” they added.